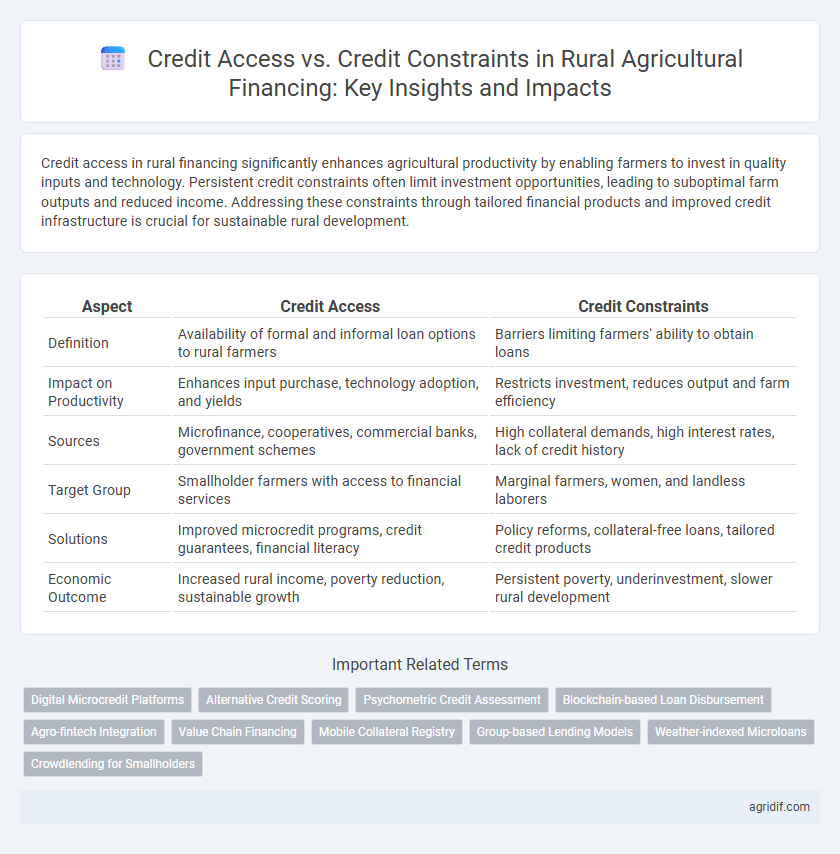

Credit access in rural financing significantly enhances agricultural productivity by enabling farmers to invest in quality inputs and technology. Persistent credit constraints often limit investment opportunities, leading to suboptimal farm outputs and reduced income. Addressing these constraints through tailored financial products and improved credit infrastructure is crucial for sustainable rural development.

Table of Comparison

| Aspect | Credit Access | Credit Constraints |

|---|---|---|

| Definition | Availability of formal and informal loan options to rural farmers | Barriers limiting farmers' ability to obtain loans |

| Impact on Productivity | Enhances input purchase, technology adoption, and yields | Restricts investment, reduces output and farm efficiency |

| Sources | Microfinance, cooperatives, commercial banks, government schemes | High collateral demands, high interest rates, lack of credit history |

| Target Group | Smallholder farmers with access to financial services | Marginal farmers, women, and landless laborers |

| Solutions | Improved microcredit programs, credit guarantees, financial literacy | Policy reforms, collateral-free loans, tailored credit products |

| Economic Outcome | Increased rural income, poverty reduction, sustainable growth | Persistent poverty, underinvestment, slower rural development |

Introduction to Rural Financing in Agriculture

Rural financing plays a critical role in agricultural development by enabling farmers to access necessary capital for inputs, technology, and expansion. Credit access refers to the availability of formal financial services to rural farmers, which is often limited by factors such as high transaction costs, lack of collateral, and inadequate financial infrastructure. Credit constraints in rural areas hinder investment and productivity growth, perpetuating poverty and reducing agricultural output.

Defining Credit Access and Credit Constraints

Credit access refers to the ability of rural farmers and agribusinesses to obtain financial resources from formal and informal lenders to invest in agricultural production, inputs, and technology. Credit constraints occur when these rural economic agents face barriers such as high-interest rates, lack of collateral, or limited financial literacy that restrict their borrowing capacity and limit investment opportunities. Understanding the differences between credit access and credit constraints is critical for designing effective rural financing policies that enhance agricultural productivity and rural income.

Importance of Credit in Agricultural Development

Credit access in rural areas is pivotal for agricultural development, enabling farmers to invest in quality seeds, fertilizers, and modern equipment that increase productivity and income. Credit constraints, such as high interest rates and lack of collateral, limit farmers' ability to expand operations and adopt innovative technologies, hindering economic growth in the agricultural sector. Effective rural financing mechanisms improve credit availability, reduce financial risks, and promote sustainable agricultural development by supporting smallholder farmers.

Factors Influencing Credit Access for Farmers

Factors influencing credit access for farmers include collateral availability, credit history, and financial literacy, which significantly impact loan approval rates. Institutional factors such as proximity to financial institutions, bureaucratic requirements, and interest rates also play crucial roles in either enabling or restricting rural financing. Socioeconomic variables like farm size, income stability, and social capital further affect a farmer's ability to secure necessary credit for agricultural investment.

Common Barriers: Understanding Credit Constraints

Credit constraints in rural financing arise primarily from limited collateral, inadequate credit history, and high information asymmetry between lenders and borrowers. These barriers restrict smallholder farmers' access to formal credit, hindering investments in productivity-enhancing technologies and inputs. Understanding these constraints enables the design of targeted financial products and policies that improve credit accessibility and rural economic development.

Impact of Credit Constraints on Rural Productivity

Credit constraints in rural areas significantly limit farmers' ability to invest in quality seeds, fertilizers, and modern equipment, hindering productivity growth and income diversification. Limited access to formal credit often forces reliance on informal lenders with high interest rates, exacerbating financial stress and reducing investment capacity. Empirical studies show that alleviating credit constraints through targeted rural financing improves agricultural output, adoption of technology, and overall economic resilience.

Institutional Roles in Facilitating Credit Access

Institutional roles are pivotal in enhancing credit access for rural farmers by providing formal financial services, reducing information asymmetries, and mitigating risks associated with lending. Agricultural cooperatives, government agencies, and rural banks implement targeted credit programs and guarantee schemes that alleviate credit constraints and promote sustainable rural financing. Efficient institutional frameworks improve collateral mechanisms, credit appraisal, and financial literacy, thereby increasing the overall accessibility and affordability of agricultural credit in rural economies.

Policy Interventions to Overcome Credit Barriers

Policy interventions targeting rural financing effectively reduce credit constraints by improving access to formal credit sources and lowering borrowing costs for smallholder farmers. Implementation of credit guarantee schemes and subsidized interest rates encourages financial institutions to extend loans to underserved rural populations. Digital financial services and mobile banking platforms further enhance the outreach and efficiency of credit delivery, overcoming traditional barriers in remote agricultural communities.

Comparative Outcomes: Access vs Constraints in Rural Finance

Credit access in rural financing significantly enhances agricultural productivity by enabling farmers to invest in improved seeds, fertilizers, and technology, leading to higher yields and income stability. Conversely, credit constraints limit investment opportunities, perpetuating low productivity and vulnerability to economic shocks. Comparative studies show that overcoming credit barriers boosts rural economic development, increases financial inclusion, and reduces poverty more effectively than regions where credit remains inaccessible.

Future Directions for Inclusive Rural Credit Systems

Improving credit access in rural areas requires integrating digital financial services and mobile banking to overcome traditional barriers. Tailoring loan products to the unique income cycles and risk profiles of smallholder farmers enhances financial inclusion and repayment rates. Future rural credit systems should leverage data analytics and alternative credit scoring methods to expand access while minimizing credit constraints.

Related Important Terms

Digital Microcredit Platforms

Digital microcredit platforms significantly enhance credit access for rural farmers by offering tailored, low-interest loans through mobile technology, reducing dependency on traditional financial institutions. These platforms address credit constraints by leveraging alternative data for credit scoring, enabling broader financial inclusion and timely capital infusion essential for agricultural productivity.

Alternative Credit Scoring

Alternative credit scoring models enhance rural financing by utilizing non-traditional data such as mobile phone usage, social networks, and transaction history to assess creditworthiness in the absence of formal credit records. This approach mitigates credit constraints for smallholder farmers and rural entrepreneurs by expanding access to financial services and improving the accuracy of risk assessment in underserved agricultural economies.

Psychometric Credit Assessment

Psychometric credit assessment enhances rural financing by evaluating borrowers' cognitive traits and personality rather than relying solely on traditional financial records, addressing credit constraints faced by smallholder farmers. This approach improves credit access by enabling lenders to better predict repayment behavior and extend loans to underserved rural populations with limited collateral.

Blockchain-based Loan Disbursement

Blockchain-based loan disbursement enhances credit access for rural farmers by providing transparent, tamper-proof records that reduce the risk for lenders and lower transaction costs. This technology mitigates traditional credit constraints by enabling real-time verification of borrower credentials and facilitating decentralized financing platforms, increasing the availability and efficiency of rural agricultural loans.

Agro-fintech Integration

Agro-fintech integration enhances rural financing by improving credit access through digital platforms that reduce intermediaries and increase transparency, thereby enabling smallholder farmers to secure timely loans tailored to agricultural cycles. Despite these advancements, credit constraints persist due to limited digital literacy, insufficient collateral, and data gaps, which fintech innovations strive to mitigate through alternative credit scoring models and mobile-based financial services.

Value Chain Financing

Credit access in rural value chain financing enhances smallholder productivity by providing timely inputs, while credit constraints limit farmers' ability to invest in high-yield technologies and diversify crops. Efficient value chain financing integrates suppliers, producers, and buyers, reducing transaction costs and mitigating risks associated with rural credit markets.

Mobile Collateral Registry

Mobile Collateral Registry (MCR) systems significantly enhance credit access for rural farmers by digitizing collateral records, reducing transaction costs, and increasing transparency in loan approval processes. Improved credit access through MCR mitigates traditional credit constraints faced by rural borrowers, fostering greater financial inclusion and stimulating agricultural productivity.

Group-based Lending Models

Group-based lending models enhance credit access for rural farmers by leveraging social collateral and peer monitoring, reducing default risks and transaction costs. These models mitigate credit constraints in agricultural financing by facilitating collective responsibility, improving loan repayment rates, and enabling smallholder farmers to secure funds for productivity investments.

Weather-indexed Microloans

Weather-indexed microloans significantly enhance credit access for rural farmers by providing insurance-based financial products that reduce weather-related risks, fostering investment in agricultural inputs and productivity. These microloans address credit constraints caused by unpredictable climate conditions, enabling more resilient and sustainable rural financing mechanisms that improve income stability and food security.

Crowdlending for Smallholders

Crowdlending platforms have emerged as innovative solutions to enhance credit access for smallholder farmers, bridging the financing gap caused by traditional credit constraints such as high collateral requirements and limited banking infrastructure. By leveraging digital networks and peer-to-peer lending models, crowdlending provides rural smallholders with more flexible, timely, and affordable financial resources that stimulate agricultural productivity and income stability.

Credit Access vs Credit Constraints for Rural Financing Infographic

agridif.com

agridif.com