Farmers exhibiting risk aversion prefer selecting crops with stable yields and predictable market prices to minimize potential losses during adverse conditions. In contrast, risk-seeking farmers may choose high-return but volatile crops, accepting greater uncertainty for the chance of substantial profits. Crop selection decisions thus hinge on the individual's tolerance for risk and the economic environment influencing price and yield variability.

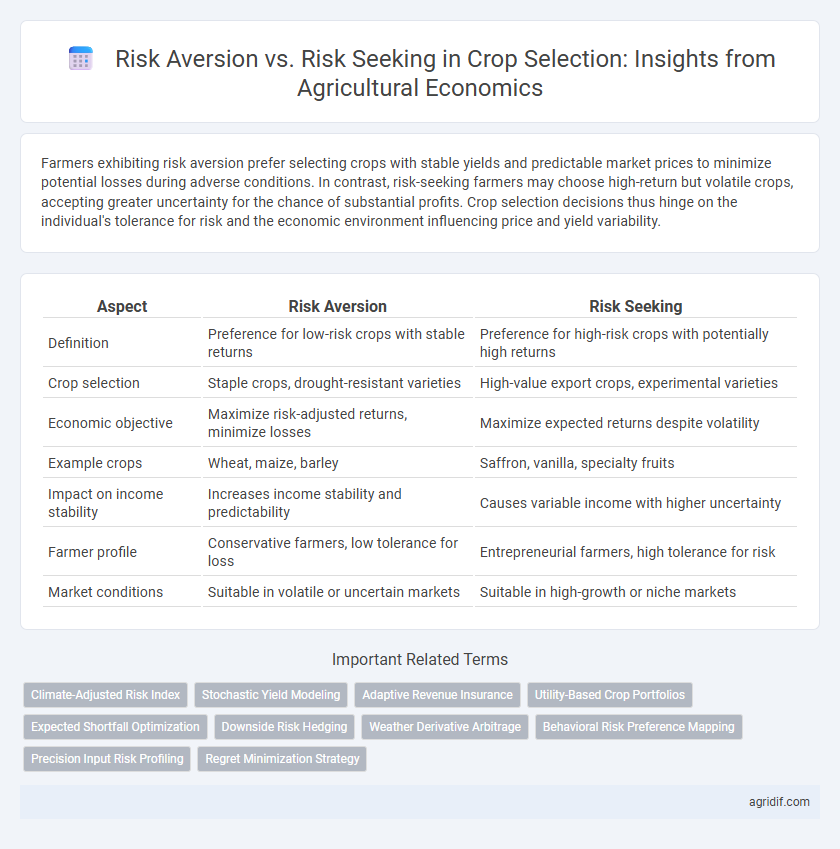

Table of Comparison

| Aspect | Risk Aversion | Risk Seeking |

|---|---|---|

| Definition | Preference for low-risk crops with stable returns | Preference for high-risk crops with potentially high returns |

| Crop selection | Staple crops, drought-resistant varieties | High-value export crops, experimental varieties |

| Economic objective | Maximize risk-adjusted returns, minimize losses | Maximize expected returns despite volatility |

| Example crops | Wheat, maize, barley | Saffron, vanilla, specialty fruits |

| Impact on income stability | Increases income stability and predictability | Causes variable income with higher uncertainty |

| Farmer profile | Conservative farmers, low tolerance for loss | Entrepreneurial farmers, high tolerance for risk |

| Market conditions | Suitable in volatile or uncertain markets | Suitable in high-growth or niche markets |

Understanding Risk Attitudes in Agricultural Decision-Making

Understanding risk attitudes in agricultural decision-making reveals how risk aversion leads farmers to prefer stable, lower-yield crops that minimize income variability, while risk-seeking behavior drives the selection of high-yield but volatile crops. Empirical studies show that risk-averse farmers often prioritize crop diversification and insurance mechanisms to safeguard against market and climatic uncertainties. Risk preferences significantly influence investment in inputs and technology, affecting overall productivity and income stability in farming systems.

The Role of Risk Aversion in Crop Selection

Risk aversion significantly influences crop selection decisions by motivating farmers to choose crops with stable, predictable yields to minimize potential losses. Empirical studies show that risk-averse farmers prefer low-variance crops such as staple grains over high-risk, high-return options like specialty fruits or biofuels. Economic models integrating utility functions confirm that higher risk aversion correlates with conservative crop portfolios aimed at ensuring income stability and reducing exposure to price volatility and climate uncertainty.

Drivers and Implications of Risk-Seeking Behavior among Farmers

Risk-seeking behavior among farmers in crop selection is driven primarily by the pursuit of higher returns from high-yield or specialty crops despite uncertain market prices and environmental factors. Factors such as access to credit, exposure to market volatility, and lack of risk mitigation tools encourage this preference for riskier crops with potentially greater profit margins. This behavior impacts agricultural sustainability and income stability, often leading to increased vulnerability to crop failure and fluctuating market conditions.

Economic Theories Underpinning Risk Preferences in Agriculture

Economic theories such as expected utility theory and prospect theory explain farmers' risk preferences in crop selection, highlighting why risk-averse farmers prefer stable, lower-yield crops while risk-seeking farmers choose high-variance, high-return options. Risk aversion aligns with diminishing marginal utility of wealth, causing farmers to prioritize consistent income and minimize potential losses amid volatile agricultural markets. In contrast, risk-seeking behavior emerges from potential overweighing of high payoffs predicted by prospect theory, motivating some farmers to invest in crops with uncertain but potentially lucrative outcomes.

Impact of Risk Attitudes on Crop Diversification Strategies

Farmers with risk-averse attitudes tend to diversify crops extensively to minimize potential losses from market volatility and adverse weather conditions. In contrast, risk-seeking farmers often concentrate on high-reward crops, accepting greater exposure to price fluctuations and climatic uncertainties. This divergence in risk preferences significantly shapes regional crop patterns, influencing overall agricultural resilience and economic stability.

Market Volatility and its Influence on Farmer Risk Preferences

Market volatility significantly influences farmer risk preferences, with risk-averse farmers favoring stable crops that offer predictable yields and prices to minimize financial losses. In contrast, risk-seeking farmers may choose high-return, volatile crops despite price fluctuations, aiming to maximize profit under uncertain market conditions. Understanding these behaviors aids in designing crop insurance and support programs that align with different risk profiles in agricultural economics.

Case Studies: Risk Aversion vs. Risk Seeking in Crop Choice

Case studies in agricultural economics reveal that risk-averse farmers tend to select stable, low-variance crops such as wheat or barley to secure consistent income despite lower yields. Conversely, risk-seeking farmers often choose high-reward but volatile crops like specialty fruits or biofuel crops, willing to face price fluctuations for potentially greater profits. Empirical data from regions like sub-Saharan Africa and Southeast Asia demonstrate that access to credit and market information significantly influence farmers' risk preferences in crop selection.

Effects of Climate Change on Risk Orientation in Crop Selection

Climate change intensifies weather variability and extreme events, significantly influencing farmers' risk orientation in crop selection. Increased climate-related uncertainties drive risk-averse farmers to prefer resilient, low-yield crops, while risk-seeking farmers may opt for high-yield but climate-sensitive varieties. Understanding how shifting climatic patterns affect risk preferences is crucial for developing adaptive agricultural policies and crop recommendation systems.

Policy Measures Shaping Farmer Risk Behavior and Crop Choice

Policy measures such as crop insurance, price support programs, and access to credit significantly influence farmer risk aversion, encouraging the selection of staple crops with stable returns over high-risk, high-reward alternatives. Subsidies targeting drought-resistant or pest-resistant varieties reduce uncertainty, thereby shifting risk-averse farmers toward diversified cropping patterns. Institutional interventions that enhance market information and reduce input costs also empower risk-seeking farmers to experiment with innovative or export-oriented crops, balancing risk and profitability in agricultural decision-making.

Future Trends: Adapting Crop Selection to Dynamic Risk Environments

Farmers increasingly prioritize risk aversion by selecting crop varieties with greater resilience to climate volatility, leveraging advanced data analytics to forecast market fluctuations and environmental conditions. Emerging technologies, such as precision agriculture and AI-driven predictive modeling, enable dynamic adjustments in crop portfolios to balance potential yield with acceptable risk levels. Future trends highlight a shift towards integrated risk management strategies that blend traditional risk-averse behaviors with selective risk-seeking approaches to optimize profitability under uncertain agricultural markets.

Related Important Terms

Climate-Adjusted Risk Index

Farmers exhibiting high risk aversion prefer crop selections aligned with a low Climate-Adjusted Risk Index, minimizing potential losses from climate variability. Conversely, risk-seeking producers opt for crops with higher Climate-Adjusted Risk Index values, seeking greater returns despite increased exposure to climate-induced uncertainties.

Stochastic Yield Modeling

Farmers exhibiting risk aversion in crop selection prioritize crops with lower yield variability, making stochastic yield models essential for quantifying potential losses under uncertain climate and market conditions. Conversely, risk-seeking farmers use stochastic yield modeling to identify high-reward crop options despite greater variance, optimizing portfolios to maximize expected returns in volatile environments.

Adaptive Revenue Insurance

Adaptive Revenue Insurance provides a tailored risk management strategy that mitigates potential revenue losses for risk-averse farmers by stabilizing income despite crop yield fluctuations or price volatility. Conversely, risk-seeking farmers might leverage this insurance to explore higher-return crop options with greater variability, balancing potential gains against insured revenue protection.

Utility-Based Crop Portfolios

Utility-based crop portfolios balance risk aversion and risk seeking by optimizing expected utility rather than solely maximizing expected returns, allowing farmers to choose crops that align with their individual risk preferences and financial goals. Empirical studies show that incorporating risk aversion into portfolio selection reduces exposure to adverse weather or price shocks, while controlled risk-seeking elements can capitalize on high-reward crop options for increased profitability.

Expected Shortfall Optimization

Expected Shortfall Optimization in agricultural economics prioritizes minimizing potential losses in crop selection by accounting for extreme downside risks, favoring risk-averse decision-makers who aim to protect against severe adverse outcomes. Conversely, risk-seeking farmers may overlook Expected Shortfall metrics, opting for higher expected returns despite greater vulnerability to significant yield shortfalls under adverse conditions.

Downside Risk Hedging

Farmers with high risk aversion prioritize downside risk hedging by selecting crops with stable yields and resilient market demand, minimizing potential losses from adverse weather or price fluctuations. In contrast, risk-seeking farmers prefer high-variance crops that offer greater profit potential despite higher exposure to downside risks, leveraging diversification and insurance mechanisms to manage their exposure.

Weather Derivative Arbitrage

Farmers demonstrating risk aversion prefer conservative crop selection strategies that minimize exposure to weather variability, leveraging weather derivatives to hedge against adverse climate impacts. In contrast, risk-seeking farmers exploit weather derivative arbitrage opportunities by selecting crops with high returns correlated to volatile weather patterns, aiming to capitalize on price differentials and derivative payoffs.

Behavioral Risk Preference Mapping

Farmers exhibiting risk aversion prioritize crop choices with stable, lower-yield returns to minimize potential losses, while risk-seeking farmers favor high-variance crops offering greater profit potential despite uncertainty. Behavioral risk preference mapping utilizes psychological and socioeconomic data to accurately categorize farmers' decision-making profiles, optimizing crop selection strategies under varying market and climate risks.

Precision Input Risk Profiling

Precision Input Risk Profiling enables farmers to align their crop selection with individual risk preferences, distinguishing between risk-averse producers who prioritize stable yields and risk-seeking farmers willing to adopt high-variability crops for potential gains. This approach integrates detailed data analytics on input costs, weather patterns, and market volatility, optimizing cropping strategies to balance expected returns with acceptable risk thresholds.

Regret Minimization Strategy

Farmers employing regret minimization strategies in crop selection prioritize minimizing potential future regret, often opting for crops with stable but moderate returns rather than high-risk, high-reward options typical of risk-seeking behavior. This approach balances economic uncertainty by reducing emotional and financial distress associated with adverse outcomes in volatile agricultural markets.

Risk aversion vs Risk seeking for crop selection Infographic

agridif.com

agridif.com