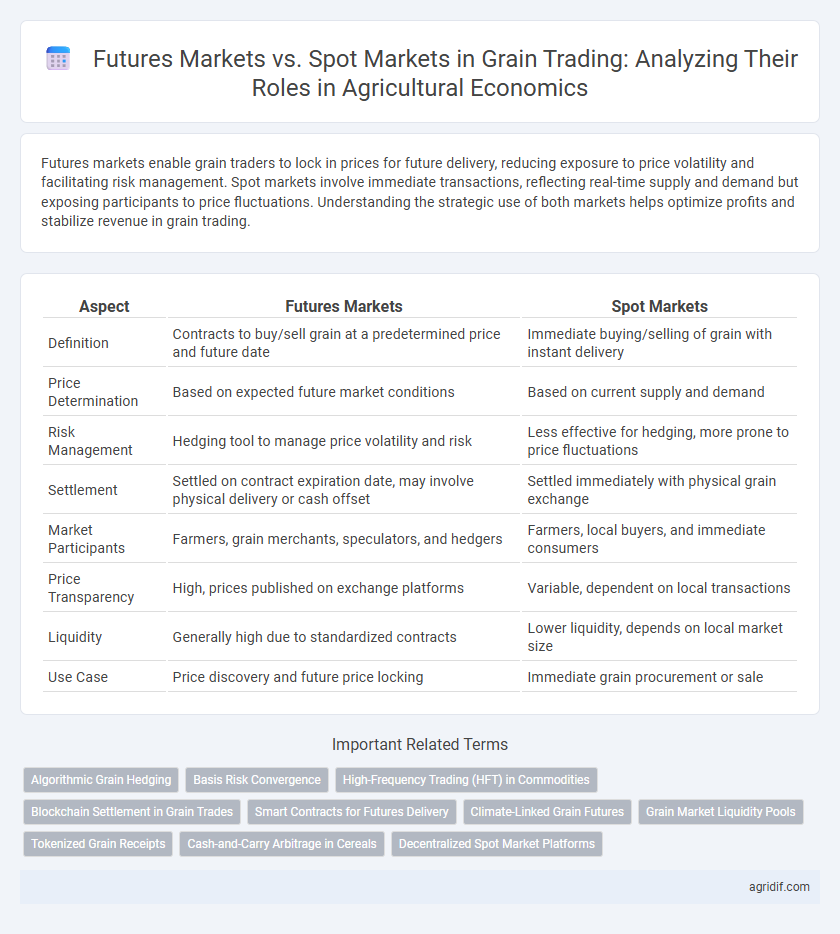

Futures markets enable grain traders to lock in prices for future delivery, reducing exposure to price volatility and facilitating risk management. Spot markets involve immediate transactions, reflecting real-time supply and demand but exposing participants to price fluctuations. Understanding the strategic use of both markets helps optimize profits and stabilize revenue in grain trading.

Table of Comparison

| Aspect | Futures Markets | Spot Markets |

|---|---|---|

| Definition | Contracts to buy/sell grain at a predetermined price and future date | Immediate buying/selling of grain with instant delivery |

| Price Determination | Based on expected future market conditions | Based on current supply and demand |

| Risk Management | Hedging tool to manage price volatility and risk | Less effective for hedging, more prone to price fluctuations |

| Settlement | Settled on contract expiration date, may involve physical delivery or cash offset | Settled immediately with physical grain exchange |

| Market Participants | Farmers, grain merchants, speculators, and hedgers | Farmers, local buyers, and immediate consumers |

| Price Transparency | High, prices published on exchange platforms | Variable, dependent on local transactions |

| Liquidity | Generally high due to standardized contracts | Lower liquidity, depends on local market size |

| Use Case | Price discovery and future price locking | Immediate grain procurement or sale |

Introduction to Grain Trading Markets

Futures markets for grain trading allow producers and buyers to hedge against price volatility by locking in prices for delivery at a future date, providing financial risk management tools. Spot markets involve the immediate exchange of grain commodities at current market prices, reflecting real-time supply and demand dynamics. Understanding the differences between these markets is essential for optimizing trading strategies and managing price risks in agricultural economics.

Overview of Futures and Spot Markets

Futures markets for grain trading involve standardized contracts to buy or sell specific quantities of grain at predetermined prices for future delivery, allowing producers and buyers to hedge against price volatility. Spot markets, by contrast, facilitate the immediate exchange of grain at current market prices, reflecting real-time supply and demand conditions. The integration of futures and spot markets enhances price discovery, risk management, and market liquidity in agricultural economics.

Key Differences Between Futures and Spot Markets

Futures markets for grain trading involve standardized contracts traded on exchanges, allowing buyers and sellers to lock in prices for future delivery, providing price risk management and liquidity. Spot markets deal with the immediate exchange of physical grain at current market prices, enabling quick transactions without long-term commitment. Key differences include timing of delivery, price determination, contract standardization, and risk exposure, where futures markets offer hedging opportunities while spot markets reflect real-time supply and demand.

Price Discovery in Grain Markets

Futures markets play a critical role in price discovery for grain trading by aggregating diverse information from producers, consumers, and speculators, which helps establish transparent and forward-looking price signals. Spot markets provide immediate transaction prices reflecting current supply and demand but are often more volatile due to short-term fluctuations and local conditions. Combining insights from futures and spot markets enhances market efficiency, aiding stakeholders in managing price risks and making informed production and purchasing decisions.

Hedging Strategies in Futures Markets

Futures markets allow grain traders to lock in prices ahead of harvest, reducing exposure to price volatility and securing profit margins. By entering into futures contracts, producers hedge against the risk of falling crop prices, while buyers protect against rising costs, enhancing financial predictability. This risk management tool is essential in agricultural economics for stabilizing income and optimizing supply chain planning.

Role of Speculators and Arbitrageurs

Speculators in grain futures markets provide essential liquidity and risk absorption, enabling farmers and buyers to hedge price volatility effectively, while arbitrageurs exploit price discrepancies between futures and spot markets to ensure price alignment and market efficiency. Spot markets involve immediate delivery and settlement, reflecting current supply-demand conditions, whereas futures markets facilitate price discovery and risk management based on anticipated future prices. The dynamic interaction between speculators and arbitrageurs stabilizes grain prices, reduces transaction costs, and supports the overall efficiency of agricultural commodity trading systems.

Market Liquidity and Accessibility

Futures markets for grain trading offer high market liquidity, enabling traders to quickly enter and exit positions due to standardized contracts and centralized exchanges. Spot markets provide immediate delivery of physical grain but often face lower liquidity and greater price variability depending on regional supply and demand factors. Accessibility in futures markets is enhanced by electronic trading platforms and standardized contract sizes, whereas spot markets require direct negotiation and logistics, limiting participation primarily to local producers and buyers.

Impacts on Farmers and Agribusinesses

Futures markets allow farmers and agribusinesses to hedge against price volatility by locking in prices for grain sales, reducing income uncertainty and improving financial planning. Spot markets provide immediate delivery and payment, offering flexibility but exposing participants to price fluctuations that can impact profitability. The choice between futures and spot markets significantly influences risk management strategies and cash flow stability in the agricultural sector.

Regulatory Framework and Risk Management

Futures markets for grain trading operate under stringent regulatory frameworks such as the Commodity Futures Trading Commission (CFTC) oversight in the United States, ensuring transparency and market integrity. These markets facilitate sophisticated risk management tools like hedging, enabling producers and buyers to lock in prices and mitigate exposure to price volatility. Spot markets, while less regulated, offer immediate delivery and settlement, catering to buyers and sellers seeking quick transactions but without the same level of financial risk protection.

Future Trends in Grain Trading Markets

Futures markets for grain trading enable producers and buyers to hedge price risks by locking in prices for future delivery, providing a mechanism for price discovery and risk management. Spot markets facilitate immediate transactions based on current market prices, reflecting real-time supply and demand dynamics. Emerging trends in grain trading emphasize increased digitalization, improved predictive analytics for price forecasting, and the integration of blockchain technology to enhance transparency and traceability in both futures and spot markets.

Related Important Terms

Algorithmic Grain Hedging

Algorithmic grain hedging leverages real-time data and predictive analytics to optimize futures contracts in grain trading, enhancing risk management compared to spot markets where prices are determined instantly without hedging opportunities. This approach minimizes price volatility exposure for agricultural producers by automating trades based on market trends and weather patterns, ensuring more stable revenue streams.

Basis Risk Convergence

Basis risk convergence in grain trading occurs as futures prices approach spot prices near contract expiration, reducing the price difference and minimizing risk for producers and buyers. Efficient convergence ensures accurate price signals in agricultural economics, enabling better decision-making and risk management in grain futures markets compared to spot markets.

High-Frequency Trading (HFT) in Commodities

Futures markets in grain trading enable hedging and price discovery through contracts with standardized delivery dates, offering liquidity essential for High-Frequency Trading (HFT) algorithms that exploit millisecond price movements. Spot markets provide immediate transaction settlement but lack the temporal depth and volume liquidity that HFT strategies require to efficiently capitalize on grain commodity price fluctuations.

Blockchain Settlement in Grain Trades

Futures markets enable grain producers and buyers to hedge price risks by locking in prices through standardized contracts, while spot markets involve immediate settlement of physical grain commodities. Blockchain settlement in grain trades enhances transparency, reduces counterparty risk, and accelerates transaction finality by automating contract execution and enabling immutable record-keeping across both futures and spot transactions.

Smart Contracts for Futures Delivery

Smart contracts streamline futures delivery in grain trading by automating transaction execution based on predefined conditions, reducing counterparty risk and enhancing transparency. Integrating blockchain technology with futures markets ensures secure, timely settlements compared to spot markets, where immediate delivery and price volatility present greater operational challenges.

Climate-Linked Grain Futures

Climate-linked grain futures enable producers and traders to hedge price risks associated with climate variability by integrating weather indices directly into contract specifications, enhancing pricing accuracy compared to traditional spot markets. These futures contracts facilitate market-driven risk management for grain commodities impacted by droughts, floods, and temperature fluctuations, unlike spot markets which reflect immediate delivery and are more sensitive to transient supply shocks.

Grain Market Liquidity Pools

Grain market liquidity pools in futures markets enhance price discovery and risk management by aggregating large volumes of standardized contracts, whereas spot markets provide immediate transaction settlements with physical grain delivery but typically exhibit lower liquidity and higher price volatility. Futures markets facilitate hedging strategies and speculator participation, boosting overall market depth compared to the more localized and less liquid spot grain markets.

Tokenized Grain Receipts

Tokenized grain receipts integrate blockchain technology into futures markets, enhancing transparency and liquidity by enabling secure, real-time trading of grain contracts. These digital assets bridge the gap between spot markets and futures markets, allowing farmers and traders to efficiently hedge price risks while ensuring immediate settlement and provenance verification.

Cash-and-Carry Arbitrage in Cereals

Cash-and-carry arbitrage in cereals exploits price differences between futures markets and spot markets by simultaneously buying grain at the current spot price and selling futures contracts to lock in profits after accounting for storage and carrying costs. This strategy relies on the convergence of futures and spot prices at contract maturity, ensuring arbitrage opportunities diminish as market efficiency improves in agricultural commodity trading.

Decentralized Spot Market Platforms

Decentralized spot market platforms for grain trading offer enhanced transparency and direct peer-to-peer transactions, reducing reliance on intermediaries compared to traditional futures markets. These platforms leverage blockchain technology to ensure secure, real-time settlement and better price discovery, benefiting smallholder farmers and traders by increasing market access and lowering transaction costs.

Futures Markets vs Spot Markets for grain trading Infographic

agridif.com

agridif.com