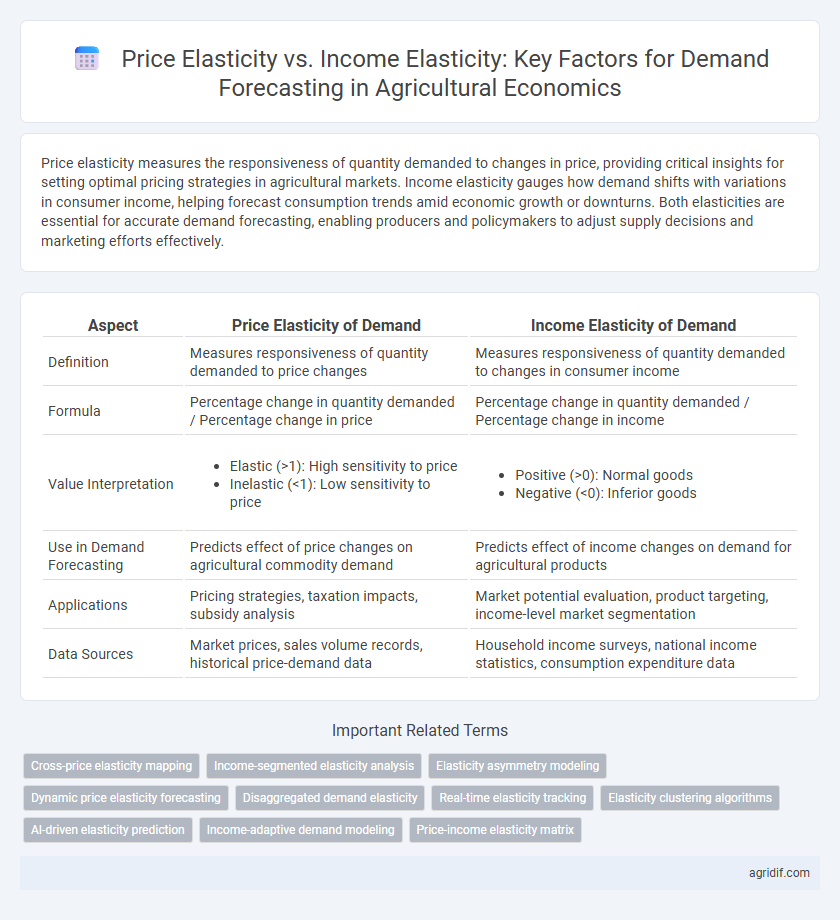

Price elasticity measures the responsiveness of quantity demanded to changes in price, providing critical insights for setting optimal pricing strategies in agricultural markets. Income elasticity gauges how demand shifts with variations in consumer income, helping forecast consumption trends amid economic growth or downturns. Both elasticities are essential for accurate demand forecasting, enabling producers and policymakers to adjust supply decisions and marketing efforts effectively.

Table of Comparison

| Aspect | Price Elasticity of Demand | Income Elasticity of Demand |

|---|---|---|

| Definition | Measures responsiveness of quantity demanded to price changes | Measures responsiveness of quantity demanded to changes in consumer income |

| Formula | Percentage change in quantity demanded / Percentage change in price | Percentage change in quantity demanded / Percentage change in income |

| Value Interpretation |

|

|

| Use in Demand Forecasting | Predicts effect of price changes on agricultural commodity demand | Predicts effect of income changes on demand for agricultural products |

| Applications | Pricing strategies, taxation impacts, subsidy analysis | Market potential evaluation, product targeting, income-level market segmentation |

| Data Sources | Market prices, sales volume records, historical price-demand data | Household income surveys, national income statistics, consumption expenditure data |

Introduction to Demand Elasticities in Agriculture

Price elasticity of demand in agriculture measures how crop or livestock quantities respond to price changes, reflecting farmers' and consumers' sensitivity to market fluctuations. Income elasticity captures variations in demand as consumer income levels shift, influencing the consumption of agricultural products ranging from staples to luxury food items. Both elasticities are crucial for demand forecasting, enabling accurate predictions of market behavior under different economic scenarios and informing policy and production decisions.

Defining Price Elasticity of Demand in Agricultural Markets

Price elasticity of demand in agricultural markets measures the responsiveness of the quantity demanded of a crop or commodity to changes in its price, reflecting consumers' sensitivity to price fluctuations. This metric is crucial for forecasting demand as it helps predict how changes in market prices, influenced by factors such as supply shocks or policy adjustments, will affect consumption levels. Understanding price elasticity supports farmers and policymakers in making informed decisions about production, pricing strategies, and market interventions in the agricultural sector.

Understanding Income Elasticity of Demand in Agriculture

Income elasticity of demand in agriculture measures how changes in consumer income affect the quantity demanded for agricultural products, providing crucial insights for demand forecasting. Unlike price elasticity, which focuses on how price changes influence demand, income elasticity reveals the sensitivity of demand to economic growth, indicating whether agricultural goods are normal or inferior products. Accurate estimation of income elasticity helps policymakers and agribusinesses predict shifts in consumption patterns and allocate resources efficiently in response to income fluctuations.

Key Differences Between Price and Income Elasticity

Price elasticity of demand measures the responsiveness of quantity demanded to changes in the price of agricultural products, reflecting consumer sensitivity to price fluctuations. Income elasticity of demand gauges how demand varies with consumer income changes, indicating whether a product is a normal or inferior good in agricultural markets. Key differences include that price elasticity often influences short-term demand adjustments, while income elasticity affects long-term consumption patterns and structural market trends.

Methods for Measuring Price Elasticity in Agricultural Products

Methods for measuring price elasticity in agricultural products include the use of econometric models such as ordinary least squares (OLS) regression and time-series analysis to estimate how quantity demanded responds to price changes. Hedonic pricing models and experimental auctions also provide insights into consumer preferences and willingness to pay. Accurate measurement of price elasticity aids in forecasting demand, optimizing pricing strategies, and informing policy decisions in the agricultural sector.

Approaches to Estimating Income Elasticity in the Agricultural Sector

Approaches to estimating income elasticity in the agricultural sector typically involve econometric modeling using time-series or panel data of household income and agricultural product consumption. Common methods include the Almost Ideal Demand System (AIDS) and Quadratic AIDS (QUAIDS) models, which capture non-linear relationships between income changes and demand variations. Accurate estimation of income elasticity enables better forecasting of commodity demand shifts in response to income growth, essential for policy planning and market strategy in agriculture.

Implications of Price Elasticity for Demand Forecasting

Price elasticity of demand measures the responsiveness of quantity demanded to changes in price, providing critical insights for agricultural producers in setting optimal prices. Understanding price elasticity helps forecast demand fluctuations caused by price adjustments, enabling more accurate revenue predictions and inventory management. High price elasticity in agricultural products suggests that small price changes can significantly impact consumer demand, influencing strategic decisions in supply chain and marketing efforts.

Role of Income Elasticity in Predicting Agricultural Demand

Income elasticity plays a crucial role in predicting agricultural demand by measuring how changes in consumer income levels affect the quantity of agricultural products demanded. Unlike price elasticity, which focuses solely on price variations, income elasticity captures broader economic dynamics, helping forecast shifts in demand as local and global incomes evolve. Accurate estimation of income elasticity enables policymakers and agribusinesses to anticipate market growth, plan production, and allocate resources efficiently in response to income-driven consumption changes.

Case Studies: Elasticity Application in Agricultural Economics

Price elasticity of demand in agricultural economics measures how quantity demanded responds to price changes, essential for predicting market reactions to policy shifts or supply variations. Income elasticity assesses demand sensitivity to income fluctuations, revealing consumer behavior patterns for agricultural products during economic growth or recession periods. Case studies demonstrate that combining both elasticities enhances accuracy in demand forecasting, aiding policymakers and farmers in adjusting strategies to optimize production and pricing.

Strategic Forecasting: Integrating Both Elasticities for Better Decision-Making

Price elasticity measures the responsiveness of demand to changes in agricultural product prices, while income elasticity gauges demand variation with shifts in consumer income. Strategic forecasting in agricultural economics integrates both elasticities to enhance accuracy in predicting demand fluctuations under varying economic conditions. Combining these metrics enables policymakers and producers to optimize production planning and market strategies, ensuring better decision-making amid dynamic market environments.

Related Important Terms

Cross-price elasticity mapping

Cross-price elasticity plays a crucial role in demand forecasting by measuring the responsiveness of the quantity demanded for one agricultural product when the price of a related product changes, indicating substitution or complementarity between crops like corn and soybeans. Mapping these elasticities alongside price and income elasticity helps agribusinesses optimize production decisions and forecast market shifts more accurately by understanding interdependencies across commodity prices and consumer income levels.

Income-segmented elasticity analysis

Income-segmented elasticity analysis in agricultural economics reveals that low-income consumers exhibit higher income elasticity of demand for staple crops, indicating greater sensitivity to income changes compared to price elasticity. This differentiation enables more precise demand forecasting by tailoring strategies to income segments, optimizing resource allocation and market interventions.

Elasticity asymmetry modeling

Price elasticity of demand measures sensitivity to price changes, while income elasticity assesses demand response to income variations, both critical in agricultural economics for forecasting. Elasticity asymmetry modeling captures differing consumer reactions to price increases versus decreases and varying income levels, improving accuracy in demand projections for agricultural commodities.

Dynamic price elasticity forecasting

Dynamic price elasticity forecasting in agricultural economics allows for real-time adjustments based on fluctuating market conditions, improving demand prediction accuracy by capturing consumers' sensitivity to price changes over time. Unlike income elasticity, which measures demand responsiveness to income variations, dynamic price elasticity provides more immediate insights crucial for optimizing pricing strategies and managing supply in volatile agricultural markets.

Disaggregated demand elasticity

Disaggregated demand elasticity provides more precise insights by analyzing price elasticity and income elasticity at the product or sub-market level, enabling accurate demand forecasting in agricultural economics. Understanding variations in elasticity across different crops and consumer segments improves resource allocation and market strategy formulation.

Real-time elasticity tracking

Real-time tracking of price elasticity and income elasticity enhances demand forecasting accuracy by capturing immediate consumer responses to price changes and income fluctuations in agricultural markets. Leveraging big data analytics and machine learning algorithms enables dynamic adjustment of elasticity estimates, improving decision-making for supply chain management and policy formulation.

Elasticity clustering algorithms

Price elasticity measures consumers' responsiveness to price changes in agricultural products, while income elasticity assesses demand variations due to income fluctuations, both crucial for accurate demand forecasting. Elasticity clustering algorithms segment agricultural products based on similar price and income elasticity patterns, enhancing predictive accuracy by identifying demand sensitivity groups within market data.

AI-driven elasticity prediction

AI-driven elasticity prediction models enhance demand forecasting in agricultural economics by accurately measuring price elasticity, which captures consumers' responsiveness to price changes, and income elasticity, reflecting demand shifts due to income variations. Leveraging machine learning algorithms on large datasets enables precise estimation of these elasticities, improving supply chain efficiency and policy formulation in volatile agricultural markets.

Income-adaptive demand modeling

Income-adaptive demand modeling integrates income elasticity analysis to capture consumer responsiveness to income changes, significantly enhancing demand forecasting accuracy in agricultural markets. This approach contrasts with traditional price elasticity models by emphasizing income variability's impact on consumption patterns, thereby enabling more precise predictions of agricultural product demand under shifting economic conditions.

Price-income elasticity matrix

The Price-Income Elasticity Matrix combines price elasticity of demand, which measures responsiveness of quantity demanded to price changes, with income elasticity, indicating sensitivity to income fluctuations, to enhance demand forecasting accuracy in agricultural economics. This matrix allows analysts to categorize agricultural products by their demand responsiveness, aiding in strategic pricing and production decisions under varying market and economic conditions.

Price elasticity vs income elasticity for demand forecasting Infographic

agridif.com

agridif.com