Crop insurance protects farmers by covering losses due to natural disasters like droughts or floods, ensuring recovery for damaged yields. Revenue insurance offers broader protection by safeguarding against losses in total income caused by both yield declines and price fluctuations in the market. Both tools play crucial roles in agricultural risk management, enabling farmers to stabilize income and maintain financial resilience.

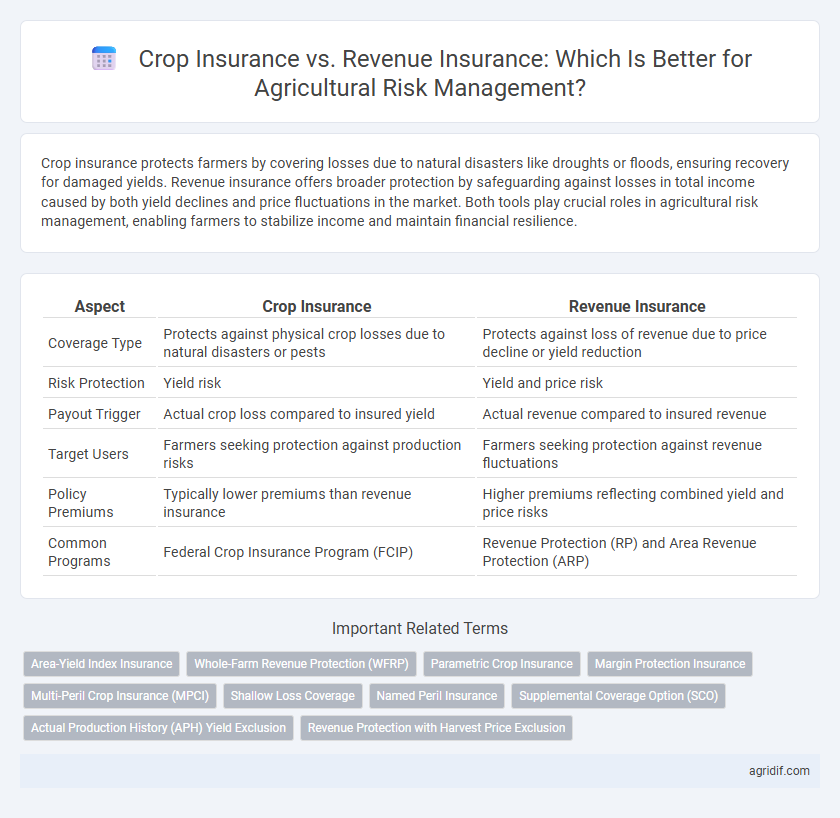

Table of Comparison

| Aspect | Crop Insurance | Revenue Insurance |

|---|---|---|

| Coverage Type | Protects against physical crop losses due to natural disasters or pests | Protects against loss of revenue due to price decline or yield reduction |

| Risk Protection | Yield risk | Yield and price risk |

| Payout Trigger | Actual crop loss compared to insured yield | Actual revenue compared to insured revenue |

| Target Users | Farmers seeking protection against production risks | Farmers seeking protection against revenue fluctuations |

| Policy Premiums | Typically lower premiums than revenue insurance | Higher premiums reflecting combined yield and price risks |

| Common Programs | Federal Crop Insurance Program (FCIP) | Revenue Protection (RP) and Area Revenue Protection (ARP) |

Understanding Crop Insurance: Basics and Coverage

Crop insurance primarily protects farmers against yield losses due to natural disasters such as drought, floods, or pest infestations by providing indemnity based on actual production history. Revenue insurance, in contrast, safeguards farmers against revenue loss caused by a combination of price fluctuations and yield variability, offering a more comprehensive financial safety net. Understanding the specific coverage, terms, and eligibility criteria of crop insurance policies is essential for effective risk management and maximizing government support through premium subsidies.

Revenue Insurance: An Overview

Revenue insurance provides farmers with protection against losses in income caused by declines in crop prices, yields, or a combination of both, ensuring more stable financial outcomes compared to traditional crop insurance that only covers yield losses. It calculates indemnities based on expected revenue established through futures market prices and actual harvested yields, offering comprehensive risk management tailored to fluctuating market conditions. This type of insurance is particularly valuable in volatile markets where price swings significantly impact farmers' profitability and cash flow stability.

Key Differences Between Crop and Revenue Insurance

Crop insurance primarily protects against physical losses from natural disasters like droughts or floods, providing indemnity based on yield reduction, while revenue insurance covers losses due to both yield decline and price fluctuations, ensuring a guaranteed income level. Crop insurance payouts are triggered by actual damage to crops, whereas revenue insurance uses projected revenue benchmarks to determine compensation, offering broader financial risk protection. Revenue insurance tends to be more comprehensive but comes with higher premiums compared to crop insurance, making the choice dependent on a producer's risk exposure and financial goals.

Risk Mitigation: How Each Insurance Type Protects Farmers

Crop insurance minimizes yield loss risk by compensating farmers based on harvested quantities affected by natural disasters or adverse weather. Revenue insurance protects farmers by guaranteeing a set income level, covering losses from both low yields and price fluctuations in the market. Both insurance types provide critical financial stability, with crop insurance focusing on production risk and revenue insurance addressing combined production and market price risks.

Cost Comparison: Crop vs. Revenue Insurance Premiums

Crop insurance premiums often present a lower upfront cost compared to revenue insurance due to their focus solely on yield loss rather than price fluctuations. Revenue insurance premiums tend to be higher as they cover both yield and revenue risks, incorporating market price variability into the cost structure. Farmers must weigh the premium cost difference against the breadth of risk coverage when selecting the most cost-effective insurance option for risk management.

Suitability for Different Farm Types and Crops

Crop insurance is generally more suitable for farms with stable yields and commodity crops as it protects against production losses due to natural disasters. Revenue insurance offers broader protection by covering both yield losses and price fluctuations, making it ideal for diversified farms or those growing high-value or specialty crops. Choosing between these insurance types depends on the farm's risk exposure, crop variety, and market price volatility.

Impact on Farm Income Stability

Crop insurance primarily protects against yield losses caused by natural disasters, offering farmers a safety net during poor harvests and stabilizing farm income. Revenue insurance extends coverage by guarding against both yield declines and market price fluctuations, reducing income variability more effectively. Studies show that revenue insurance programs enhance farm income stability by providing broader risk protection compared to traditional crop insurance.

Government Policies and Subsidies for Crop and Revenue Insurance

Government policies regularly subsidize both crop insurance and revenue insurance to enhance risk management for farmers, aiming to stabilize agricultural incomes amid fluctuating market prices and unpredictable weather conditions. Crop insurance mainly covers losses due to natural disasters affecting yield, while revenue insurance extends coverage to include price declines, supported by federal programs like the USDA's Risk Management Agency. Subsidies lower premium costs, making these insurance options more accessible and encouraging broader participation to safeguard financial stability in the agricultural sector.

Claims Process: Steps and Challenges

The claims process for crop insurance typically involves verifying yield losses based on acreage reports and historical production data, while revenue insurance requires assessment of both yield and market price fluctuations to calculate indemnities. Challenges in crop insurance claims include timely damage assessment and accurate loss verification under varying weather conditions, whereas revenue insurance claims must address price volatility and complex reconciliation of expected versus actual revenue. Both insurance types demand detailed record-keeping, extensive field inspections, and coordination with adjusters to ensure claims are processed efficiently and fairly.

Future Trends in Agricultural Insurance for Risk Management

Future trends in agricultural insurance emphasize the integration of crop insurance and revenue insurance with advanced data analytics and satellite technology to enhance risk assessment accuracy. Precision agriculture tools will enable insurers to offer tailored policies that reflect real-time crop health and market conditions, improving farmer resilience to weather volatility and price fluctuations. Blockchain and AI-driven platforms are poised to streamline claims processing and fraud detection, fostering greater trust and efficiency in risk management solutions.

Related Important Terms

Area-Yield Index Insurance

Area-Yield Index Insurance offers a risk management solution based on aggregated data from specific geographic areas, reducing individual farmer moral hazard and adverse selection compared to traditional crop insurance. This approach links payouts to regional average yields rather than individual farm losses, providing more stable and cost-effective protection against widespread yield fluctuations caused by weather or pests.

Whole-Farm Revenue Protection (WFRP)

Whole-Farm Revenue Protection (WFRP) offers comprehensive risk management by insuring total farm revenue from all commodities, providing broader coverage compared to traditional crop or revenue insurance that typically focuses on specific crops. This integrated approach helps farmers manage revenue variability caused by yield loss, price fluctuations, and market conditions across their entire farm operation.

Parametric Crop Insurance

Parametric crop insurance offers farmers a streamlined risk management solution by triggering payouts based on predefined weather parameters, such as rainfall or temperature thresholds, rather than actual crop loss, enabling faster claims processing and reduced moral hazard. Unlike traditional crop insurance and revenue insurance that require loss verification or yield assessments, parametric policies provide objective, index-based coverage tailored to mitigate weather-related risks efficiently in agricultural production.

Margin Protection Insurance

Margin Protection Insurance provides farmers with tailored risk management by covering the difference between expected and actual margin, integrating both yield and price fluctuations. Compared to traditional crop insurance, which primarily protects yield losses, margin protection offers more comprehensive coverage against revenue variability, enhancing financial stability for agricultural producers.

Multi-Peril Crop Insurance (MPCI)

Multi-Peril Crop Insurance (MPCI) offers comprehensive risk management by covering losses from multiple natural perils such as drought, floods, and pests, directly protecting crop yields. Revenue insurance extends this protection by guaranteeing a level of income based on price fluctuations and yield variability, providing a broader safety net for farmers against market and production risks.

Shallow Loss Coverage

Crop insurance primarily covers yield loss due to natural disasters, while revenue insurance protects against both yield and price fluctuations, offering a more comprehensive risk management approach. Shallow loss coverage in revenue insurance provides financial support for smaller, more frequent losses that traditional crop insurance may not cover, enhancing stability for farmers.

Named Peril Insurance

Named Peril Insurance under crop insurance covers specific risks such as drought, flood, or hail, providing financial protection only when these identified events cause crop damage. Revenue insurance, contrastingly, offers broader risk management by protecting against revenue losses due to yield reductions or price drops, making Named Peril Insurance more limited but cost-effective for targeted risk coverage.

Supplemental Coverage Option (SCO)

Supplemental Coverage Option (SCO) enhances traditional crop insurance by providing area-based coverage that supplements individual crop policies, protecting against widespread revenue losses due to factors like drought or price declines. SCO's integration with revenue insurance optimizes risk management by covering revenue shortfalls beyond the individual policy's coverage, offering farmers more comprehensive financial protection in volatile markets.

Actual Production History (APH) Yield Exclusion

Crop insurance and revenue insurance both provide vital risk management tools, but Actual Production History (APH) Yield Exclusion specifically enhances coverage by allowing farmers to exclude low-yield years from their APH calculation, leading to higher average yields and potentially lower premiums. This provision benefits producers facing historically poor yields due to adverse conditions, improving access to more accurate and affordable insurance options under both crop and revenue insurance programs.

Revenue Protection with Harvest Price Exclusion

Revenue Protection with Harvest Price Exclusion (RP-HPE) offers farmers risk management by guaranteeing a revenue level based on projected prices while excluding any price increases at harvest, reducing premium costs compared to traditional revenue protection. This insurance protects against yield losses and price declines but does not cover price gains, making it a strategic option for farmers prioritizing yield risk hedging without paying for higher harvest price guarantees.

Crop insurance vs revenue insurance for risk management Infographic

agridif.com

agridif.com