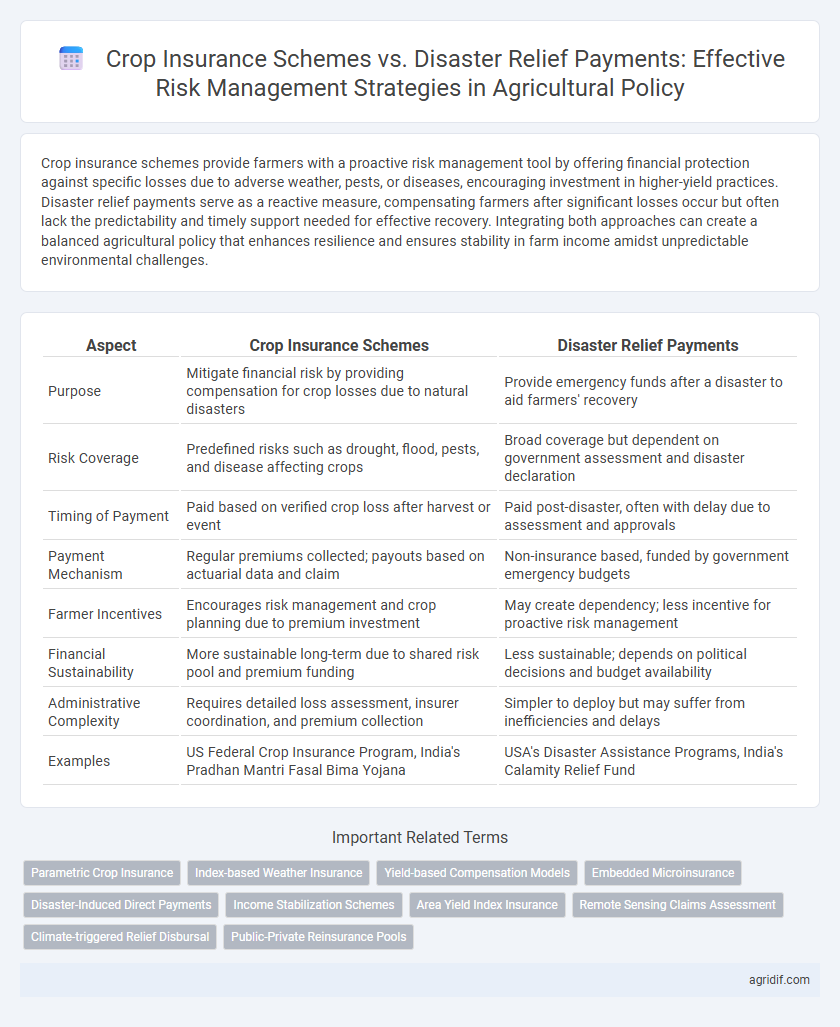

Crop insurance schemes provide farmers with a proactive risk management tool by offering financial protection against specific losses due to adverse weather, pests, or diseases, encouraging investment in higher-yield practices. Disaster relief payments serve as a reactive measure, compensating farmers after significant losses occur but often lack the predictability and timely support needed for effective recovery. Integrating both approaches can create a balanced agricultural policy that enhances resilience and ensures stability in farm income amidst unpredictable environmental challenges.

Table of Comparison

| Aspect | Crop Insurance Schemes | Disaster Relief Payments |

|---|---|---|

| Purpose | Mitigate financial risk by providing compensation for crop losses due to natural disasters | Provide emergency funds after a disaster to aid farmers' recovery |

| Risk Coverage | Predefined risks such as drought, flood, pests, and disease affecting crops | Broad coverage but dependent on government assessment and disaster declaration |

| Timing of Payment | Paid based on verified crop loss after harvest or event | Paid post-disaster, often with delay due to assessment and approvals |

| Payment Mechanism | Regular premiums collected; payouts based on actuarial data and claim | Non-insurance based, funded by government emergency budgets |

| Farmer Incentives | Encourages risk management and crop planning due to premium investment | May create dependency; less incentive for proactive risk management |

| Financial Sustainability | More sustainable long-term due to shared risk pool and premium funding | Less sustainable; depends on political decisions and budget availability |

| Administrative Complexity | Requires detailed loss assessment, insurer coordination, and premium collection | Simpler to deploy but may suffer from inefficiencies and delays |

| Examples | US Federal Crop Insurance Program, India's Pradhan Mantri Fasal Bima Yojana | USA's Disaster Assistance Programs, India's Calamity Relief Fund |

Understanding Agricultural Risk Management Strategies

Crop insurance schemes provide farmers with predictive financial protection by covering potential losses from adverse weather, pests, and market fluctuations, promoting stability and encouraging investment in crop production. Disaster relief payments offer reactive support after catastrophic events but often lack the immediacy and predictability needed for proactive risk management. Integrating crop insurance with disaster relief enhances comprehensive agricultural risk management by balancing preventive coverage with emergency aid.

Overview of Crop Insurance Schemes in Agriculture

Crop insurance schemes in agriculture provide farmers with financial protection against losses caused by natural disasters, pests, and price fluctuations, ensuring income stability and encouraging investment in crop production. These schemes use actuarial data and risk assessment models to offer tailored premiums and coverage options, promoting efficient risk management and reducing dependency on unpredictable disaster relief payments. By transferring risk to insurers, crop insurance fosters resilience within the agricultural sector, supporting sustainable farming practices and enhancing food security.

Disaster Relief Payments: Scope and Limitations

Disaster relief payments provide immediate financial assistance to farmers after extreme events like droughts or floods, covering losses often excluded by crop insurance schemes. These payments have a broader scope, addressing diverse hazards and vulnerable crops not always insurable under formal policies. However, limitations include delayed disbursement, dependency risk, and insufficient coverage for long-term recovery or recurrent disasters.

Comparative Analysis: Crop Insurance vs Disaster Relief

Crop insurance schemes provide proactive risk management by offering farmers indemnity payments based on yield or revenue losses, promoting financial stability and encouraging investment in production. Disaster relief payments serve as reactive aid, triggered post-catastrophic events, often leading to delayed support and potential market distortions. Empirical studies indicate crop insurance enhances long-term resilience and market efficiency more effectively than disaster relief, which may foster dependency and reduce incentives for risk mitigation.

Financial Sustainability of Crop Insurance Programs

Crop insurance schemes offer a structured risk management tool that enhances financial sustainability by pooling premiums and spreading risk across a broad base of farmers, reducing reliance on unpredictable disaster relief payments. These insurance programs incentivize better farm management practices and provide timely compensation, helping stabilize farm incomes and agricultural markets. In contrast, disaster relief payments often impose significant fiscal burdens on governments, leading to budgetary uncertainty and diminishing incentives for proactive risk mitigation among farmers.

Timeliness and Efficiency of Disaster Relief Payments

Disaster relief payments provide immediate financial support to farmers following adverse events, ensuring timely assistance compared to the more structured payouts of crop insurance schemes. While crop insurance requires claim verification and processing that can delay compensation, disaster relief payments expedite resource delivery, reducing liquidity constraints for affected farmers. Efficient disaster relief enhances farmers' capacity to recover quickly, though it often lacks the predictive risk management framework offered by crop insurance policies.

Impact on Farmer Behavior and Risk-Taking

Crop insurance schemes incentivize farmers to adopt innovative but riskier agricultural practices by providing financial protection against crop loss, leading to increased investment in high-yield technologies. Disaster relief payments, however, often create moral hazard by encouraging riskier behavior without promoting proactive risk management, as farmers rely on post-disaster compensation rather than preventive measures. Empirical studies show that transparent and well-structured crop insurance programs significantly enhance farmers' willingness to engage in productive risk-taking compared to unpredictable disaster relief payments.

Government Roles in Supporting Risk Management Tools

Government roles in supporting risk management tools include promoting crop insurance schemes and providing disaster relief payments to stabilize farmer incomes during adverse events. Crop insurance schemes offer proactive financial protection by compensating losses from specific hazards, encouraging investment in sustainable farming practices. Disaster relief payments serve as reactive support, allocating funds post-crisis to aid recovery, but may present challenges in timely delivery and fiscal sustainability.

Accessibility and Affordability for Smallholder Farmers

Crop insurance schemes provide smallholder farmers with affordable, pre-emptive financial protection against yield losses, enhancing accessibility through subsidized premiums and tailored coverage options. Disaster relief payments, while offering post-event financial support, often lack timely accessibility and sufficient funds to fully compensate for losses, limiting their effectiveness for smallholder risk management. Emphasizing expanded access to crop insurance can improve financial resilience and reduce dependency on unpredictable disaster relief programs.

Policy Recommendations for Enhancing Agricultural Resilience

Crop insurance schemes provide a proactive risk management approach by offering farmers financial protection against yield losses due to natural disasters, encouraging investment and sustainable practices. Disaster relief payments, while essential in catastrophic events, often result in delayed assistance and may not adequately incentivize risk reduction strategies. Policy recommendations emphasize expanding affordable and accessible crop insurance coverage, integrating technology for accurate risk assessment, and streamlining disaster relief processes to complement insurance, thereby enhancing agricultural resilience and stability.

Related Important Terms

Parametric Crop Insurance

Parametric crop insurance offers timely risk transfer by triggering payouts based on predefined weather indices, reducing the delays and moral hazard associated with traditional disaster relief payments and indemnity-based schemes. By leveraging satellite data and automated triggers, parametric insurance enhances the efficiency of agricultural risk management, providing more predictable financial protection for farmers against climate-related losses.

Index-based Weather Insurance

Index-based weather insurance offers a data-driven approach to agricultural risk management by providing payouts triggered by predefined weather indices, reducing moral hazard and administrative costs compared to traditional crop insurance schemes. Unlike disaster relief payments, which are reactive and often delayed, index-based insurance delivers timely financial support to farmers, enhancing resilience against climate variability and extreme weather events.

Yield-based Compensation Models

Yield-based crop insurance schemes provide farmers with financial payouts directly linked to actual crop yields, allowing precise risk management by compensating for shortfalls due to weather variability or pest infestations. Disaster relief payments often lack this specificity, offering lump-sum aids that may insufficiently address individual yield losses, highlighting the efficiency of yield-based models in stabilizing farm income and promoting agricultural sustainability.

Embedded Microinsurance

Embedded microinsurance in crop insurance schemes offers targeted risk management by integrating affordable coverage directly into agricultural inputs, enhancing smallholder farmers' financial resilience without reliance on ex-post disaster relief payments that often suffer from delayed disbursement and insufficient coverage. This proactive approach reduces farmers' vulnerability to climate-induced losses and stabilizes income streams, fostering sustainable agricultural productivity and rural development.

Disaster-Induced Direct Payments

Disaster-induced direct payments provide immediate financial relief to farmers affected by severe weather events, ensuring rapid cash flow to sustain agricultural operations and livelihoods. Unlike crop insurance schemes, which require pre-planning and premium payments, direct payments offer a reactive risk management tool that can address unforeseen disasters without the administrative delays inherent in claim processing.

Income Stabilization Schemes

Crop insurance schemes provide a proactive risk management tool that stabilizes farmer income by offering compensation against specific losses due to adverse weather or pest outbreaks, thus encouraging investment and productivity. Disaster relief payments, while essential for emergency support, are reactive and less effective in income stabilization as they often arrive after significant financial harm has occurred to agricultural producers.

Area Yield Index Insurance

Area Yield Index Insurance offers a data-driven risk management tool by compensating farmers based on regional crop yields rather than individual losses, reducing moral hazard and adverse selection common in traditional crop insurance schemes. In contrast, disaster relief payments provide reactive financial support after catastrophic events without incentivizing risk mitigation, often leading to budget unpredictability and inefficient resource allocation in agricultural policy.

Remote Sensing Claims Assessment

Remote sensing technology enhances the accuracy and efficiency of crop insurance claims assessment by providing real-time, high-resolution data on crop health and damage. This approach reduces reliance on disaster relief payments by enabling precise risk management and timely compensation for insured farmers.

Climate-triggered Relief Disbursal

Crop insurance schemes provide proactive financial protection against climate-related losses by offering timely indemnity payouts based on predefined triggers such as drought or flood severity, enhancing farmers' ability to manage risk effectively. Disaster relief payments are reactive measures that often result in delayed support and insufficient coverage, making crop insurance a more efficient tool for stabilizing agricultural incomes under climate variability.

Public-Private Reinsurance Pools

Public-private reinsurance pools enhance crop insurance schemes by distributing risk between government and private insurers, improving financial stability and coverage for farmers facing unpredictable climate hazards. These pools reduce reliance on disaster relief payments by providing timely, actuarially sound compensation that supports proactive risk management and agricultural resilience.

Crop Insurance Schemes vs Disaster Relief Payments for risk management Infographic

agridif.com

agridif.com