Fixed costs, such as land rent and machinery depreciation, remain constant regardless of production levels, making them crucial for long-term budget planning in agriculture. Variable costs, including seeds, fertilizers, and labor, fluctuate with the scale of operations and must be carefully estimated to optimize resource allocation. Effective budget planning balances these costs to enhance profitability and manage financial risks in farming businesses.

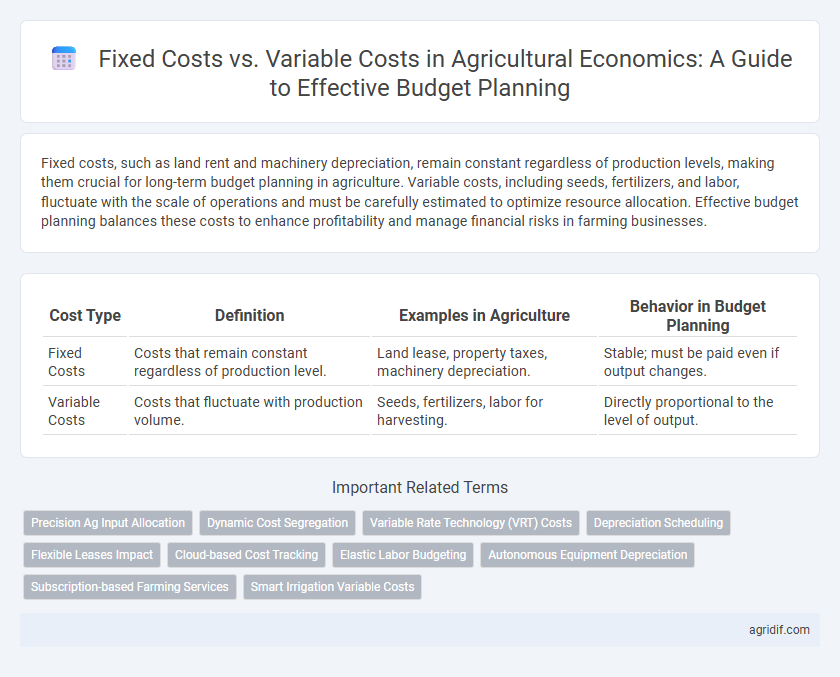

Table of Comparison

| Cost Type | Definition | Examples in Agriculture | Behavior in Budget Planning |

|---|---|---|---|

| Fixed Costs | Costs that remain constant regardless of production level. | Land lease, property taxes, machinery depreciation. | Stable; must be paid even if output changes. |

| Variable Costs | Costs that fluctuate with production volume. | Seeds, fertilizers, labor for harvesting. | Directly proportional to the level of output. |

Defining Fixed Costs in Agricultural Operations

Fixed costs in agricultural operations remain constant regardless of production volume, including expenses such as land leases, property taxes, and machinery depreciation. These costs must be covered even when crop yields fluctuate or livestock numbers change, making accurate identification critical for effective budget planning. Understanding fixed costs allows farmers to determine baseline financial obligations and optimize resource allocation in variable market conditions.

Identifying Variable Costs in Farming Enterprises

Variable costs in farming enterprises include expenses like seeds, fertilizers, pesticides, fuel, labor wages, and irrigation water, which fluctuate with the level of production. Identifying these costs accurately is crucial for effective budget planning, as they directly impact profitability and cash flow management. Monitoring variable costs enables farmers to adjust input use and optimize resource allocation in response to changing market conditions.

Importance of Cost Classification for Budget Planning

Accurate cost classification into fixed and variable costs is crucial for effective agricultural budget planning, enabling farmers to predict expenses and optimize resource allocation. Fixed costs, such as land rent and equipment depreciation, remain constant regardless of production levels, while variable costs like seeds, fertilizers, and labor fluctuate with output. Distinguishing these costs improves financial forecasting, risk management, and decision-making in farm operations.

Impact of Fixed Costs on Long-Term Farm Viability

Fixed costs, such as land rent and equipment depreciation, remain constant regardless of production levels and significantly influence long-term farm viability by creating a financial baseline that must be met each season. These costs reduce flexibility in budget planning, making it imperative for farmers to maintain steady revenue streams or buffer reserves to cover expenses during low-yield periods. Effective management of fixed costs enhances stability in farm operations and supports sustainable investment decisions.

Tracking Variable Costs for Short-Term Decision Making

Tracking variable costs such as seeds, fertilizer, and labor is essential for accurate budget planning in agricultural economics, as these expenses fluctuate with production levels and directly impact short-term profitability. Fixed costs like equipment depreciation and land lease remain constant, thus separating variable costs allows farmers to make informed decisions regarding crop choices and resource allocation. Efficient monitoring of variable costs enhances responsiveness to market changes and optimizes operational efficiency during critical growing seasons.

Methods to Allocate Fixed and Variable Costs Accurately

Accurate allocation of fixed and variable costs in agricultural budget planning is essential for precise profitability analysis and resource optimization. Methods such as activity-based costing help assign fixed costs like machinery depreciation to specific farming activities, while variable costs such as seeds and fertilizers are tracked directly to production levels. Implementing detailed cost tracking systems and using farm management software improves the separation and allocation of these costs, enabling more informed decision-making and efficient budget control.

Role of Cost Analysis in Farm Budgeting

Cost analysis plays a critical role in farm budgeting by distinguishing fixed costs, such as machinery depreciation and property taxes, from variable costs like seeds, fertilizers, and labor. Understanding these cost categories enables farmers to predict cash flow requirements, optimize resource allocation, and make informed decisions under varying production levels. Accurate identification of fixed and variable costs enhances profitability forecasting and risk management in agricultural enterprises.

Strategies to Reduce Variable Costs in Agriculture

Reducing variable costs in agriculture involves adopting precision farming techniques, which optimize resource use such as water, fertilizers, and pesticides by targeting specific crop needs. Implementing crop rotation and integrated pest management can also minimize input expenses and improve soil health, thus lowering costs over the growing season. Leveraging technology like automated machinery and data-driven decision tools enhances efficiency and reduces labor and fuel expenditures, significantly impacting overall variable costs.

Balancing Fixed and Variable Costs for Profit Maximization

Balancing fixed and variable costs is crucial for profit maximization in agricultural economics, as fixed costs such as land leases and equipment depreciation remain constant regardless of output, while variable costs like seeds, fertilizers, and labor fluctuate with production levels. Effective budget planning requires accurately forecasting these costs to optimize input allocation and avoid overextending resources, ensuring that total expenses do not exceed revenue generated from crop yields or livestock sales. Strategic management of fixed and variable costs enhances farm profitability by aligning production scale with market prices and minimizing financial risk.

Case Study: Budget Planning in Crop vs. Livestock Farming

Fixed costs in crop farming include expenses like land rent and machinery depreciation, which remain constant regardless of output, whereas variable costs such as seeds, fertilizer, and labor fluctuate based on production levels. In livestock farming, fixed costs encompass infrastructure and equipment, while variable costs cover feed, veterinary services, and breeding expenses, which vary with herd size. Effective budget planning requires careful distinction between these cost types to optimize resource allocation and improve financial sustainability in both crop and livestock operations.

Related Important Terms

Precision Ag Input Allocation

Fixed costs in agricultural economics, such as machinery depreciation and land lease fees, remain constant regardless of production levels, while variable costs like seeds, fertilizers, and labor fluctuate with input usage. Precision Ag Input Allocation optimizes budget planning by precisely adjusting variable input costs based on field-specific data, enhancing cost-efficiency and maximizing yield potential.

Dynamic Cost Segregation

Dynamic cost segregation in agricultural economics enhances budget planning by accurately categorizing fixed costs such as land rent and machinery depreciation, alongside variable costs like seed, fertilizer, and labor expenses, enabling more precise cost control and resource allocation. This approach allows farmers to adjust operational strategies in response to market fluctuations and seasonal changes, optimizing economic efficiency and profitability.

Variable Rate Technology (VRT) Costs

Variable Rate Technology (VRT) costs in agricultural economics fluctuate with input usage such as seeds, fertilizers, and pesticides, impacting overall budget planning by allowing precise resource allocation. Unlike fixed costs, which remain constant regardless of production levels, VRT costs enable farmers to optimize expenditures based on actual field conditions, enhancing cost efficiency and crop yield.

Depreciation Scheduling

Depreciation scheduling plays a critical role in budget planning by allocating fixed costs associated with long-term assets, such as machinery and buildings, over their useful lifespan, ensuring accurate expense matching. Variable costs fluctuate with production levels, while fixed costs remain constant regardless of output, making precise depreciation schedules essential to distinguish asset value loss from operational expenses in agricultural budgeting.

Flexible Leases Impact

Flexible leases in agricultural economics significantly alter budget planning by converting a portion of fixed costs into variable costs, allowing farmers to adjust expenses based on production levels and market conditions. This adaptability enhances financial resilience by reducing overall fixed cost burdens and increasing operational flexibility in response to changing agricultural outputs and economic fluctuations.

Cloud-based Cost Tracking

Cloud-based cost tracking enables precise differentiation between fixed costs, such as land rent and equipment depreciation, and variable costs like seeds and fertilizers in agricultural budgets. This technology provides real-time data analytics, enhancing decision-making accuracy and optimizing resource allocation for sustainable farm management.

Elastic Labor Budgeting

Fixed costs in agricultural economics such as land lease payments and machinery depreciation remain constant irrespective of production volume, while variable costs like seeds, fertilizers, and labor fluctuate with output levels; elastic labor budgeting adjusts labor expenses in response to these variable conditions, optimizing resource allocation and enhancing budget flexibility for diverse planting cycles and market demands. Implementing elastic labor budgeting enables farm managers to balance fixed cost commitments with dynamic labor needs, improving cost efficiency and maximizing profitability under varying economic and climatic scenarios.

Autonomous Equipment Depreciation

Autonomous equipment depreciation represents a fixed cost in agricultural economics, remaining constant regardless of production levels and significantly impacting long-term budget planning. Accurate allocation of depreciation expenses ensures effective cost management and strategic investment decisions for farm sustainability.

Subscription-based Farming Services

Fixed costs in subscription-based farming services include regular fees such as platform access and equipment leasing, which remain constant regardless of production levels. Variable costs fluctuate with farm output and encompass expenses like seeds, fertilizers, and labor, making accurate differentiation essential for effective budget planning in agricultural economics.

Smart Irrigation Variable Costs

Smart irrigation variable costs include expenses such as water usage fees, energy consumption for pumping, and maintenance of sensors and automated systems, which fluctuate based on irrigation frequency and duration. Accurate budgeting requires distinguishing these from fixed costs like infrastructure investments, ensuring precise allocation of resources for optimal water management and cost efficiency.

Fixed costs vs variable costs for budget planning Infographic

agridif.com

agridif.com