Hedging in agricultural economics involves using financial instruments like futures contracts to reduce price volatility and protect against adverse market movements. Speculation, on the other hand, seeks to profit from price fluctuations by taking on higher risk without direct exposure to the underlying commodity. Effective risk management requires understanding the distinct goals and risk tolerances associated with hedging and speculation strategies.

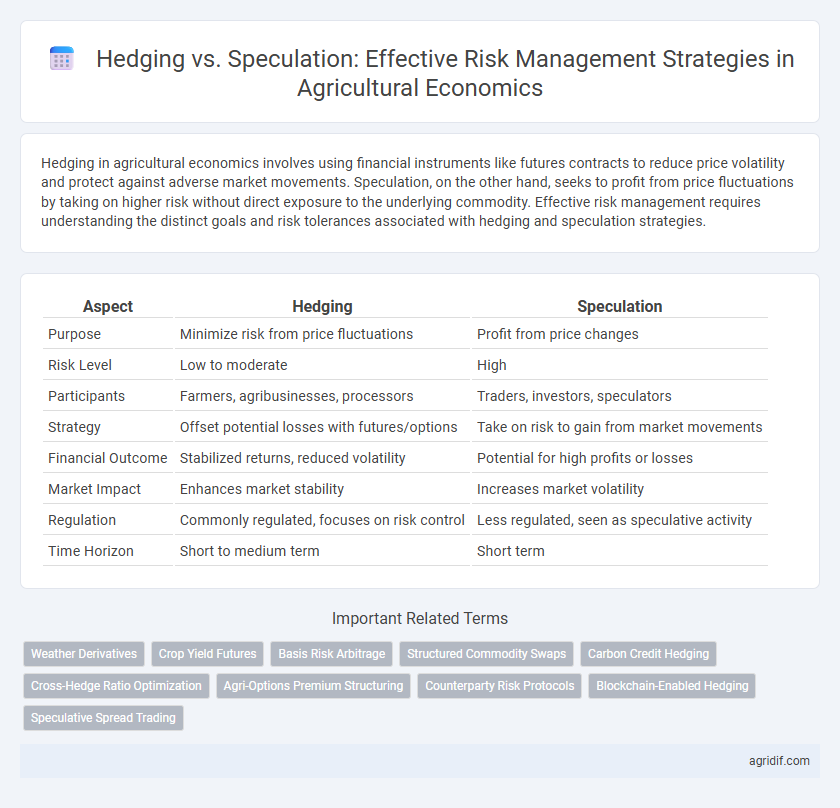

Table of Comparison

| Aspect | Hedging | Speculation |

|---|---|---|

| Purpose | Minimize risk from price fluctuations | Profit from price changes |

| Risk Level | Low to moderate | High |

| Participants | Farmers, agribusinesses, processors | Traders, investors, speculators |

| Strategy | Offset potential losses with futures/options | Take on risk to gain from market movements |

| Financial Outcome | Stabilized returns, reduced volatility | Potential for high profits or losses |

| Market Impact | Enhances market stability | Increases market volatility |

| Regulation | Commonly regulated, focuses on risk control | Less regulated, seen as speculative activity |

| Time Horizon | Short to medium term | Short term |

Understanding Risk in Agricultural Markets

Hedging in agricultural markets involves using futures contracts to protect producers and buyers against price volatility, thereby stabilizing revenue and costs. Speculation, on the other hand, entails taking on price risk to profit from anticipated market movements, which can amplify market liquidity but increases exposure to price fluctuations. Understanding the distinct roles of hedging and speculation is crucial for managing risk effectively in agricultural economics, where factors like weather, pests, and policy changes intensify price uncertainty.

Defining Hedging in Agricultural Economics

Hedging in agricultural economics involves using financial instruments such as futures contracts to mitigate price risk associated with volatile agricultural commodity markets. Producers and buyers lock in prices to protect against adverse price fluctuations, ensuring more stable income and cost structures. This risk management strategy contrasts with speculation, which seeks to profit from price movements without underlying exposure to the commodity.

Speculation: Concepts and Role in Agriculture

Speculation in agricultural economics involves taking calculated risks in commodity markets to profit from price fluctuations. Speculators provide liquidity and enhance market efficiency by absorbing price risks that farmers and agribusinesses seek to avoid. While hedgers use futures contracts to stabilize revenue, speculators assume price risk, playing a crucial role in price discovery and market integration in the agriculture sector.

Key Differences Between Hedging and Speculation

Hedging involves using financial instruments like futures and options to minimize the risk of price fluctuations in agricultural markets, ensuring price stability for producers and consumers. Speculation, by contrast, aims to profit from anticipated price movements, accepting higher risk without the intent of risk reduction. The key difference lies in risk management: hedging reduces potential losses, while speculation increases exposure for potential gains.

Tools and Instruments for Hedging Agricultural Risks

Futures contracts and options are primary tools for hedging agricultural risks, enabling producers to lock in prices and protect against market volatility. Crop insurance and forward contracts also serve as effective instruments to manage yield and price uncertainties in farming operations. Utilizing these financial mechanisms helps stabilize farm income and mitigate exposure to unpredictable weather, pests, and commodity price fluctuations.

Impact of Speculation on Commodity Prices

Speculation in commodity markets influences price volatility by increasing trading volume and liquidity, which can lead to short-term price fluctuations. While hedging aims to stabilize prices by reducing risk exposure for producers and consumers, excessive speculative activity may drive prices away from fundamental values. Empirical studies reveal that moderate speculation supports efficient price discovery, but speculative bubbles can cause price distortions affecting agricultural commodity markets.

Benefits of Hedging for Farmers and Agribusinesses

Hedging enables farmers and agribusinesses to secure stable prices for crops and livestock, reducing exposure to volatile market fluctuations. By locking in guaranteed prices through futures contracts or options, producers can improve financial planning and protect profit margins. This risk management strategy minimizes potential losses from adverse price movements in agricultural commodities.

Risks and Rewards of Speculation in Agriculture

Speculation in agriculture involves taking on higher price risks with the potential for significant financial rewards by anticipating market movements in commodities like corn, wheat, and soybeans. This practice can lead to substantial profits when price predictions are accurate, but it also exposes farmers and investors to severe losses due to volatile factors such as weather conditions, trade policies, and global supply-demand imbalances. Effective risk management requires understanding the fine balance between leveraging market opportunities and the inherent price fluctuations characteristic of agricultural commodities.

Regulatory Framework for Hedging and Speculation

The regulatory framework for hedging and speculation in agricultural economics is designed to ensure market transparency and protect participants from excessive volatility. Hedging activities are regulated under commodity trading laws such as the Commodity Exchange Act (CEA), with oversight by agencies like the Commodity Futures Trading Commission (CFTC), which enforces position limits and reporting requirements to prevent market manipulation. Speculative trading faces restrictions to minimize systemic risk and ensure that price signals reflect true supply and demand conditions, thus safeguarding the stability of agricultural commodity markets.

Strategic Decision-Making: Choosing Hedging or Speculation

Strategic decision-making in agricultural economics involves evaluating market conditions, price volatility, and individual risk tolerance to choose between hedging or speculation for risk management. Hedging mitigates price risk through futures contracts, providing stability in input costs and revenues, while speculation seeks to profit from price fluctuations but carries higher risk exposure. Farmers and agribusinesses analyze supply-demand forecasts, historical price trends, and production cycles to align risk strategies with financial goals and operational capacity.

Related Important Terms

Weather Derivatives

Weather derivatives provide a strategic tool for agricultural producers to hedge risks associated with unpredictable weather events, stabilizing income by transferring weather-related financial risks to counterparties. Unlike speculation, which focuses on profiting from market fluctuations, hedging with weather derivatives specifically mitigates potential losses in crop yields and farm revenue caused by adverse climatic conditions.

Crop Yield Futures

Crop yield futures enable farmers and agribusinesses to hedge against price volatility by locking in prices for future harvests, reducing uncertainty in income and production costs. Speculators, on the other hand, use crop yield futures to profit from market fluctuations, increasing liquidity but potentially adding price risk to producers relying on these contracts for risk management.

Basis Risk Arbitrage

Hedging in agricultural economics involves using futures contracts to minimize price risk, whereas speculation seeks to profit from price fluctuations, with basis risk arbitrage specifically addressing the risk that the difference between spot and futures prices (basis) changes unexpectedly. Effective basis risk arbitrage strategies enhance risk management by exploiting temporary basis deviations without exposure to directional price movements.

Structured Commodity Swaps

Structured commodity swaps provide a customizable hedging solution that mitigates price volatility risks in agricultural markets by locking in future prices through tailored derivative contracts. Unlike speculation, which seeks profit from price movements, these swaps enable farmers and agribusinesses to stabilize cash flows and manage uncertainties related to crop yields and commodity prices effectively.

Carbon Credit Hedging

Carbon credit hedging in agricultural economics involves using carbon credits to offset potential financial losses from fluctuating carbon prices, providing a stable risk management tool for farmers and agribusinesses aiming to reduce their environmental impact. Speculation, by contrast, entails taking positions on carbon credit price movements to profit from market volatility, which involves higher risk exposure but potential for financial gain.

Cross-Hedge Ratio Optimization

Cross-hedge ratio optimization enhances risk management in agricultural economics by minimizing basis risk when direct hedging instruments are unavailable, using statistical methods like regression analysis to determine the optimal hedge size between correlated commodities. Precise calibration of cross-hedge ratios improves portfolio stability and mitigates exposure to price volatility in agricultural markets.

Agri-Options Premium Structuring

Hedging in agricultural economics involves strategically using agri-options premium structuring to minimize price risk by locking in costs and revenues, ensuring stable farm income in volatile markets. In contrast, speculation leverages agri-options premiums to profit from price movements, accepting higher risk for potential gains, which requires sophisticated pricing models to balance premium costs and expected returns.

Counterparty Risk Protocols

Hedging in agricultural economics involves using futures contracts and options to mitigate price volatility risk, integrating rigorous counterparty risk protocols such as credit checks, collateral requirements, and standardized clearinghouses to ensure contract performance. Speculation, by contrast, carries higher counterparty risk exposure due to market-driven positions without underlying asset ownership, necessitating robust risk assessment frameworks and real-time monitoring to prevent default losses.

Blockchain-Enabled Hedging

Blockchain-enabled hedging enhances risk management in agricultural economics by providing transparent, tamper-proof contracts that ensure more accurate pricing and reduce counterparty risk. This technology improves market efficiency compared to traditional speculation by facilitating real-time data sharing, traceability, and automated settlements in commodity trading.

Speculative Spread Trading

Speculative spread trading in agricultural economics involves simultaneously buying and selling related commodity contracts to capitalize on price differential changes, aiming to profit from market volatility rather than hedging against price risk. This strategy requires deep market insight and timing, as traders exploit fluctuations between futures contracts to maximize returns without the direct risk mitigation benefits of hedging.

Hedging vs Speculation for risk management Infographic

agridif.com

agridif.com