Credit guarantees for agricultural loans reduce lender risk by promising repayment in case of borrower default, encouraging financial institutions to extend more credit to farmers. Interest subsidies directly lower the cost of borrowing by reducing the interest rate, making loans more affordable and accessible for agricultural producers. Both policies aim to enhance farmers' access to finance but differ in mechanism--credit guarantees focus on risk mitigation while interest subsidies reduce borrowing expenses.

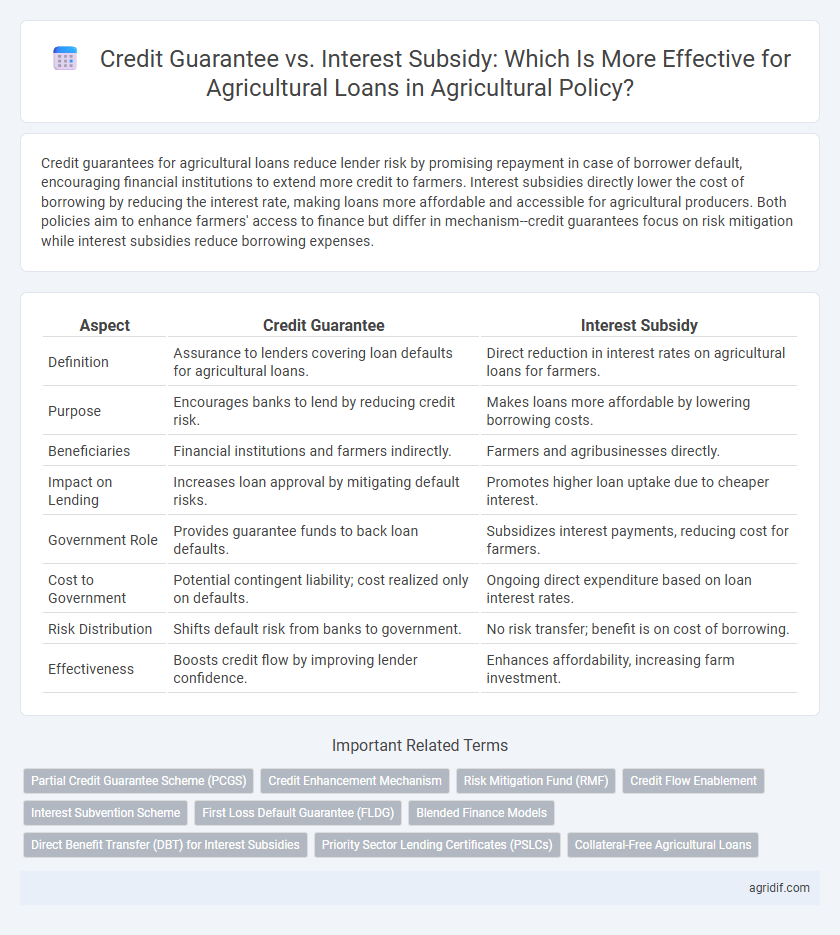

Table of Comparison

| Aspect | Credit Guarantee | Interest Subsidy |

|---|---|---|

| Definition | Assurance to lenders covering loan defaults for agricultural loans. | Direct reduction in interest rates on agricultural loans for farmers. |

| Purpose | Encourages banks to lend by reducing credit risk. | Makes loans more affordable by lowering borrowing costs. |

| Beneficiaries | Financial institutions and farmers indirectly. | Farmers and agribusinesses directly. |

| Impact on Lending | Increases loan approval by mitigating default risks. | Promotes higher loan uptake due to cheaper interest. |

| Government Role | Provides guarantee funds to back loan defaults. | Subsidizes interest payments, reducing cost for farmers. |

| Cost to Government | Potential contingent liability; cost realized only on defaults. | Ongoing direct expenditure based on loan interest rates. |

| Risk Distribution | Shifts default risk from banks to government. | No risk transfer; benefit is on cost of borrowing. |

| Effectiveness | Boosts credit flow by improving lender confidence. | Enhances affordability, increasing farm investment. |

Understanding Credit Guarantees for Agricultural Loans

Credit guarantees for agricultural loans provide lenders with a risk-sharing mechanism by backing a portion of the loan amount, thereby encouraging increased lending to farmers who might otherwise face credit access barriers. Unlike interest subsidies that reduce the cost of borrowing directly for farmers, credit guarantees primarily enhance the lender's confidence, facilitating higher loan approval rates without distorting loan pricing. This mechanism supports agricultural growth by improving credit flow, especially for small and marginal farmers, and promotes financial inclusion within rural economies.

Exploring Interest Subsidies in Agriculture Financing

Interest subsidies in agricultural financing reduce the cost of borrowing by lowering the effective interest rate, making credit more affordable for farmers and promoting investment in productivity-enhancing inputs. Unlike credit guarantees, which primarily mitigate lender risk without directly reducing loan costs, interest subsidies provide immediate financial relief to borrowers, encouraging timely repayment and expanding credit access. This targeted approach helps stimulate rural development by enabling smallholder farmers to invest in modern technologies and sustainable practices.

Comparative Overview: Credit Guarantee vs. Interest Subsidy

Credit guarantee schemes mitigate lender risk by assuring loan repayment, enhancing farmers' access to agricultural credit without directly altering loan costs. Interest subsidies reduce the effective interest rate, lowering the borrowing expense for farmers and promoting increased loan uptake for agricultural investment. While credit guarantees expand credit availability by securing lender confidence, interest subsidies provide immediate financial relief, impacting borrowing costs and farm profitability directly.

Impact on Smallholder Farmers’ Access to Credit

Credit guarantee schemes improve smallholder farmers' access to credit by reducing lender risk and encouraging financial institutions to lend without collateral, thereby expanding credit availability. Interest subsidies lower borrowing costs directly, making loans more affordable, but may not address underlying credit access barriers such as stringent lending criteria. Empirical studies show credit guarantees often result in higher loan approval rates for smallholders, while interest subsidies primarily enhance repayment capacity and loan affordability.

Risk Mitigation: How Credit Guarantees Support Lenders

Credit guarantees mitigate lender risk by assuring repayment in case of borrower default, enhancing confidence in agricultural loan approval. These guarantees reduce the likelihood of non-performing assets, encouraging banks to extend credit to high-risk farmers without excessive collateral demands. Unlike interest subsidies that lower borrowing costs but do not address lender risk, credit guarantees directly support loan portfolio stability and promote financial inclusion in the agricultural sector.

Reducing Borrowing Costs: The Role of Interest Subsidies

Interest subsidies significantly reduce borrowing costs for farmers by lowering the effective interest rate on agricultural loans, making credit more affordable and accessible. Unlike credit guarantees, which primarily mitigate lender risk without directly decreasing loan expenses, interest subsidies offer immediate financial relief to borrowers. This direct reduction in borrowing costs enhances farmers' investment capacity, promoting agricultural productivity and rural development.

Government Intervention in Agricultural Loan Schemes

Government intervention in agricultural loan schemes uses credit guarantees and interest subsidies to reduce financial risks for lenders and lower borrowing costs for farmers. Credit guarantees enhance loan accessibility by securing repayment risks, encouraging banks to lend more to the agricultural sector. Interest subsidies directly reduce the cost of borrowing, improving farmers' affordability and promoting investments in agricultural productivity.

Implementation Challenges and Administrative Efficiency

Credit guarantee schemes for agricultural loans face implementation challenges like risk assessment difficulties and limited funding, hindering accessibility for small farmers. Interest subsidy programs demand robust administrative capacity to verify eligibility and avoid leakages, often leading to higher operational costs and inefficiencies. Both mechanisms require transparent monitoring systems and coordination with financial institutions to optimize resource allocation and impact.

Long-term Sustainability of Credit Guarantee and Interest Subsidy Programs

Credit guarantee programs mitigate lender risk by covering defaults, promoting increased agricultural loan disbursement while maintaining financial system stability. Interest subsidy schemes lower borrowing costs for farmers but may strain fiscal budgets and risk market distortion if prolonged. Long-term sustainability of credit guarantees depends on effective risk assessment and recovery mechanisms, whereas interest subsidies require careful fiscal planning to avoid dependency and ensure targeted support.

Policy Recommendations for Enhancing Agricultural Credit Access

Credit guarantee schemes reduce lender risk and encourage banks to extend more agricultural loans without increasing interest rates, thereby improving credit availability for smallholder farmers. Interest subsidies lower the effective borrowing cost, but can strain fiscal budgets and may not incentivize efficient credit allocation. Policy recommendations emphasize prioritizing robust credit guarantee programs combined with targeted interest subsidies to balance risk mitigation and affordability, ensuring sustainable and inclusive agricultural credit access.

Related Important Terms

Partial Credit Guarantee Scheme (PCGS)

The Partial Credit Guarantee Scheme (PCGS) enhances farmers' access to credit by reducing lender risk through guaranteed coverage of non-performing assets without directly subsidizing interest rates, promoting sustainable lending practices. Compared to interest subsidies, PCGS encourages financial discipline among agricultural borrowers and fosters greater credit flow to small and marginal farmers by leveraging market-based risk mitigation.

Credit Enhancement Mechanism

Credit guarantee schemes enhance agricultural lending by reducing default risk and encouraging financial institutions to extend loans to farmers without upfront collateral. Unlike interest subsidies that lower borrowing costs, credit enhancement mechanisms strengthen creditworthiness and promote sustainable access to credit by mitigating lenders' risk exposure.

Risk Mitigation Fund (RMF)

The Risk Mitigation Fund (RMF) under Agricultural Policy provides a credit guarantee that reduces default risk for lenders, encouraging increased loan availability to farmers without directly subsidizing interest rates. Unlike interest subsidies, the RMF incentivizes financial institutions to extend credit by sharing the risk burden, enhancing sustainable access to credit in agriculture.

Credit Flow Enablement

Credit guarantee schemes enhance agricultural credit flow by reducing lender risk, encouraging banks to extend more loans to farmers without direct cost subsidies. Interest subsidies lower borrowing costs for farmers but may not significantly improve overall credit availability or lender willingness to finance high-risk agricultural ventures.

Interest Subvention Scheme

The Interest Subvention Scheme provides direct financial support by reducing the effective interest rates on agricultural loans, enhancing farmers' access to affordable credit and promoting timely investment in crop production. Unlike credit guarantees which mitigate lender risk indirectly, interest subvention delivers immediate cost relief to borrowers, leading to increased loan uptake and improved agricultural productivity.

First Loss Default Guarantee (FLDG)

First Loss Default Guarantee (FLDG) in agricultural credit guarantees reduces the risk for lenders by covering initial losses, encouraging greater loan disbursement to farmers without direct cost outlays for interest subsidies. Unlike interest subsidies that lower borrowing costs, FLDG enhances credit flow by mitigating non-performing assets, thereby strengthening financial inclusion and farm-level investment growth.

Blended Finance Models

Blended finance models in agricultural loans leverage credit guarantees to mitigate lender risk, attracting private investment by ensuring partial loan recovery, while interest subsidies lower borrower costs directly, promoting affordability and uptake. Combining these mechanisms enhances financial inclusion by balancing risk mitigation and cost reduction, driving sustainable agricultural development and increased credit flow to smallholder farmers.

Direct Benefit Transfer (DBT) for Interest Subsidies

Direct Benefit Transfer (DBT) for interest subsidies on agricultural loans ensures timely, transparent, and targeted credit support to farmers by directly crediting subsidy amounts to their bank accounts, reducing delays and leakages prevalent in traditional credit guarantee schemes. Unlike credit guarantee programs that primarily facilitate access to credit by mitigating lender risks, DBT interest subsidies lower the effective cost of borrowing, thereby enhancing farmers' liquidity and investment capacity in crop production and sustainable practices.

Priority Sector Lending Certificates (PSLCs)

Priority Sector Lending Certificates (PSLCs) enhance agricultural credit by enabling banks to meet mandated lending targets through market-based instruments, offering flexibility compared to direct credit guarantees or interest subsidies. Unlike interest subsidies that reduce loan costs, PSLCs promote efficient resource allocation by allowing lenders to buy and sell credit obligations, thereby incentivizing increased agricultural financing without direct fiscal burden.

Collateral-Free Agricultural Loans

Credit guarantee schemes enhance collateral-free agricultural loans by mitigating lender risk without upfront cost to farmers, promoting broader access to credit for smallholders. Interest subsidies reduce the effective borrowing cost, but may limit loan availability and strain fiscal budgets, making credit guarantees a more sustainable approach for inclusive agricultural financing.

Credit guarantee vs Interest subsidy for agricultural loans Infographic

agridif.com

agridif.com