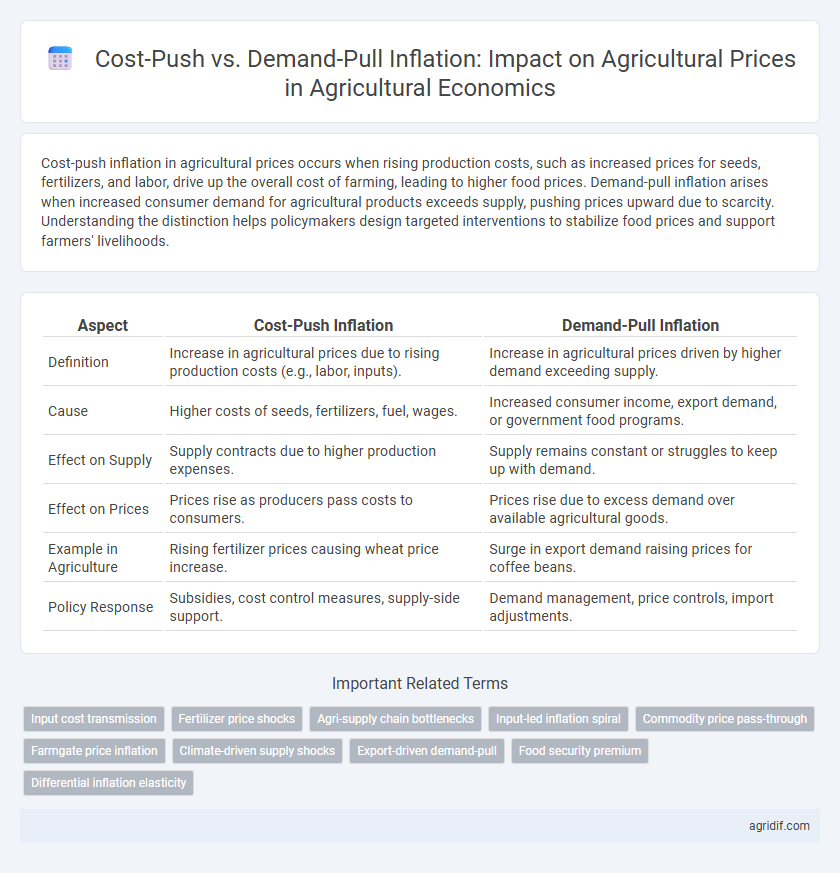

Cost-push inflation in agricultural prices occurs when rising production costs, such as increased prices for seeds, fertilizers, and labor, drive up the overall cost of farming, leading to higher food prices. Demand-pull inflation arises when increased consumer demand for agricultural products exceeds supply, pushing prices upward due to scarcity. Understanding the distinction helps policymakers design targeted interventions to stabilize food prices and support farmers' livelihoods.

Table of Comparison

| Aspect | Cost-Push Inflation | Demand-Pull Inflation |

|---|---|---|

| Definition | Increase in agricultural prices due to rising production costs (e.g., labor, inputs). | Increase in agricultural prices driven by higher demand exceeding supply. |

| Cause | Higher costs of seeds, fertilizers, fuel, wages. | Increased consumer income, export demand, or government food programs. |

| Effect on Supply | Supply contracts due to higher production expenses. | Supply remains constant or struggles to keep up with demand. |

| Effect on Prices | Prices rise as producers pass costs to consumers. | Prices rise due to excess demand over available agricultural goods. |

| Example in Agriculture | Rising fertilizer prices causing wheat price increase. | Surge in export demand raising prices for coffee beans. |

| Policy Response | Subsidies, cost control measures, supply-side support. | Demand management, price controls, import adjustments. |

Defining Cost-Push and Demand-Pull Inflation in Agriculture

Cost-push inflation in agriculture occurs when rising production costs, such as higher prices for seeds, fertilizers, and labor, drive up agricultural prices independently of demand. Demand-pull inflation arises when increased consumer demand for agricultural products exceeds supply, leading to price increases. These inflation types distinctly impact farm profitability and market stability, necessitating targeted economic policies for effective management.

Key Drivers of Agricultural Price Changes

Cost-push inflation in agricultural prices is primarily driven by rising input costs such as fertilizers, fuel, and labor, which increase production expenses and reduce supply. Demand-pull inflation occurs when consumer demand for agricultural products outpaces supply, often influenced by population growth, changing dietary preferences, and export demand. Key drivers of agricultural price changes include weather conditions, government policies, global market trends, and technological advancements affecting both supply and demand dynamics.

How Input Costs Spark Cost-Push Inflation

Rising input costs such as fertilizers, fuel, and labor directly increase production expenses in agriculture, triggering cost-push inflation as farmers raise prices to maintain profit margins. Supply chain disruptions and volatile commodity prices exacerbate these input cost hikes, further inflating agricultural product prices. This inflation type contrasts with demand-pull, which stems from heightened consumer demand rather than escalating production costs.

Demand Shocks and Their Role in Demand-Pull Inflation

Demand shocks in agricultural markets typically trigger demand-pull inflation by rapidly increasing the need for crops or livestock, outpacing current supply levels. Factors such as sudden population growth, export demand surges, or changes in consumer preferences can intensify price levels by elevating aggregate demand without immediate supply adjustments. This inflationary pressure contrasts with cost-push inflation, where rising production costs rather than demand shifts drive up agricultural prices.

Case Studies: Recent Episodes of Agricultural Price Inflation

Recent episodes of agricultural price inflation reveal distinct impacts of cost-push and demand-pull factors, with the 2020-2022 global agricultural trends showing sharp cost-push inflation driven by increased input prices such as fertilizers, energy, and labor shortages. In contrast, demand-pull inflation was evident during the 2007-2008 food price crisis, where surging global demand, particularly from emerging markets and biofuel policies, significantly elevated commodity prices. Case studies from these periods emphasize how input supply constraints and changing consumption patterns differently influence agricultural price dynamics.

Effects on Farmers: Profit Margins and Economic Stability

Cost-push inflation in agriculture, driven by rising input costs such as seeds, fertilizers, and fuel, reduces farmers' profit margins by increasing production expenses without equivalent price increases for their products. Demand-pull inflation, resulting from heightened consumer demand for agricultural goods, can boost farm revenues but may also lead to price volatility, creating economic uncertainty for farmers. Both inflation types impact economic stability, with cost-push inflation squeezing profitability and demand-pull inflation introducing market fluctuations that challenge long-term planning.

Impacts on Consumers: Food Prices and Accessibility

Cost-push inflation in agricultural economics raises food prices by increasing production expenses such as fertilizers, labor, and fuel, directly reducing consumer accessibility to essential goods. Demand-pull inflation drives up agricultural prices when consumer demand outpaces supply, often leading to temporary shortages and higher market prices that strain household budgets. Both inflation types disrupt food affordability, with cost-push inflation causing sustained price pressure, while demand-pull inflation can trigger volatile price spikes affecting consumer purchasing power.

Policy Responses to Agricultural Price Inflation

Policy responses to agricultural price inflation must differentiate between cost-push inflation, driven by rising input costs like seeds, fertilizers, and fuel, and demand-pull inflation caused by increased consumer demand for agricultural products. Supply-side measures such as subsidies for inputs, improved irrigation infrastructure, and investment in technology can mitigate cost-push inflation impacts, while demand management policies, including export controls and strategic reserves, help moderate demand-pull pressure on agricultural prices. Effective agricultural price stabilization requires targeted interventions tailored to the specific inflationary forces affecting the sector.

Inflation Spillovers Across the Food Supply Chain

Cost-push inflation in agriculture arises from rising input costs such as seeds, fertilizers, and fuel, which increase production expenses and push food prices upward throughout the supply chain. Demand-pull inflation occurs when increased consumer demand for agricultural products outpaces supply, leading to higher prices at farm, processing, and retail stages. Inflation spillovers across the food supply chain reflect how initial cost increases or demand surges amplify price pressures at each stage, exacerbating overall food inflation and impacting affordability for consumers.

Long-Term Trends and Future Outlook for Agricultural Prices

Cost-push inflation in agricultural markets arises from rising input costs such as seeds, fertilizers, and labor, leading to sustained increases in production expenses and ultimately higher farm-gate prices. Demand-pull inflation results from increased consumer demand for agricultural products, often driven by population growth and changing dietary preferences, pushing prices upward over the long term. Future outlook for agricultural prices indicates that persistent supply chain disruptions, climate change impacts on crop yields, and evolving global food demand patterns will continue to exert complex inflationary pressures on agricultural markets.

Related Important Terms

Input cost transmission

Cost-push inflation in agricultural prices arises when increased input costs such as seeds, fertilizers, and fuel lead farmers to raise output prices, directly transmitting higher production expenses to consumers. Demand-pull inflation, in contrast, occurs when rising consumer demand for agricultural products elevates prices, often intensifying input cost pressures through increased demand for inputs.

Fertilizer price shocks

Fertilizer price shocks primarily cause cost-push inflation in agricultural markets by increasing production expenses, leading to higher crop prices independent of demand changes. Demand-pull inflation, however, arises when rising consumer demand for agricultural products drives prices upward, but this effect is less directly tied to fertilizer costs.

Agri-supply chain bottlenecks

Cost-push inflation in agricultural prices arises primarily from disruptions and bottlenecks in the agri-supply chain, such as increased input costs for seeds, fertilizers, and transportation delays that elevate production expenses. Demand-pull inflation occurs when rising consumer demand for agricultural products outpaces supply capacity, often exacerbated by supply chain rigidities and seasonal constraints limiting timely market adjustments.

Input-led inflation spiral

Cost-push inflation in agricultural economics occurs when rising prices of inputs like fertilizers, fuel, and labor increase production costs, driving up overall food prices through an input-led inflation spiral. Demand-pull inflation, by contrast, results from increased consumer demand for agricultural products surpassing supply, pushing prices higher without directly affecting input costs.

Commodity price pass-through

Cost-push inflation in agricultural prices occurs when rising input costs such as seeds, fertilizers, and labor increase commodity prices, leading to partial or delayed commodity price pass-through to consumers. Demand-pull inflation, driven by increased consumer demand for agricultural products, typically results in more immediate and direct commodity price pass-through, reflecting supply constraints within agricultural markets.

Farmgate price inflation

Farmgate price inflation in agriculture is often driven by cost-push inflation, where rising input costs such as seeds, fertilizers, and fuel increase production expenses, subsequently raising prices at the farm level. Demand-pull inflation in agricultural markets occurs when heightened consumer demand for agricultural products outpaces supply, pushing farmgate prices upward as farmers respond to stronger market signals.

Climate-driven supply shocks

Climate-driven supply shocks in agriculture primarily trigger cost-push inflation by increasing production costs through reduced yields, damaged infrastructure, and higher input prices. Demand-pull inflation occurs less frequently in this sector, as sudden shifts in consumer demand rarely inflate prices compared to the direct impact of climate-induced supply constraints.

Export-driven demand-pull

Export-driven demand-pull inflation in agricultural prices occurs when increased foreign demand for crops raises domestic prices due to limited supply elasticity, contrasting with cost-push inflation where rising input costs like fertilizers and labor drive prices up independently of demand. This demand-pull effect often leads to higher agricultural export revenues but can also create domestic price volatility affecting food security and farm income stability.

Food security premium

Cost-push inflation in agricultural prices arises from increased production costs such as labor, fertilizers, and fuel, leading to higher food prices that directly impact food security premiums by raising the cost of essential staples. Demand-pull inflation occurs when rising consumer income or population growth boosts demand for agricultural products, driving prices up and increasing the food security premium as households allocate larger shares of income to secure food access.

Differential inflation elasticity

Cost-push inflation in agricultural prices arises from increased production costs like labor, fuel, and inputs, leading to a higher inflation elasticity as farmers pass expenses to consumers. Demand-pull inflation displays lower inflation elasticity in agriculture, since consumer demand growth is often inelastic due to staple crop necessity and limited substitution options.

Cost-push inflation vs demand-pull inflation for agricultural prices Infographic

agridif.com

agridif.com