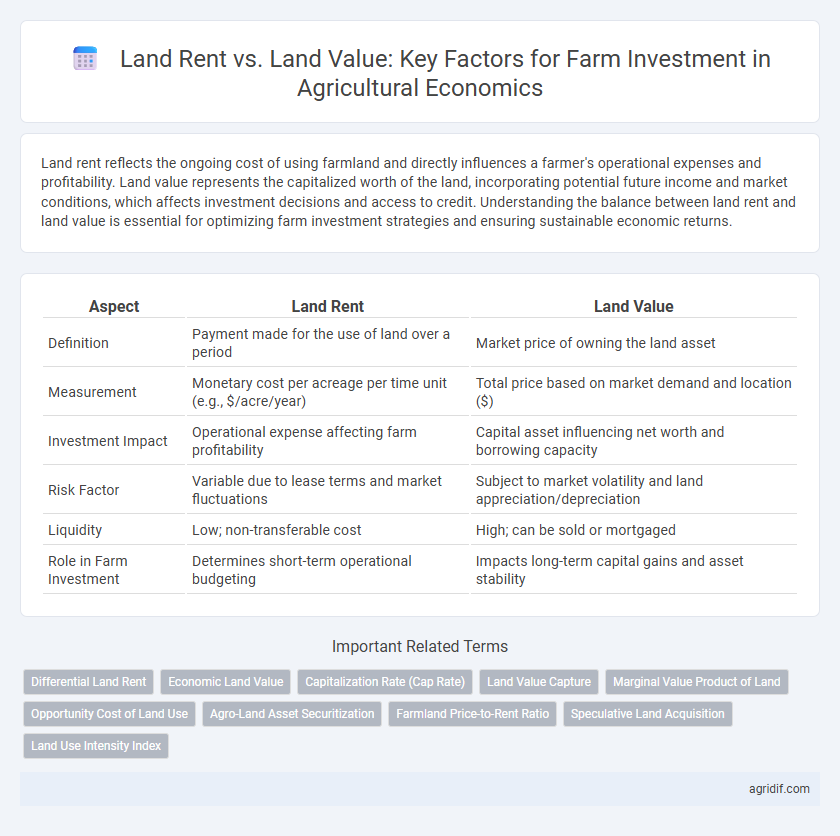

Land rent reflects the ongoing cost of using farmland and directly influences a farmer's operational expenses and profitability. Land value represents the capitalized worth of the land, incorporating potential future income and market conditions, which affects investment decisions and access to credit. Understanding the balance between land rent and land value is essential for optimizing farm investment strategies and ensuring sustainable economic returns.

Table of Comparison

| Aspect | Land Rent | Land Value |

|---|---|---|

| Definition | Payment made for the use of land over a period | Market price of owning the land asset |

| Measurement | Monetary cost per acreage per time unit (e.g., $/acre/year) | Total price based on market demand and location ($) |

| Investment Impact | Operational expense affecting farm profitability | Capital asset influencing net worth and borrowing capacity |

| Risk Factor | Variable due to lease terms and market fluctuations | Subject to market volatility and land appreciation/depreciation |

| Liquidity | Low; non-transferable cost | High; can be sold or mortgaged |

| Role in Farm Investment | Determines short-term operational budgeting | Impacts long-term capital gains and asset stability |

Understanding Land Rent in Agricultural Economics

Land rent in agricultural economics reflects the payment made for the use of land based on its productivity, directly influencing farm profitability and investment decisions. Unlike land value, which represents the market price of land as a capital asset, land rent is an ongoing cost that affects operational expenses and cash flow. Understanding the dynamics of land rent helps farmers evaluate the returns on their investments and optimize land use efficiency in various market conditions.

Defining Land Value for Farm Investments

Land value for farm investments represents the capitalized worth of agricultural land based on its potential to generate income through crop production, livestock, or other farming activities. Unlike land rent, which refers to periodic payments made for land use, land value encapsulates the asset's long-term economic benefits, influenced by factors such as soil fertility, location, market access, and future development possibilities. Understanding land value is crucial for farm investment decisions as it determines the feasibility and profitability of acquiring or expanding agricultural operations.

Key Factors Influencing Land Rent

Land rent in agricultural economics is primarily influenced by factors such as soil fertility, proximity to markets, and irrigation availability, which directly affect the productivity and profitability of farm investments. Unlike land value, which reflects the capitalized worth of land based on long-term potential and market demand, land rent fluctuates with seasonal outputs and short-term economic conditions. Understanding these key determinants helps investors optimize farm operations and select lands that maximize returns relative to investment costs.

Determinants of Agricultural Land Value

Agricultural land value is primarily determined by factors such as soil fertility, location, access to water resources, and proximity to markets, which directly impact expected agricultural productivity and profitability. Land rent reflects the income-generating potential of the land, serving as a key indicator for investors assessing the return on farm investment relative to land value. Understanding the dynamic relationship between land rent and land value enables more accurate valuation models, guiding optimal capital allocation in agricultural economics.

Income Approach vs Market Value in Land Assessment

Land rent represents the income generated from agricultural production on a property, serving as the primary basis for the Income Approach in farm investment valuation, where future earnings are discounted to determine land worth. In contrast, land value under the Market Value method reflects the current price a buyer is willing to pay, influenced by factors such as location, soil quality, and comparable sales data. Understanding the distinction between income capitalization and market trends is critical for accurate land assessment and optimizing farm investment decisions.

Land Rent’s Role in Farm Profitability

Land rent directly impacts farm profitability by representing a recurring cost that reduces net returns from agricultural production. Higher land rents often signal increased competition for farmland, influencing farmers' decisions on investment and cultivation intensity. Understanding the balance between land rent and land value is crucial for optimizing farm investment strategies and ensuring sustainable economic returns.

Impact of Land Value on Investment Decisions

High land values significantly influence farm investment decisions by increasing the opportunity cost of capital tied up in land ownership, often discouraging expansion or improvement projects. Land rent, representing the annual return on land use, provides a more flexible basis for assessing short-term investments compared to the capital-intensive commitments linked with land value. Understanding the interplay between land rent and land value is crucial for farmers and policymakers aiming to optimize resource allocation and promote sustainable agricultural development.

Land Rent vs Land Value: Comparative Analysis

Land rent represents the periodic payment made for the use of agricultural land, reflecting its productivity and location advantages, whereas land value denotes the market price based on current and expected future benefits from the land. In farm investment decisions, understanding the ratio of land rent to land value helps determine the capitalization rate and the potential return on investment. Empirical studies show that regions with high land value but relatively low land rent may indicate overvaluation, impacting long-term sustainability of farm investments.

Policy Implications for Land Rent and Value

Land rent, reflecting the annual payment for land use, directly influences farmers' operational costs and investment decisions, while land value represents the capitalized worth affected by land productivity and market expectations. Policy implications emphasize implementing land taxation and rent control measures to stabilize rental rates, promote equitable access, and encourage efficient land use. Enhancing transparency in land markets and supporting land tenure security can balance land value appreciation with sustainable farm investment incentives.

Strategic Recommendations for Farm Investors

Farm investors should prioritize analyzing land rent trends as they reflect the income-generating potential and operational costs, providing real-time signals for investment decisions. Evaluating land value offers insights into long-term asset appreciation but may be influenced by speculative factors and market volatility. Strategic investment should balance current rental yields with expected capital gains to optimize farm profitability and risk management.

Related Important Terms

Differential Land Rent

Differential land rent arises from variations in land fertility and location, directly impacting the profitability of farm investments by influencing how much rent a farmer is willing to pay relative to the productivity of the land. Higher differential rent reflects increased agricultural output potential, thereby elevating land value and guiding investment decisions toward more fertile or better-positioned plots.

Economic Land Value

Economic land value in agricultural economics reflects the present worth of future land rent streams, serving as a critical metric for farm investment decision-making. Unlike land rent, which represents annual income generated from the land, economic land value incorporates discounted cash flow analysis to evaluate long-term profitability and capital appreciation potential of farm properties.

Capitalization Rate (Cap Rate)

Land rent directly influences the capitalization rate, which is the ratio of net income to land value, guiding farmers in assessing the profitability of farm investments. A lower cap rate indicates higher land values relative to rent, often signaling increased competition or expected future income growth in agricultural land markets.

Land Value Capture

Land rent reflects the periodic returns from agricultural production, while land value signifies the capitalized worth of the landasset, influenced by factors like soil quality and market conditions. Capturing land value through strategic farm investments enhances long-term profitability by optimizing land use efficiency and securing tenure benefits, thus bridging the gap between annual rents and accumulated land wealth.

Marginal Value Product of Land

The Marginal Value Product of Land (MVPL) quantifies the additional output generated by an incremental unit of land, directly influencing land rent as it reflects the land's contribution to farm profitability. Land rent typically equates to the MVPL, whereas land value capitalizes expected future rents, making MVPL essential for evaluating optimal farm investment decisions.

Opportunity Cost of Land Use

Land rent reflects the opportunity cost of land use by quantifying the income forgone from alternative uses, while land value captures the capitalized present value of expected future returns from farm investment. Understanding the distinction between land rent and land value is crucial for optimizing resource allocation and maximizing profitability in agricultural economics.

Agro-Land Asset Securitization

Land rent directly influences farm profitability and cash flow, serving as a critical metric for assessing agricultural investment returns, while land value reflects the underlying asset's long-term capital appreciation and collateral potential. Agro-Land Asset Securitization leverages this distinction by converting future land rent streams into tradable securities, thus unlocking liquidity and enhancing capital access for farm investments.

Farmland Price-to-Rent Ratio

The farmland price-to-rent ratio is a critical indicator in agricultural economics that compares the market value of land to its annual rental income, influencing farm investment decisions by signaling relative land affordability and income potential. Higher ratios suggest land prices may be overvalued relative to rental income, potentially deterring investment, while lower ratios indicate better alignment for profitable farming operations.

Speculative Land Acquisition

Speculative land acquisition in agricultural economics drives up land value independently of productive use, resulting in inflated land rent that can deter efficient farm investment. This divergence between land rent and land value creates challenges for farmers seeking to optimize resource allocation and maximize returns on agricultural capital.

Land Use Intensity Index

The Land Use Intensity Index measures the degree to which land is utilized for agricultural production, directly influencing land rent by reflecting productivity and opportunity cost, while land value represents the capitalized worth of this intensive use over time. Higher intensity levels typically elevate land rent due to increased returns per unit area, whereas land value integrates these rents discounted over future periods, guiding optimal farm investment decisions.

Land rent vs land value for farm investment Infographic

agridif.com

agridif.com