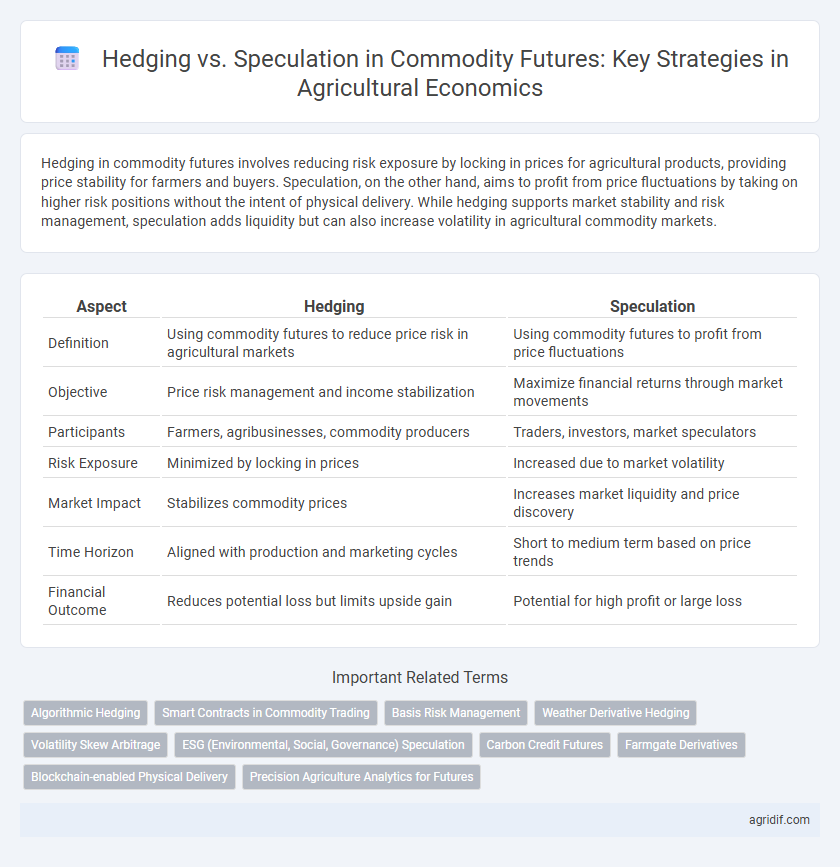

Hedging in commodity futures involves reducing risk exposure by locking in prices for agricultural products, providing price stability for farmers and buyers. Speculation, on the other hand, aims to profit from price fluctuations by taking on higher risk positions without the intent of physical delivery. While hedging supports market stability and risk management, speculation adds liquidity but can also increase volatility in agricultural commodity markets.

Table of Comparison

| Aspect | Hedging | Speculation |

|---|---|---|

| Definition | Using commodity futures to reduce price risk in agricultural markets | Using commodity futures to profit from price fluctuations |

| Objective | Price risk management and income stabilization | Maximize financial returns through market movements |

| Participants | Farmers, agribusinesses, commodity producers | Traders, investors, market speculators |

| Risk Exposure | Minimized by locking in prices | Increased due to market volatility |

| Market Impact | Stabilizes commodity prices | Increases market liquidity and price discovery |

| Time Horizon | Aligned with production and marketing cycles | Short to medium term based on price trends |

| Financial Outcome | Reduces potential loss but limits upside gain | Potential for high profit or large loss |

Introduction to Commodity Futures in Agricultural Economics

Commodity futures in agricultural economics serve as essential instruments for both hedging and speculation, enabling producers and investors to manage price risks associated with volatile agricultural markets. Hedging involves locking in prices to protect against unfavorable price fluctuations, ensuring income stability for farmers and processors. Speculators, on the other hand, seek to profit from price movements by assuming risk, which contributes liquidity and price discovery in commodity futures markets.

Understanding Hedging: Purpose and Mechanisms

Hedging in commodity futures aims to mitigate price risk by allowing producers and consumers to lock in prices, ensuring financial stability amid market volatility. It involves taking a futures position opposite to an existing or anticipated spot market position, thereby offsetting potential losses in the physical market. This risk management mechanism contrasts speculative trading, which seeks profit from price fluctuations without underlying exposure to the commodity.

Speculation in Agricultural Markets: Roles and Strategies

Speculation in agricultural markets involves taking positions in commodity futures to profit from price fluctuations, enhancing market liquidity and price discovery. Traders analyze factors such as weather patterns, supply-demand dynamics, and geopolitical events to predict price movements in crops like wheat, corn, and soybeans. Speculators employ strategies including trend following, spread trading, and options trading to capitalize on short-term market volatility, often accepting higher risk for potential gains.

Key Differences between Hedging and Speculation

Hedging in commodity futures involves farmers or producers locking in prices to reduce the risk of adverse price movements, ensuring stable revenue and safeguarding profit margins. Speculation, by contrast, aims to profit from price volatility through buying and selling futures contracts without any underlying exposure to the physical commodity. The key difference lies in risk management versus risk-taking: hedging minimizes market uncertainty for producers, while speculation seeks potential financial gains by assuming that risk.

Risk Management Techniques in Agricultural Commodity Futures

Hedging in agricultural commodity futures serves as a vital risk management technique that protects farmers and agribusinesses from price volatility by locking in prices for future delivery, thereby ensuring income stability. Speculation involves taking on price risk by buying or selling futures contracts to profit from anticipated market movements, which can increase market liquidity but also introduces higher risk exposure. Effective risk management in agricultural commodity futures prioritizes hedging strategies to mitigate adverse price fluctuations and safeguard economic sustainability in farming operations.

Benefits of Hedging for Farmers and Agribusinesses

Hedging in commodity futures allows farmers and agribusinesses to stabilize income by locking in prices, reducing the risk of adverse market fluctuations. This practice provides financial predictability, enabling better budgeting and investment decisions critical for operational sustainability. By mitigating price volatility, hedging supports long-term planning and protects profit margins in the agricultural sector.

Speculators’ Impact on Agricultural Commodity Prices

Speculators play a critical role in agricultural commodity markets by providing liquidity and facilitating price discovery for futures contracts. Their trading activities increase market efficiency but can also lead to heightened price volatility in staple crops like wheat, corn, and soybeans. Empirical studies indicate that excessive speculative trading may amplify short-term price fluctuations without fundamentally altering long-term supply and demand dynamics.

Economic Implications of Hedging vs Speculation

Hedging in commodity futures stabilizes prices and reduces income volatility for producers and consumers, enhancing market efficiency and risk management in agricultural economics. Speculation, while increasing market liquidity and price discovery, can also amplify price volatility and lead to potential market distortions. The economic implications of hedging emphasize risk mitigation and stable production incentives, whereas speculation influences price dynamics and can impact resource allocation in the agricultural sector.

Regulatory Perspectives on Hedging and Speculation

Regulatory frameworks distinguish hedging as a risk management strategy using commodity futures to stabilize prices and secure revenues for agricultural producers, contrasting with speculation, which involves assuming market risk for potential profit. Agencies like the Commodity Futures Trading Commission (CFTC) enforce position limits and reporting requirements to prevent market manipulation and excessive speculation that can increase volatility. These regulations aim to maintain market integrity, protect producers' economic interests, and ensure transparent price discovery in agricultural commodity futures markets.

Best Practices for Managing Commodity Price Volatility

Hedging in commodity futures involves using contracts to lock in prices and reduce exposure to fluctuations, providing stability for producers and buyers. Speculation, contrastingly, aims to profit from price movements but introduces higher risk and potential market instability. Best practices for managing commodity price volatility prioritize hedging strategies supported by thorough market analysis and risk assessment to safeguard financial outcomes.

Related Important Terms

Algorithmic Hedging

Algorithmic hedging in commodity futures leverages advanced quantitative models and real-time data to optimize risk management by dynamically adjusting positions based on market fluctuations, reducing exposure to price volatility. Unlike speculative trading that seeks profit from price movements, algorithmic hedging prioritizes minimizing potential losses in agricultural commodity markets by automating decision-making processes and improving execution efficiency.

Smart Contracts in Commodity Trading

Hedging with smart contracts in commodity futures enhances risk management by automating execution based on predefined conditions, reducing counterparty risk and increasing transparency. Speculation leverages smart contracts to execute rapid trades and enforce settlement terms efficiently, thereby optimizing liquidity and market responsiveness in commodity trading.

Basis Risk Management

Hedging in commodity futures aims to minimize basis risk by locking in prices and reducing uncertainty between spot and futures prices, whereas speculation accepts basis risk to profit from price fluctuations. Effective basis risk management involves monitoring historical basis volatility and choosing optimal hedge ratios to enhance risk reduction in agricultural markets.

Weather Derivative Hedging

Hedging with weather derivatives in agricultural economics provides farmers and agribusinesses a risk management tool to protect against unpredictable weather impacts on crop yields, thereby stabilizing income and reducing volatility compared to speculative trading. These derivatives, tied to weather indices such as temperature and rainfall, offer insurance-like benefits by compensating for adverse weather conditions without the intention of profiting from market fluctuations.

Volatility Skew Arbitrage

Hedging in commodity futures mitigates price risk by locking in prices, while speculation exploits market movements for profit, with volatility skew arbitrage leveraging differences in implied volatility across strike prices to capitalize on pricing inefficiencies. This strategy exploits the asymmetric volatility pattern in commodity options markets, enabling traders to profit from mispriced risk premiums without directional exposure to underlying commodity price changes.

ESG (Environmental, Social, Governance) Speculation

Hedging in commodity futures mitigates price risks for agricultural producers by locking in prices, promoting market stability and aligning with ESG goals through reduced financial uncertainty and resource efficiency. Speculation, particularly ESG-focused, leverages futures markets to drive capital towards sustainable practices and innovation but risks amplifying price volatility that can impact social equity and environmental outcomes.

Carbon Credit Futures

Carbon credit futures serve as an essential tool for hedging in agricultural economics, allowing farmers and agribusinesses to manage risks associated with carbon emissions costs by locking in prices. Speculation in carbon credit futures involves traders seeking profit from price volatility, which can increase market liquidity but also introduce pricing uncertainty for producers reliant on stable carbon cost estimates.

Farmgate Derivatives

Hedging in commodity futures using farmgate derivatives helps farmers lock in prices to protect against market volatility, ensuring stable income and cost management. Speculation involves traders assuming price risk to profit from price fluctuations, increasing market liquidity but exposing farmers to unpredictable price shifts.

Blockchain-enabled Physical Delivery

Hedging in commodity futures utilizes blockchain-enabled physical delivery to enhance transparency, reduce counterparty risk, and ensure secure, real-time settlement of agricultural products, optimizing price stability for producers and buyers. Speculation, by contrast, leverages blockchain technology to facilitate rapid transaction verification and immutable record-keeping, enabling traders to efficiently capitalize on price volatility without the need for physical product exchange.

Precision Agriculture Analytics for Futures

Hedging in commodity futures uses Precision Agriculture Analytics to minimize price risks by leveraging real-time data on crop yields and market trends, ensuring more accurate risk management for farmers and agribusinesses. Speculation, contrastingly, relies on predictive analytics within these platforms to capitalize on price volatility, but introduces higher uncertainty compared to the risk-averse strategies employed in hedging.

Hedging vs speculation for commodity futures Infographic

agridif.com

agridif.com