Price elasticity measures how the quantity demanded of agricultural goods responds to changes in their prices, often showing more sensitivity for non-essential or luxury crops, whereas income elasticity reflects how demand shifts with consumers' income changes, typically indicating higher demand for staple foods as incomes rise. Understanding these elasticities helps farmers and policymakers predict market responses, optimize pricing strategies, and plan production according to economic fluctuations. The interplay between price and income elasticity determines the overall demand dynamics, influencing supply decisions and market stability in agricultural sectors.

Table of Comparison

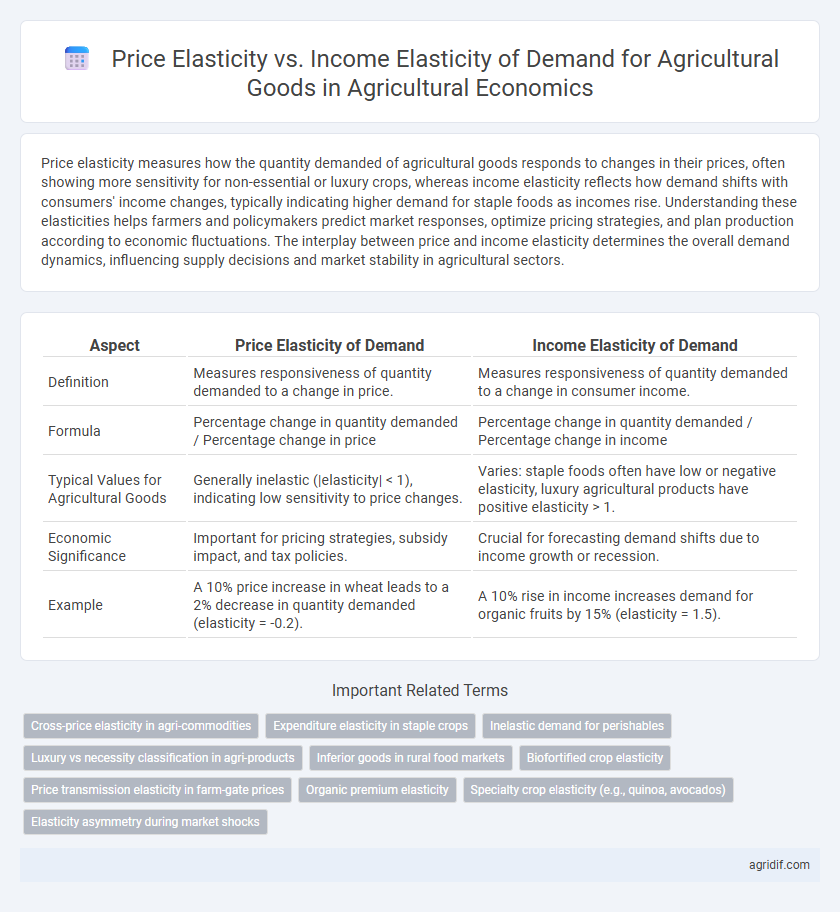

| Aspect | Price Elasticity of Demand | Income Elasticity of Demand |

|---|---|---|

| Definition | Measures responsiveness of quantity demanded to a change in price. | Measures responsiveness of quantity demanded to a change in consumer income. |

| Formula | Percentage change in quantity demanded / Percentage change in price | Percentage change in quantity demanded / Percentage change in income |

| Typical Values for Agricultural Goods | Generally inelastic (|elasticity| < 1), indicating low sensitivity to price changes. | Varies: staple foods often have low or negative elasticity, luxury agricultural products have positive elasticity > 1. |

| Economic Significance | Important for pricing strategies, subsidy impact, and tax policies. | Crucial for forecasting demand shifts due to income growth or recession. |

| Example | A 10% price increase in wheat leads to a 2% decrease in quantity demanded (elasticity = -0.2). | A 10% rise in income increases demand for organic fruits by 15% (elasticity = 1.5). |

Introduction to Elasticities in Agricultural Economics

Price elasticity of demand measures how the quantity demanded of agricultural goods responds to changes in their prices, highlighting consumer sensitivity to price fluctuations. Income elasticity captures the relationship between changes in consumers' income levels and the corresponding demand for agricultural products, indicating whether goods are normal or inferior. Understanding both elasticities is essential for predicting market behavior, setting pricing strategies, and formulating agricultural policies.

Defining Price Elasticity of Demand for Agricultural Goods

Price elasticity of demand for agricultural goods measures the responsiveness of quantity demanded to changes in price, reflecting how sensitive consumers are to price fluctuations in products like grains, fruits, and livestock. This elasticity is crucial for farmers and policymakers, as it influences revenue projections and subsidy allocations amidst volatile market prices. Understanding price elasticity aids in optimizing supply decisions and anticipating consumer behavior in response to price shifts in the agricultural sector.

Exploring Income Elasticity in the Agricultural Sector

Income elasticity in the agricultural sector measures how changes in consumer income influence the demand for agricultural goods, distinguishing essential staples from luxury items. Generally, staple crops such as rice and wheat display low income elasticity, indicating demand remains relatively stable despite income fluctuations, whereas high-value products like organic fruits and specialty vegetables exhibit higher income elasticity, reflecting increased consumption with rising incomes. Understanding income elasticity helps policymakers and producers optimize pricing strategies and production planning in response to economic growth and income distribution changes.

Key Differences Between Price and Income Elasticity

Price elasticity of demand for agricultural goods measures the responsiveness of quantity demanded to changes in the prices of those goods, reflecting how sensitive consumers are to price fluctuations. Income elasticity of demand captures how the quantity demanded of agricultural products varies with changes in consumer income, indicating whether goods are normal or inferior. Key differences lie in their determinants and implications: price elasticity affects pricing and supply decisions directly, while income elasticity informs demand forecasts based on economic growth or recession trends.

Factors Influencing Price Elasticity in Agriculture

Price elasticity of demand for agricultural goods is influenced by factors such as the availability of substitutes, the necessity of the product, and the time period under consideration. Seasonal variations, perishability, and the proportion of income spent on the product also play critical roles in determining price responsiveness. Understanding these factors helps optimize pricing strategies and forecast revenue in agricultural markets.

Determinants of Income Elasticity for Agricultural Produce

Income elasticity for agricultural produce is influenced primarily by factors such as consumer preferences, the necessity or luxury status of the goods, and overall income levels within a population. Staple crops tend to have lower income elasticity because demand remains relatively stable regardless of income changes, while high-value horticultural products exhibit higher income elasticity as increased income allows for greater consumption. Urbanization and dietary diversification also play significant roles in increasing income elasticity by shifting demand toward more nutritious and processed agricultural goods.

Impact of Elasticities on Farm Revenue and Pricing Strategies

Price elasticity of demand for agricultural goods measures how quantity demanded responds to price changes, directly impacting farm revenue by indicating potential revenue loss or gain from price adjustments. Income elasticity reflects changes in demand due to consumer income variations, guiding farmers on which crops to prioritize during economic growth or downturns to maximize revenue. Understanding both elasticities enables farmers to develop pricing strategies that optimize revenue by balancing price sensitivity and income-driven demand shifts in agricultural markets.

Policy Implications of Elasticity in Agricultural Markets

Price elasticity in agricultural markets influences how changes in product prices affect the quantity demanded, guiding policymakers in setting tariffs and subsidies to stabilize farmer incomes. Income elasticity indicates how demand for agricultural goods shifts with consumer income, aiding in forecast adjustments for food security and nutrition programs during economic growth or recession. Understanding both elasticities allows for targeted interventions that balance market efficiency with social welfare objectives, optimizing resource allocation and minimizing market volatility.

Case Studies: Elasticity Effects in Major Agricultural Commodities

Price elasticity of demand for major agricultural commodities such as wheat and corn typically exhibits inelastic behavior due to their necessity and limited substitutes, while income elasticity varies significantly, with luxury crops like fruits showing higher responsiveness to income changes. Case studies from countries like India and Brazil reveal that staple grains have low income elasticity, reinforcing their role as essential goods, whereas horticultural products experience greater demand shifts as consumer incomes rise. Understanding these elasticity differences helps policymakers and farmers optimize production and marketing strategies to adapt to economic fluctuations and consumer behavior trends.

Future Trends in Agricultural Demand Elasticities

Future trends in agricultural demand elasticities indicate a growing differentiation between price elasticity and income elasticity for various crops and livestock products. Price elasticity of demand for staple grains tends to remain inelastic due to their essential nature, while income elasticity for high-value agricultural goods, such as fruits, vegetables, and organic products, is expected to increase as consumer incomes rise globally. Advances in technology, urbanization, and shifts in dietary preferences will further influence these elasticities, driving more responsive demand patterns for diverse agricultural commodities.

Related Important Terms

Cross-price elasticity in agri-commodities

Cross-price elasticity in agricultural commodities measures the responsiveness of the demand for one agricultural good when the price of another related good changes, highlighting substitution or complementarity effects within the agricultural market. This metric is crucial for understanding competitive dynamics among crops like wheat and corn, enabling policymakers and farmers to anticipate shifts in demand and optimize production strategies based on price fluctuations.

Expenditure elasticity in staple crops

Expenditure elasticity for staple crops typically exhibits low values, reflecting the inelastic demand as these goods constitute essential food items with limited substitution. Price elasticity tends to be more elastic in non-staple agricultural goods, while income elasticity for staples remains relatively low due to their necessity status in household consumption.

Inelastic demand for perishables

Price elasticity of demand for perishables in agriculture tends to be relatively inelastic due to the necessity and limited substitutability of fresh products, resulting in minor quantity changes despite price fluctuations. Income elasticity for these goods is generally low or positive but modest, reflecting steady consumer demand even with varying income levels, as perishables are essential for daily nutrition rather than luxury items.

Luxury vs necessity classification in agri-products

Price elasticity of agricultural goods tends to be higher for luxury products, as consumers reduce consumption significantly with price increases, while necessity agri-products exhibit lower price elasticity due to their essential role in diets. Income elasticity is positive and greater than one for luxury agricultural items, indicating demand rises disproportionately with income growth, whereas necessity goods have income elasticity between zero and one, reflecting more stable consumption across income levels.

Inferior goods in rural food markets

Price elasticity for inferior agricultural goods in rural food markets tends to be relatively more elastic as consumers reduce demand in response to price increases, while income elasticity is negative, reflecting decreased consumption as rural incomes rise and consumers shift to higher-quality substitutes. Understanding these contrasting elasticities helps optimize pricing strategies and forecast demand fluctuations under varying economic conditions in agricultural economics.

Biofortified crop elasticity

Price elasticity of biofortified crops tends to be relatively inelastic due to the essential nature and limited substitutes of these nutrient-enriched products, indicating consumers are less sensitive to price changes. Income elasticity for biofortified crops is generally positive and higher than conventional staples, reflecting increased demand as consumer incomes rise and awareness of nutritional benefits grows in agricultural economies.

Price transmission elasticity in farm-gate prices

Price elasticity of demand measures the responsiveness of quantity demanded to changes in farm-gate prices, directly affecting price transmission elasticity, which quantifies how price changes at the farm level pass through to consumers or intermediaries. Income elasticity of demand for agricultural goods reflects changes in consumer income influencing demand, but price transmission elasticity specifically highlights the efficiency and responsiveness of market channels in adjusting farm-gate prices to price signals.

Organic premium elasticity

Price elasticity of demand for organic agricultural goods typically exhibits higher sensitivity compared to conventional products, reflecting consumers' responsiveness to price changes in premium-priced organic items. Income elasticity for organic premium goods often reveals positive values greater than one, indicating these products function as luxury goods with demand increasing disproportionately as consumer incomes rise.

Specialty crop elasticity (e.g., quinoa, avocados)

Specialty crops like quinoa and avocados exhibit higher income elasticity compared to price elasticity, indicating consumer demand increases more significantly with rising income than with changes in price. This reflects their status as luxury or health-conscious goods, where purchasing decisions are more sensitive to income fluctuations than to price variations.

Elasticity asymmetry during market shocks

Price elasticity of demand for agricultural goods often exhibits higher sensitivity during market shocks, reflecting consumers' immediate response to price changes, whereas income elasticity tends to show asymmetric behavior as income fluctuations affect purchasing power more gradually. This elasticity asymmetry highlights the critical need for adaptive pricing strategies and income support measures to stabilize agricultural markets under economic stress.

Price elasticity vs Income elasticity for agricultural goods Infographic

agridif.com

agridif.com