Price discovery in agricultural marketing allows commodity prices to be determined through supply and demand dynamics, reflecting real-time market conditions and promoting transparency. In contrast, price fixation establishes set prices by agreements or regulations, which can stabilize income but may limit market responsiveness and efficiency. Balancing price discovery and price fixation is essential for optimizing farmer revenues while maintaining market stability in commodity sales.

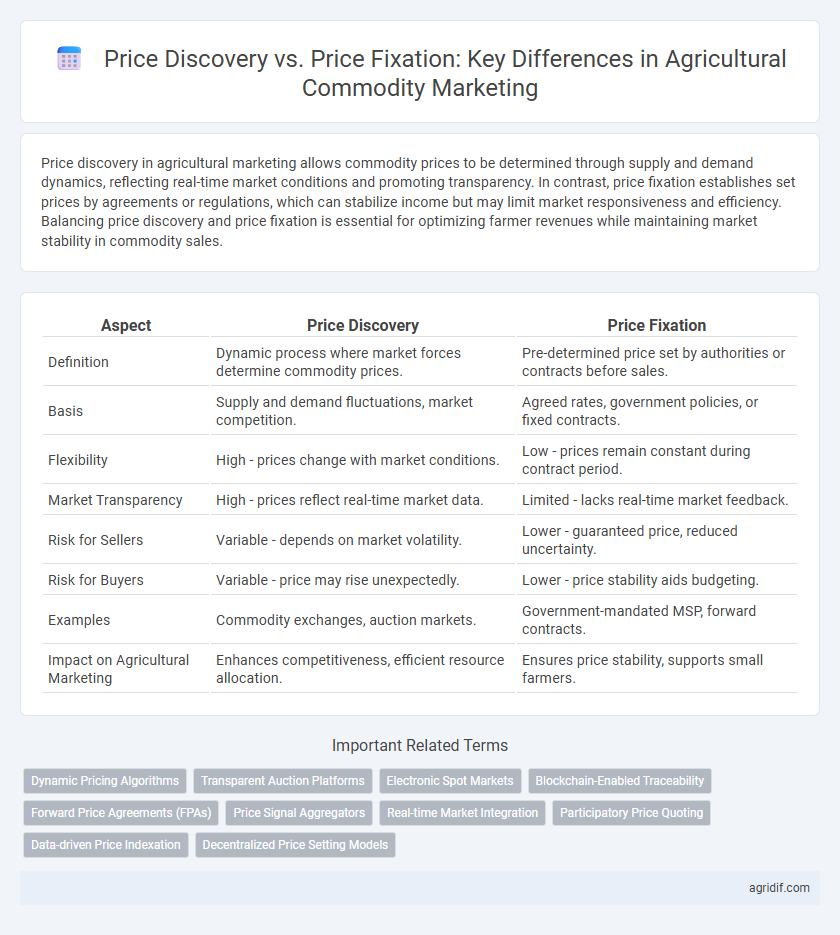

Table of Comparison

| Aspect | Price Discovery | Price Fixation |

|---|---|---|

| Definition | Dynamic process where market forces determine commodity prices. | Pre-determined price set by authorities or contracts before sales. |

| Basis | Supply and demand fluctuations, market competition. | Agreed rates, government policies, or fixed contracts. |

| Flexibility | High - prices change with market conditions. | Low - prices remain constant during contract period. |

| Market Transparency | High - prices reflect real-time market data. | Limited - lacks real-time market feedback. |

| Risk for Sellers | Variable - depends on market volatility. | Lower - guaranteed price, reduced uncertainty. |

| Risk for Buyers | Variable - price may rise unexpectedly. | Lower - price stability aids budgeting. |

| Examples | Commodity exchanges, auction markets. | Government-mandated MSP, forward contracts. |

| Impact on Agricultural Marketing | Enhances competitiveness, efficient resource allocation. | Ensures price stability, supports small farmers. |

Introduction to Price Discovery and Price Fixation in Agriculture

Price discovery in agriculture refers to the process where market forces of supply and demand determine commodity prices through open negotiation and competition. Price fixation, however, involves setting predetermined prices by regulatory bodies or agreements, often to stabilize markets and protect farmers' incomes. Understanding these mechanisms is crucial for efficient agricultural marketing, influencing how farmers, traders, and policymakers interact within commodity markets.

Key Differences Between Price Discovery and Price Fixation

Price discovery in agricultural marketing involves the dynamic process where buyers and sellers interact to determine the market value of commodities based on supply, demand, and quality factors. Price fixation, however, refers to setting the commodity price through predetermined agreements or regulatory mechanisms, often eliminating market fluctuations. Key differences include the level of market responsiveness, with price discovery reflecting real-time price adjustments and price fixation relying on fixed or negotiated prices regardless of immediate market conditions.

Mechanisms of Price Discovery in Agricultural Commodity Markets

Mechanisms of price discovery in agricultural commodity markets involve dynamic interactions between buyers and sellers through market platforms such as futures exchanges, spot markets, and electronic trading systems, which reflect real-time supply and demand conditions. Transparent auction systems and bidding processes enable efficient aggregation of information, helping to establish fair market prices that respond to fluctuating inputs like weather patterns, crop yields, and global trade policies. Unlike price fixation, where prices are predetermined by authorities or cartels, price discovery mechanisms ensure market-driven pricing that enhances competitiveness and allocative efficiency in agricultural trade.

Government Role in Price Fixation of Farm Commodities

Government plays a critical role in price fixation for farm commodities by establishing minimum support prices (MSPs) to protect farmers from volatile market fluctuations and ensure remunerative returns. This intervention helps stabilize agricultural markets by setting a floor price, preventing distress sales during surplus production periods. While price discovery through open market mechanisms reflects real-time supply and demand, government price fixation acts as a safeguard against market failures and price crashes in commodity sales.

Advantages of Market-Based Price Discovery for Farmers

Market-based price discovery enables farmers to receive real-time, transparent pricing signals driven by actual supply and demand dynamics, enhancing income accuracy and market responsiveness. This approach reduces the risk of price manipulation and ensures fair competition among buyers, promoting equitable transactions for agricultural commodities. Improved price discovery mechanisms empower farmers to make informed production and sales decisions, optimizing profitability in volatile markets.

Drawbacks and Risks of Price Fixation in Agriculture

Price fixation in agricultural markets can lead to significant drawbacks such as reduced market efficiency and distorted supply-demand signals, resulting in surpluses or shortages. Fixed prices often discourage farmers from responding to market fluctuations, limiting their incentive to improve production or shift crops, which can harm long-term agricultural sustainability. This rigidity increases the risk of market imbalances, ultimately threatening food security and farmer livelihoods by suppressing price discovery mechanisms essential for fair valuation.

Impact of Price Discovery and Fixation on Supply Chain Efficiency

Price discovery in agricultural marketing enables market participants to establish commodity prices based on real-time demand and supply dynamics, enhancing transparency and responsiveness throughout the supply chain. Price fixation, often determined by regulatory bodies or pre-agreed contracts, can limit price volatility but may reduce incentives for producers and buyers to optimize supply chain efficiency. Efficient price discovery mechanisms facilitate better allocation of resources, reduce information asymmetry, and promote adaptive supply chain strategies, leading to improved distribution and reduced wastage in agricultural markets.

Influence on Farmer Profits and Consumer Prices

Price discovery mechanisms in agricultural marketing enable transparent and competitive pricing that reflects real-time supply and demand, often leading to fairer farmer profits and fluctuating consumer prices. In contrast, price fixation, typically government-imposed or through monopolistic systems, can stabilize prices but may suppress farmer incomes or inflate consumer costs due to lack of market signals. Efficient price discovery supports dynamic market equilibrium, benefiting both producers through improved revenue and consumers through competitive pricing.

Case Studies: Price Discovery vs Price Fixation in Major Commodities

Case studies on major commodities such as wheat, cotton, and coffee reveal that price discovery mechanisms, driven by transparent market information and competitive bidding, enhance market efficiency and farmer income. In contrast, price fixation through government interventions or cartel regulations often leads to price distortions and reduced incentives for producers. Empirical data from commodity exchanges show that dynamic price discovery aligns supply-demand signals more accurately, benefiting both producers and consumers.

Future Outlook: Balancing Price Discovery and Fixation for Sustainable Agriculture

Balancing price discovery and price fixation mechanisms in agricultural marketing is crucial for sustainable commodity sales, as dynamic price discovery ensures market-driven signals reflecting supply-demand fluctuations. Price fixation, through contracts or government interventions, provides farmers with income stability and reduces risk exposure in volatile markets. Integrating adaptive models combining real-time price discovery with strategic price fixation supports resilient agricultural economies and enhances long-term food security.

Related Important Terms

Dynamic Pricing Algorithms

Dynamic pricing algorithms enhance price discovery in commodity sales by analyzing real-time market data, demand fluctuations, and supply conditions to set optimal prices. These algorithms contrast with traditional price fixation methods by enabling adaptive pricing strategies that reflect market volatility and promote efficient resource allocation.

Transparent Auction Platforms

Transparent auction platforms enhance price discovery by allowing real-time bidding based on supply and demand dynamics, reflecting true market value for commodities. Unlike price fixation methods, these platforms reduce information asymmetry and enable competitive pricing, ensuring fair and efficient commodity sales.

Electronic Spot Markets

Electronic Spot Markets enhance price discovery by enabling real-time bidding and transparent transactions for commodities, reflecting current supply and demand dynamics. Unlike price fixation, which sets predetermined prices, electronic platforms foster competitive pricing that better aligns with market conditions and reduces information asymmetry.

Blockchain-Enabled Traceability

Blockchain-enabled traceability enhances price discovery in agricultural marketing by providing transparent, real-time data on commodity origin, quality, and transaction history, allowing buyers and sellers to negotiate prices based on verified information. This contrasts with price fixation methods, where prices are predetermined with limited market feedback, reducing the efficiency and fairness of commodity sales.

Forward Price Agreements (FPAs)

Forward Price Agreements (FPAs) enable producers and buyers in agricultural markets to lock in prices for commodities ahead of harvest, enhancing price discovery by reflecting anticipated market conditions while reducing uncertainty. Unlike price fixation, which sets a rigid sale price regardless of future market fluctuations, FPAs offer flexibility and risk management, aligning prices closer to real-time supply and demand dynamics.

Price Signal Aggregators

Price signal aggregators play a crucial role in price discovery by compiling real-time data from various markets to reflect true supply and demand conditions for commodities. Unlike price fixation, which sets predetermined prices, these aggregators enable dynamic pricing, helping farmers and buyers make informed decisions based on current market trends.

Real-time Market Integration

Price discovery in agricultural marketing leverages real-time market integration to reflect dynamic supply-demand conditions, enabling transparent and competitive pricing for commodities. In contrast, price fixation often relies on predetermined or administratively set rates, which may not capture immediate market fluctuations, leading to potential inefficiencies and misallocation of resources.

Participatory Price Quoting

Participatory price quoting in agricultural marketing enhances price discovery by incorporating real-time input from farmers, traders, and buyers, leading to transparent and dynamic commodity pricing. This collaborative mechanism contrasts with price fixation, which sets static prices that may not reflect current market conditions, reducing efficiency and farmers' bargaining power.

Data-driven Price Indexation

Data-driven price indexation enhances price discovery in agricultural markets by utilizing real-time commodity transaction data, enabling more accurate reflectance of supply-demand dynamics. This approach contrasts with price fixation methods, which often rely on predetermined or administratively set prices, potentially leading to market inefficiencies and reduced farmer incentives.

Decentralized Price Setting Models

Decentralized price setting models facilitate dynamic price discovery in commodity markets by enabling multiple independent buyers and sellers to negotiate prices based on real-time supply and demand conditions. This contrasts with centralized price fixation systems where prices are predetermined, often leading to inefficiencies and reduced market responsiveness.

Price Discovery vs Price Fixation for commodity sales Infographic

agridif.com

agridif.com