Traditional credit often involves stringent collateral requirements and lengthy approval processes, limiting access for small-scale farmers. Microfinance provides more flexible, smaller loans tailored to the needs of agricultural investments, enhancing financial inclusion and enabling timely input purchases. This accessibility fosters increased productivity and supports sustainable rural development by empowering farmers with necessary resources.

Table of Comparison

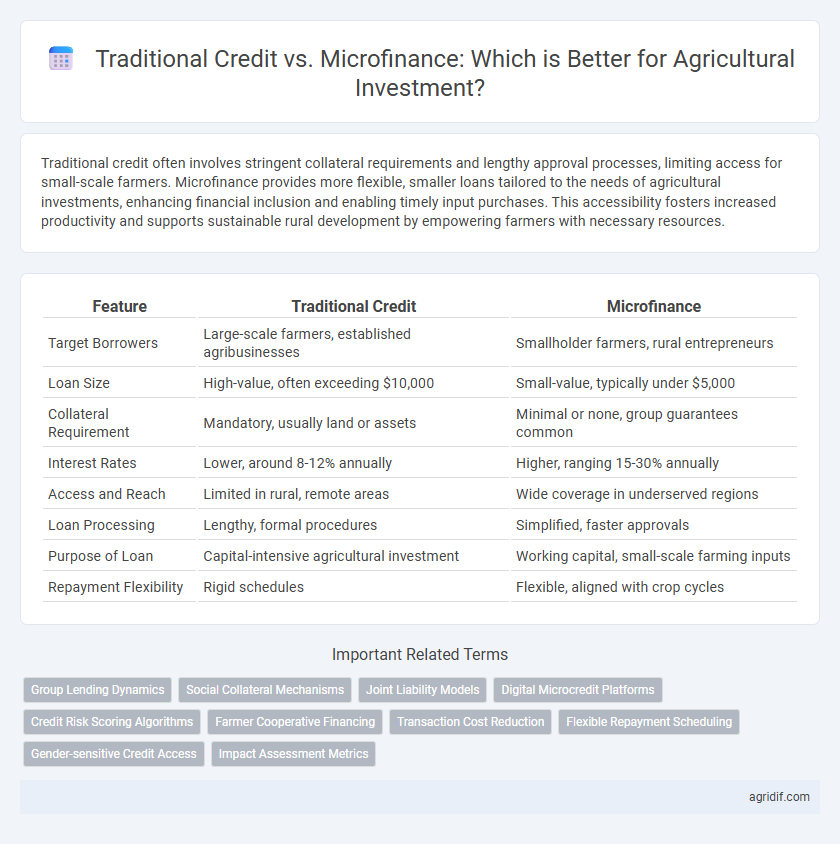

| Feature | Traditional Credit | Microfinance |

|---|---|---|

| Target Borrowers | Large-scale farmers, established agribusinesses | Smallholder farmers, rural entrepreneurs |

| Loan Size | High-value, often exceeding $10,000 | Small-value, typically under $5,000 |

| Collateral Requirement | Mandatory, usually land or assets | Minimal or none, group guarantees common |

| Interest Rates | Lower, around 8-12% annually | Higher, ranging 15-30% annually |

| Access and Reach | Limited in rural, remote areas | Wide coverage in underserved regions |

| Loan Processing | Lengthy, formal procedures | Simplified, faster approvals |

| Purpose of Loan | Capital-intensive agricultural investment | Working capital, small-scale farming inputs |

| Repayment Flexibility | Rigid schedules | Flexible, aligned with crop cycles |

Overview of Agricultural Investment Financing

Traditional credit for agricultural investment often involves formal financial institutions requiring collateral and lengthy approval processes, limiting access for smallholder farmers. Microfinance, in contrast, offers more flexible, small-scale loans tailored to the cash flow and risk profiles of agricultural activities, enhancing financial inclusion. Both financing methods play crucial roles in agricultural investment, but microfinance significantly improves accessibility and supports sustainable rural development.

Defining Traditional Credit in Agriculture

Traditional credit in agriculture refers to formal lending provided by banks and financial institutions, often requiring collateral, credit history, and extensive documentation, making access challenging for smallholder farmers. These loans typically feature fixed interest rates and longer repayment periods, targeting established agricultural enterprises rather than subsistence or emerging farmers. Limited flexibility and stringent eligibility criteria restrict traditional credit's reach, prompting the rise of microfinance as an alternative for agricultural investment.

Understanding Microfinance in Agricultural Contexts

Microfinance offers tailored financial services to smallholder farmers often excluded from traditional credit due to lack of collateral and formal credit history. Unlike conventional loans, microfinance provides flexible terms, lower barriers to entry, and incorporates social collateral, enhancing access to timely agricultural inputs and technologies. This targeted approach boosts farm productivity and income resilience, driving sustainable rural development.

Accessibility and Outreach: Traditional Credit vs Microfinance

Traditional credit institutions often impose stringent collateral requirements and complex approval processes, limiting accessibility for smallholder farmers and rural entrepreneurs. Microfinance institutions prioritize outreach by offering tailored loan products with minimal collateral, enabling broader access to credit for underserved agricultural communities. Enhanced accessibility through microfinance increases investment opportunities and supports sustainable agricultural development in remote and marginalized areas.

Interest Rates and Repayment Terms Comparison

Traditional credit for agricultural investment typically involves higher interest rates averaging 15-25% annually, with rigid repayment schedules tied to fixed installment cycles that may not align with crop harvesting seasons. Microfinance institutions offer more flexible repayment terms, often allowing seasonal or grace period payments that correspond to agricultural cash flows, and generally charge lower interest rates ranging from 10-20%. The tailored repayment options in microfinance reduce default risk and enhance investment accessibility for smallholder farmers compared to conventional credit systems.

Impact on Smallholder Farmers’ Productivity

Traditional credit institutions often require collateral and formal credit histories, limiting access for smallholder farmers and constraining their ability to invest in productivity-enhancing inputs. Microfinance, with flexible lending terms and lower entry barriers, significantly improves smallholders' access to capital, enabling adoption of advanced technologies and sustainable practices. Empirical studies show microfinance participation correlates with increased crop yields and diversified income sources among smallholder farmers.

Risk Management and Collateral Requirements

Traditional credit for agricultural investment often imposes stringent collateral requirements, limiting access for smallholder farmers who lack formal assets. Microfinance institutions mitigate risk through group lending models and flexible repayment schedules, enhancing financial inclusion and enabling diversified risk management strategies. This approach reduces dependency on physical collateral, facilitating investment in sustainable agricultural practices.

Gender and Social Inclusion in Agricultural Financing

Traditional credit systems often exclude women and marginalized groups due to collateral requirements and bureaucratic barriers, limiting their access to agricultural investment. Microfinance institutions provide tailored financial products that enhance gender equity by offering flexible loans and financial literacy programs specifically designed for female farmers and socially excluded communities. These inclusive financial services drive improved agricultural productivity and economic empowerment by addressing unique socio-economic constraints faced by underrepresented groups.

Case Studies: Successes and Limitations

Traditional credit often involves stringent collateral requirements and higher interest rates, limiting access for smallholder farmers, whereas microfinance institutions provide tailored, small-scale loans that better suit the irregular income cycles of agricultural activities. Case studies from regions like Sub-Saharan Africa demonstrate microfinance's success in increasing farm productivity and income by enabling timely input purchases and diversification. However, limitations such as loan size constraints and inadequate financial literacy remain challenges that restrict the full potential of microfinance for sustainable agricultural investment.

Policy Implications and Future Directions

Traditional credit institutions often impose strict collateral requirements and high-interest rates, limiting smallholder farmers' access to formal financial services. Microfinance initiatives enhance agricultural investment by providing tailored, flexible loan products with lower barriers, promoting inclusive growth and rural development. Policymakers should support regulatory frameworks that encourage microfinance expansion, integrate digital technologies, and foster public-private partnerships to scale sustainable agricultural finance solutions.

Related Important Terms

Group Lending Dynamics

Traditional credit often involves individual collateral requirements and higher interest rates, limiting smallholder farmers' access to necessary funds for agricultural investments. Microfinance, particularly through group lending dynamics, leverages social collateral and peer monitoring, enhancing repayment rates and enabling collective investment in productivity-enhancing technologies.

Social Collateral Mechanisms

Traditional credit systems rely heavily on physical collateral, limiting smallholder farmers' access to agricultural investment, whereas microfinance leverages social collateral mechanisms such as group lending, peer monitoring, and trust networks to reduce default risks and enhance financial inclusion. Social collateral in microfinance fosters community accountability and mutual support, enabling farmers to obtain timely credit for inputs, technology adoption, and productivity improvements without the barrier of formal securities.

Joint Liability Models

Joint liability models in microfinance enhance agricultural investment by pooling risk among borrowers, which increases credit access and reduces default rates compared to traditional credit systems that rely on individual collateral. This collective responsibility mechanism fosters higher repayment discipline and facilitates smallholder farmers' inclusion in financial markets, driving sustainable agricultural growth.

Digital Microcredit Platforms

Digital microcredit platforms revolutionize agricultural investment by providing farmers with easy access to small, flexible loans tailored to seasonal cash flows, overcoming limitations of traditional credit such as rigid collateral requirements and lengthy approval processes. These platforms leverage data analytics and mobile technology to offer timely financial services, enhancing productivity and income stability for smallholder farmers.

Credit Risk Scoring Algorithms

Credit risk scoring algorithms in agricultural finance leverage data analytics to assess borrower repayment capacity, with microfinance institutions often utilizing more flexible, small-scale credit models compared to traditional banks' rigid credit evaluation frameworks. These algorithms enhance investment decisions by incorporating localized agricultural variables, enabling tailored risk assessments that improve access to credit for smallholder farmers and reduce default rates in agricultural investments.

Farmer Cooperative Financing

Traditional credit often imposes high collateral requirements and stringent creditworthiness evaluations, limiting farmers' access to agricultural investments. Farmer cooperative financing through microfinance leverages collective guarantees and local trust networks, enhancing credit availability and promoting sustainable investment in smallholder agriculture.

Transaction Cost Reduction

Microfinance institutions reduce transaction costs in agricultural investment by offering smaller, flexible loans tailored to farmers' seasonal income cycles, unlike traditional credit systems that involve extensive documentation and higher collateral requirements. This streamlined access enhances farmers' ability to invest in inputs and technologies, boosting productivity and financial inclusion in rural economies.

Flexible Repayment Scheduling

Traditional credit for agricultural investment often involves rigid repayment schedules that may not align with crop cycles, causing financial stress for farmers. Microfinance institutions provide flexible repayment options tailored to seasonal income fluctuations, improving cash flow management and investment sustainability in agriculture.

Gender-sensitive Credit Access

Traditional credit systems often impose stringent collateral requirements and favor male borrowers, limiting women's access to agricultural investment funds. Microfinance institutions utilize gender-sensitive approaches by offering flexible loans and targeted financial services that empower women farmers to increase productivity and economic participation.

Impact Assessment Metrics

Traditional credit typically involves higher loan amounts with stringent collateral requirements, leading to lower access rates among smallholder farmers, while microfinance offers smaller, collateral-free loans tailored to agricultural cycles, enhancing inclusivity. Impact assessment metrics for these credit models focus on loan repayment rates, increases in agricultural productivity, income diversification, and improvements in farmers' household welfare.

Traditional credit vs microfinance for agricultural investment Infographic

agridif.com

agridif.com