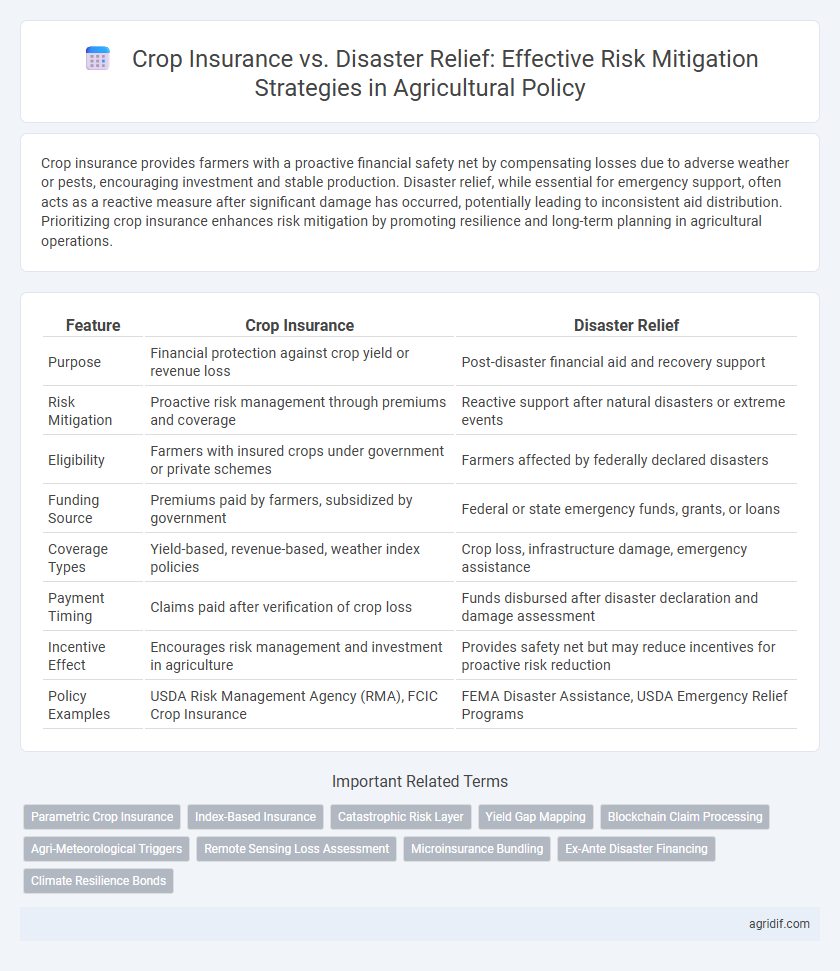

Crop insurance provides farmers with a proactive financial safety net by compensating losses due to adverse weather or pests, encouraging investment and stable production. Disaster relief, while essential for emergency support, often acts as a reactive measure after significant damage has occurred, potentially leading to inconsistent aid distribution. Prioritizing crop insurance enhances risk mitigation by promoting resilience and long-term planning in agricultural operations.

Table of Comparison

| Feature | Crop Insurance | Disaster Relief |

|---|---|---|

| Purpose | Financial protection against crop yield or revenue loss | Post-disaster financial aid and recovery support |

| Risk Mitigation | Proactive risk management through premiums and coverage | Reactive support after natural disasters or extreme events |

| Eligibility | Farmers with insured crops under government or private schemes | Farmers affected by federally declared disasters |

| Funding Source | Premiums paid by farmers, subsidized by government | Federal or state emergency funds, grants, or loans |

| Coverage Types | Yield-based, revenue-based, weather index policies | Crop loss, infrastructure damage, emergency assistance |

| Payment Timing | Claims paid after verification of crop loss | Funds disbursed after disaster declaration and damage assessment |

| Incentive Effect | Encourages risk management and investment in agriculture | Provides safety net but may reduce incentives for proactive risk reduction |

| Policy Examples | USDA Risk Management Agency (RMA), FCIC Crop Insurance | FEMA Disaster Assistance, USDA Emergency Relief Programs |

Understanding Risk Mitigation in Agriculture

Crop insurance provides farmers with financial protection by covering losses due to adverse weather events, pests, and disease, enabling more stable income and investment capacity. Disaster relief acts as a safety net, offering post-event assistance to recover from significant losses but often lacks the proactive risk management benefits of insurance. Effective agricultural risk mitigation integrates crop insurance to encourage resilience and sustainability while relying on disaster relief for support during extreme, unpredictable catastrophes.

Overview of Crop Insurance Policies

Crop insurance policies provide farmers with financial protection by covering losses due to natural disasters, pests, and adverse weather conditions, ensuring income stability and encouraging agricultural investment. Key programs like the Federal Crop Insurance Corporation (FCIC) and private insurers offer multiple plans, including yield-based, revenue-based, and area-wide insurance, tailored to diverse cropping systems and regions. These policies help mitigate financial risks more proactively compared to disaster relief, which is typically reactive and less predictable for long-term farm planning.

The Role of Disaster Relief in Agriculture

Disaster relief plays a critical role in agriculture by providing immediate financial assistance to farmers affected by natural catastrophes such as droughts, floods, and hurricanes, enabling rapid recovery and stabilization of rural economies. Unlike crop insurance, which requires pre-emptive enrollment and involves risk assessment and premium payments, disaster relief is often reactive, funded by government aid, and targets post-disaster recovery efforts. Effective integration of disaster relief with crop insurance enhances risk mitigation strategies, reduces long-term agricultural losses, and supports food security.

Comparative Analysis: Crop Insurance vs Disaster Relief

Crop insurance offers a proactive risk management tool that provides farmers with financial compensation based on predetermined coverage, encouraging investment in higher-yield practices and stabilizing farm income. Disaster relief serves as a reactive measure, delivering emergency aid post-catastrophe but often lacks the predictability and timely support necessary for sustained agricultural productivity. Comparative analysis reveals crop insurance promotes resilience through risk sharing and loss reduction incentives, whereas disaster relief's sporadic nature may lead to dependency and insufficient mitigation of future risks.

Financial Sustainability and Cost Implications

Crop insurance provides a proactive financial tool enabling farmers to manage risk by paying premiums calibrated to expected losses, enhancing long-term financial sustainability through predictable cost structures. Disaster relief, while crucial for emergency support, often incurs unpredictable and substantial fiscal burdens on government budgets, challenging sustainable funding allocations. Comparing cost implications, crop insurance promotes risk-sharing mechanisms that reduce reliance on volatile government expenditures associated with disaster relief payouts.

Timeliness of Support: Speed of Payouts

Crop insurance provides timely payouts based on predefined triggers, ensuring farmers receive financial support promptly after adverse events. Disaster relief programs often experience delays due to assessment and approval processes, which can extend the time before aid reaches affected producers. Rapid disbursement in crop insurance enhances farmers' ability to recover quickly, maintaining operational stability and reducing long-term economic losses.

Impact on Farmer Decision-Making

Crop insurance provides a predictable safety net, encouraging farmers to invest in higher-value crops and innovative practices by reducing financial uncertainty. Disaster relief, often reactive and variable, may discourage proactive risk management, leading to more conservative planting and investment decisions. Consistent access to crop insurance enhances long-term farm planning, whereas reliance on sporadic disaster aid can distort risk perception and affect productivity.

Government Involvement and Policy Frameworks

Government involvement in agricultural risk mitigation prominently features crop insurance programs and disaster relief initiatives, each embedded within distinct policy frameworks aimed at stabilizing farm income. Crop insurance, supported by federal subsidies and regulated under the Federal Crop Insurance Act, provides proactive financial protection against yield losses and price fluctuations, encouraging risk management among farmers. Disaster relief, governed through emergency appropriations and the Farm Bill provisions, offers reactive assistance post-catastrophe but may lack the predictability and preventative incentives inherent in insurance-based policies.

Challenges in Implementation and Coverage

Crop insurance faces challenges such as high premiums, limited participation from small-scale farmers, and difficulty in accurately assessing localized risks, which restricts comprehensive coverage. Disaster relief programs often suffer from delayed disbursements, ad hoc funding, and inconsistent eligibility criteria that undermine timely risk mitigation. Both approaches struggle with data gaps and administrative barriers, leading to coverage gaps and reduced effectiveness in supporting agricultural resilience.

Future Directions for Agricultural Risk Management

Crop insurance offers a proactive risk mitigation tool by providing farmers with financial protection against yield losses, whereas disaster relief serves as a reactive measure following adverse events. Future directions in agricultural risk management emphasize integrating advanced data analytics and satellite technology to enhance crop insurance precision and timely payouts. Embracing digital platforms and public-private partnerships will streamline risk assessment and improve resilience against climate-induced uncertainties.

Related Important Terms

Parametric Crop Insurance

Parametric crop insurance offers a data-driven risk mitigation solution by providing payouts based on pre-defined weather indices such as rainfall or temperature thresholds, reducing claim processing times compared to traditional crop insurance and disaster relief programs. Compared to disaster relief, parametric insurance delivers quicker financial support to farmers, enabling timely recovery and enhancing resilience against climate-induced agricultural losses.

Index-Based Insurance

Index-based crop insurance offers precise risk mitigation by using measurable indices such as rainfall or yield data to trigger payouts, minimizing moral hazard and reducing administrative costs compared to traditional disaster relief programs. This approach enables faster compensation to farmers, enhancing resilience against climate variability while promoting agricultural stability and investment in risk-prone regions.

Catastrophic Risk Layer

Crop insurance targeting the Catastrophic Risk Layer provides farmers with indemnity against severe losses from extreme events, ensuring financial stability through structured premiums and payouts. Disaster relief programs offer post-event aid but lack the proactive risk sharing and tailored coverage that crop insurance delivers for managing catastrophic agricultural risks.

Yield Gap Mapping

Crop insurance provides farmers with financial protection based on pre-agreed yield thresholds, effectively mitigating risks by leveraging yield gap mapping to identify areas of productivity loss and tailor coverage. Disaster relief, while reactive and less precise, relies on yield gap data to assess damage severity but often lacks the predictive and preventive advantages of insurance schemes.

Blockchain Claim Processing

Crop insurance leverages blockchain claim processing to enhance transparency, reduce fraud, and expedite claim settlements, offering farmers quicker financial recovery compared to traditional disaster relief methods. Blockchain's immutable ledger and smart contracts ensure accurate risk assessment and automate payouts, minimizing administrative delays in agricultural risk mitigation.

Agri-Meteorological Triggers

Agri-meteorological triggers enhance crop insurance effectiveness by using precise weather data to activate payouts, ensuring timely risk mitigation for farmers. Disaster relief, often delayed and less targeted, lacks the predictive accuracy of agri-meteorological systems, making crop insurance a more reliable tool for managing climate-related agricultural risks.

Remote Sensing Loss Assessment

Remote sensing loss assessment enhances crop insurance accuracy by providing real-time, high-resolution data on crop health and damage, enabling precise indemnity calculations and reducing disputes. Disaster relief programs benefit from remote sensing by quickly identifying affected areas and quantifying losses, but crop insurance offers more proactive risk management through satellite-derived yield predictions and damage evaluations.

Microinsurance Bundling

Microinsurance bundling enhances risk mitigation in agricultural policy by providing smallholder farmers with affordable, tailored crop insurance that complements traditional disaster relief programs. This integrated approach reduces vulnerability by ensuring timely payouts and improving resilience against climate-induced crop failures.

Ex-Ante Disaster Financing

Ex-ante disaster financing through crop insurance provides farmers with proactive financial protection by transferring risk before a disaster occurs, ensuring quicker recovery and stability in agricultural production. Unlike disaster relief, which offers reactive aid post-event, crop insurance incentivizes risk management and reduces the fiscal burden on governments, enhancing overall resilience in the agricultural sector.

Climate Resilience Bonds

Climate Resilience Bonds are an innovative financial instrument designed to enhance crop insurance by providing targeted funding for proactive climate adaptation measures, thereby reducing farmers' reliance on reactive disaster relief programs. These bonds enable scalable investment in resilient agricultural infrastructure and technologies, directly mitigating climate-related risks and promoting sustainable crop production under increasing environmental variability.

Crop insurance vs disaster relief for risk mitigation Infographic

agridif.com

agridif.com