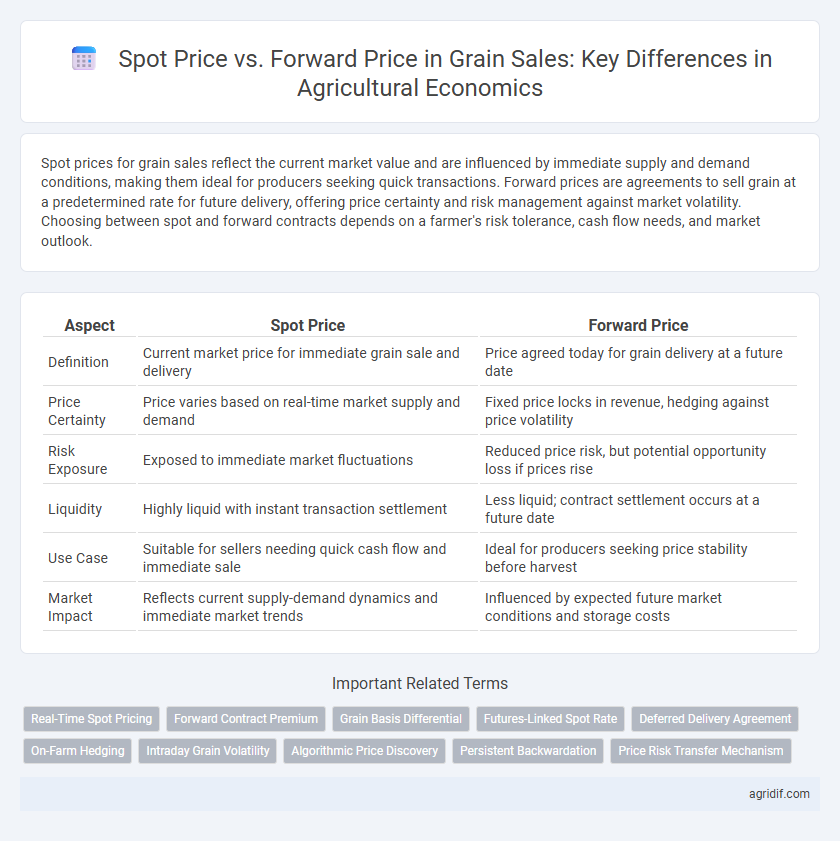

Spot prices for grain sales reflect the current market value and are influenced by immediate supply and demand conditions, making them ideal for producers seeking quick transactions. Forward prices are agreements to sell grain at a predetermined rate for future delivery, offering price certainty and risk management against market volatility. Choosing between spot and forward contracts depends on a farmer's risk tolerance, cash flow needs, and market outlook.

Table of Comparison

| Aspect | Spot Price | Forward Price |

|---|---|---|

| Definition | Current market price for immediate grain sale and delivery | Price agreed today for grain delivery at a future date |

| Price Certainty | Price varies based on real-time market supply and demand | Fixed price locks in revenue, hedging against price volatility |

| Risk Exposure | Exposed to immediate market fluctuations | Reduced price risk, but potential opportunity loss if prices rise |

| Liquidity | Highly liquid with instant transaction settlement | Less liquid; contract settlement occurs at a future date |

| Use Case | Suitable for sellers needing quick cash flow and immediate sale | Ideal for producers seeking price stability before harvest |

| Market Impact | Reflects current supply-demand dynamics and immediate market trends | Influenced by expected future market conditions and storage costs |

Introduction to Spot and Forward Prices in Grain Markets

Spot prices for grain reflect the current market value determined by immediate supply and demand conditions, offering real-time pricing for buyers and sellers. Forward prices are agreed upon today for grain delivery at a future date, helping producers and buyers manage price risk and forecast revenues. These pricing mechanisms are central to agricultural economics, enabling efficient market operations and financial planning in grain markets.

Key Differences Between Spot Price and Forward Price

Spot price reflects the current market value of grain for immediate delivery, influenced by real-time supply and demand conditions. Forward price is a contractually agreed price set today for grain delivery at a future date, helping farmers and buyers hedge against price volatility. Spot prices fluctuate daily, while forward prices provide price certainty and risk management in agricultural economics.

Factors Influencing Spot Prices for Grains

Spot prices for grains are primarily influenced by immediate supply and demand conditions, weather patterns affecting crop yields, and current storage costs. Market volatility, transportation availability, and government policies such as export restrictions or subsidies also play significant roles in determining spot prices. Seasonal factors and global events causing sudden shifts in market sentiment further impact the spot price dynamics in grain markets.

Determinants of Forward Contract Prices in Agriculture

Forward contract prices in agriculture are primarily influenced by expected future spot prices, storage costs, interest rates, and anticipated supply-demand imbalances. The cost of carry, incorporating expenses like warehousing, insurance, and financing, plays a critical role in determining the forward price premium or discount relative to the spot price. Market expectations about weather conditions, government policies, and global trade dynamics also significantly impact the forward pricing of grain sales.

Risk Management: Spot Price vs Forward Contracts

Spot prices for grain sales reflect current market conditions and are subject to immediate delivery, exposing farmers to price volatility and market fluctuations. Forward contracts lock in a predetermined price for future delivery, providing producers with price certainty and reducing exposure to adverse price movements. Effective risk management in agricultural economics involves balancing the liquidity and flexibility of spot sales with the price stability and risk mitigation offered by forward contracts.

Price Volatility and its Impact on Grain Sales Strategies

Spot prices for grain reflect real-time market conditions and exhibit higher volatility due to immediate supply and demand fluctuations. Forward prices, set through contracts, provide price certainty and help farmers manage risk by locking in rates ahead of harvest, mitigating the impact of unexpected market shifts. Price volatility influences grain sales strategies by encouraging producers to balance spot market opportunities with forward contracting to protect profit margins against unpredictable price swings.

Benefits and Limitations of Spot Sales for Farmers

Spot sales for grain offer immediate payment and eliminate market uncertainty, allowing farmers to access cash flow quickly. However, spot prices are subject to daily market volatility, potentially leading to lower returns compared to forward contracts that lock in future prices. Farmers face risks of price drops after harvest in spot markets, which can impact profitability and financial planning.

Advantages and Challenges of Forward Sales Contracts

Forward sales contracts in grain trading offer price certainty by locking in a selling price before harvest, protecting farmers from market volatility and enabling better cash flow management. These contracts also facilitate risk management and budgeting accuracy, but challenges include reduced flexibility to capitalize on favorable market price increases and potential basis risk if local cash prices diverge from futures market prices. Farmers must weigh the benefits of price stability against the risk of opportunity loss and ensure contract terms align with production forecasts to optimize revenue.

Role of Market Information in Spot and Forward Pricing

Market information plays a crucial role in determining spot and forward prices for grain sales by reflecting current supply and demand dynamics and anticipated future market conditions. Spot prices are influenced by immediate factors such as harvest yields, weather patterns, and inventory levels, providing a real-time valuation of grain. Forward prices incorporate market expectations, including projected production trends and policy changes, allowing producers and buyers to hedge against price volatility through informed contract agreements.

Strategic Considerations for Choosing Spot vs Forward Sales in Grain Markets

Spot price sales in grain markets offer immediate payment based on current market conditions, providing liquidity and reducing price risk exposure but may miss potential future price increases. Forward price contracts enable producers to lock in prices ahead of harvest, ensuring revenue certainty and aiding in cash flow management, though they carry basis risk and the possibility of forgoing higher spot prices. Strategic decisions between spot and forward sales hinge on risk tolerance, cash flow needs, market outlook, and storage capacity within agricultural economics frameworks.

Related Important Terms

Real-Time Spot Pricing

Real-time spot pricing for grain sales reflects the immediate market value based on current supply and demand, offering farmers accurate signals for timely selling decisions. Forward prices, by contrast, lock in future transaction rates, reducing price uncertainty but potentially sacrificing responsiveness to market fluctuations evident in spot pricing.

Forward Contract Premium

The forward contract premium in grain sales represents the price difference where the forward price exceeds the spot price, reflecting storage costs, interest rates, and market expectations about future supply and demand. This premium incentivizes producers to lock in prices ahead of harvest, mitigating price risk and stabilizing revenue against market volatility.

Grain Basis Differential

Grain basis differential represents the difference between the spot price at the local elevator and the futures price at the exchange, reflecting transportation costs, quality, and local supply-demand conditions. Farmers use the basis to evaluate the relative attractiveness of spot versus forward price contracts, optimizing timing and location for grain sales to maximize revenue.

Futures-Linked Spot Rate

The futures-linked spot rate for grain sales reflects the current spot price adjusted by the cost of carry, incorporating storage, interest rates, and time until delivery, providing a more accurate economic signal for producers and buyers. This relationship between spot and forward prices optimizes hedging strategies, allowing farmers to manage price risk effectively in volatile grain markets.

Deferred Delivery Agreement

Spot price for grain sales reflects current market value for immediate delivery, while forward price under a Deferred Delivery Agreement locks in a future sale price, minimizing price risk for producers. Deferred Delivery Agreements enable farmers to secure a contract price ahead of harvest, providing cash flow certainty and protecting against adverse market fluctuations.

On-Farm Hedging

On-farm hedging of grain sales leverages spot prices to capture immediate market conditions, while forward prices enable farmers to lock in future revenue and mitigate the risk of price volatility. Effective use of forward contracts aligns with crop inventory levels and anticipated harvest timing, optimizing income stability in volatile agricultural markets.

Intraday Grain Volatility

Intraday grain price volatility significantly impacts the spread between spot and forward prices, as real-time market fluctuations reflect supply-demand imbalances and weather-related uncertainties. Understanding this volatility allows agricultural economists to optimize grain sales strategies by leveraging forward contracts to hedge against unpredictable intraday spot price swings.

Algorithmic Price Discovery

Algorithmic price discovery leverages real-time market data and predictive analytics to accurately determine spot and forward prices for grain sales, enhancing transparency and efficiency in agricultural markets. By integrating machine learning models with historical price trends and supply-demand variables, these algorithms optimize pricing strategies, reducing risk and improving profitability for farmers and traders.

Persistent Backwardation

Spot prices for grain often exhibit persistent backwardation when immediate delivery prices exceed forward contract prices, signaling strong current demand or supply shortages in agricultural markets. This pricing pattern incentivizes producers to sell grain promptly, impacting storage costs and futures market dynamics in agricultural economics.

Price Risk Transfer Mechanism

Spot price reflects the current market value of grain, enabling immediate transactions with no delivery delay, whereas forward price sets a predetermined amount for future delivery, facilitating price risk transfer between producers and buyers. This mechanism allows farmers to hedge against price volatility by locking in prices in advance, thus stabilizing income and managing market uncertainty effectively.

Spot price vs Forward price for grain sales Infographic

agridif.com

agridif.com