Input subsidies reduce the cost of essential farming resources like seeds, fertilizers, and equipment, directly lowering production expenses for farmers. Output subsidies provide financial incentives based on the quantity or quality of agricultural products sold, encouraging higher production and market competitiveness. Governments must balance these approaches to achieve sustainable agricultural growth while minimizing market distortions and ensuring fair farmer incomes.

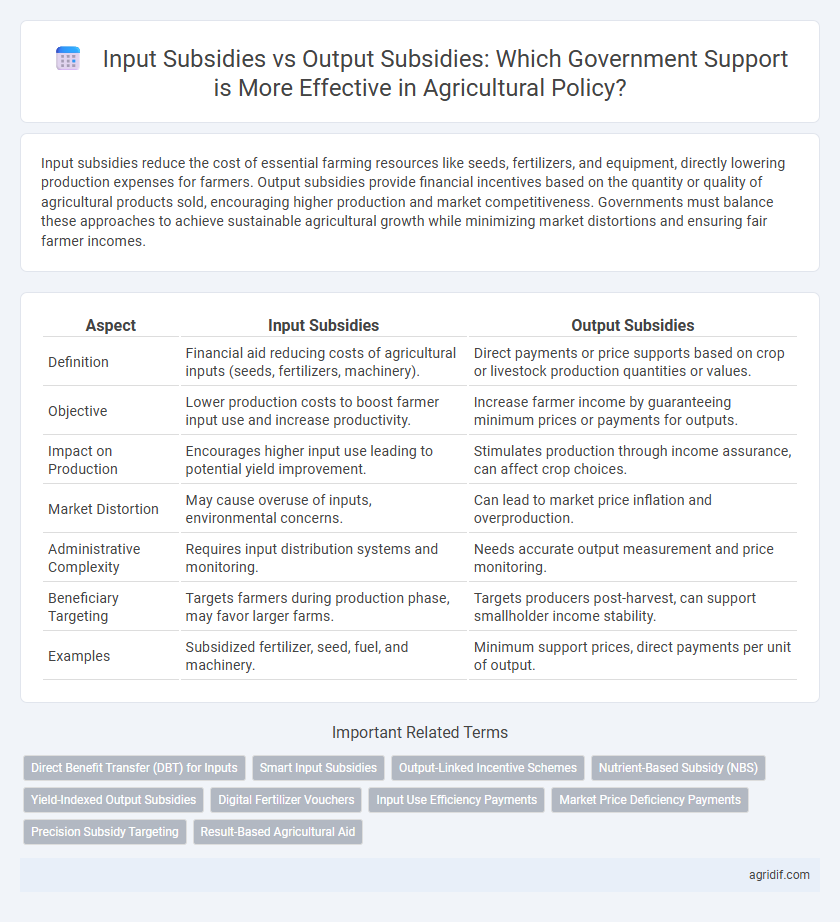

Table of Comparison

| Aspect | Input Subsidies | Output Subsidies |

|---|---|---|

| Definition | Financial aid reducing costs of agricultural inputs (seeds, fertilizers, machinery). | Direct payments or price supports based on crop or livestock production quantities or values. |

| Objective | Lower production costs to boost farmer input use and increase productivity. | Increase farmer income by guaranteeing minimum prices or payments for outputs. |

| Impact on Production | Encourages higher input use leading to potential yield improvement. | Stimulates production through income assurance, can affect crop choices. |

| Market Distortion | May cause overuse of inputs, environmental concerns. | Can lead to market price inflation and overproduction. |

| Administrative Complexity | Requires input distribution systems and monitoring. | Needs accurate output measurement and price monitoring. |

| Beneficiary Targeting | Targets farmers during production phase, may favor larger farms. | Targets producers post-harvest, can support smallholder income stability. |

| Examples | Subsidized fertilizer, seed, fuel, and machinery. | Minimum support prices, direct payments per unit of output. |

Understanding Input and Output Subsidies in Agriculture

Input subsidies in agriculture reduce the cost of essential farming inputs such as seeds, fertilizers, and irrigation, enabling farmers to increase production efficiency and crop yields. Output subsidies directly support the sale of agricultural products by guaranteeing minimum prices or providing payments per unit of output, stabilizing farmers' incomes and market competitiveness. Understanding the distinct roles and impacts of input and output subsidies helps policymakers design targeted interventions that promote sustainable agricultural growth and rural development.

Key Differences Between Input and Output Subsidies

Input subsidies reduce the cost of agricultural inputs such as seeds, fertilizers, and equipment, directly lowering production expenses for farmers. Output subsidies provide financial support based on the quantity or quality of agricultural products sold, incentivizing higher production or improved product standards. Key differences include how input subsidies influence production costs and resource use, while output subsidies affect pricing and market incentives.

Impacts of Input Subsidies on Farm Productivity

Input subsidies, such as reduced prices for seeds, fertilizers, and machinery, directly lower production costs, enabling farmers to increase crop yields and improve farm productivity. Evidence shows that input subsidies lead to higher input use efficiency and encourage investment in modern farming techniques, resulting in sustainable productivity gains. However, poorly targeted input subsidies can cause market distortions and dependency issues, limiting long-term agricultural growth.

Benefits and Drawbacks of Output Subsidies

Output subsidies incentivize farmers by directly increasing the profitability of their agricultural products, leading to higher production and improved market competitiveness. These subsidies can enhance food security and promote export growth but may cause market distortions, overproduction, and fiscal burdens on governments. Unlike input subsidies, output subsidies risk encouraging unsustainable farming practices and can be challenging to administer effectively due to price volatility.

Fiscal Sustainability of Input vs Output Subsidies

Input subsidies, such as fertilizer and seed subsidies, often lead to higher government expenditure due to continuous demand and price distortions, challenging fiscal sustainability. Output subsidies, which provide financial support based on crop yields or market prices, can encourage overproduction and market imbalances but allow for more targeted fiscal controls through conditional disbursements. Fiscal sustainability analysis shows input subsidies require long-term budget commitments, while output subsidies offer potentially lower fiscal burdens if carefully designed and monitored.

Targeting Efficiency: Which Farmers Benefit Most?

Input subsidies primarily benefit smallholder farmers by reducing the cost of seeds, fertilizers, and machinery, thereby enhancing targeted support for resource-constrained producers. Output subsidies often favor larger, market-oriented farms that can leverage economies of scale to increase production and access market premiums. Targeting efficiency depends on aligning subsidies with farmer needs: input subsidies improve input accessibility for smallholders, while output subsidies reward production performance, often skewed towards well-capitalized farmers.

Environmental Implications of Subsidy Policies

Input subsidies, such as fertilizer and water support, often lead to overuse of resources and increased environmental degradation, including soil erosion and water pollution. Output subsidies, which guarantee prices or purchase quantities, can encourage higher production levels but may also incentivize unsustainable farming practices that harm biodiversity and increase greenhouse gas emissions. Effective agricultural policy requires balancing these subsidies to promote sustainable resource management while minimizing negative environmental impacts.

Market Distortions and Price Volatility

Input subsidies, such as fertilizers and seeds, often lead to market distortions by encouraging overuse of specific inputs, which can reduce overall efficiency and distort resource allocation in agriculture. Output subsidies, paid per unit of agricultural product, may increase price volatility by incentivizing farmers to produce more of subsidized crops, potentially leading to overproduction and market gluts. Both subsidy types impact price signals differently, with input subsidies stabilizing input costs but potentially causing inefficiencies, while output subsidies risk exacerbating market fluctuations and distortions in commodity prices.

Best Practices for Subsidy Reform in Agriculture

Input subsidies target seeds, fertilizers, and machinery, enhancing production efficiency but often leading to market distortions and fiscal strain. Output subsidies support prices for crops or livestock, stabilizing farmer income but potentially encouraging overproduction and inefficiencies. Best practices for subsidy reform emphasize transparency, targeting vulnerable farmers, and gradually shifting towards direct income support or investment in infrastructure and extension services to promote sustainable agricultural growth.

Policy Recommendations for Effective Government Support

Input subsidies, such as reduced prices on seeds, fertilizers, and machinery, directly lower production costs and improve farmer access to essential resources, promoting increased agricultural productivity. Output subsidies, including price supports or guaranteed minimum prices, incentivize higher yields by ensuring stable income for farmers but may lead to market distortions and inefficient resource allocations if improperly designed. Effective government support requires balanced policies that combine targeted input subsidies to enhance production efficiency with carefully monitored output subsidies to stabilize farmer income without compromising market competitiveness.

Related Important Terms

Direct Benefit Transfer (DBT) for Inputs

Input subsidies delivered through Direct Benefit Transfer (DBT) mechanisms enhance transparency and reduce leakages by directly crediting farmers' accounts, increasing efficiency in agricultural support programs. In contrast, output subsidies focus on guaranteeing prices or market interventions but often face challenges in targeting and fiscal sustainability.

Smart Input Subsidies

Smart input subsidies target key agricultural inputs such as seeds, fertilizers, and irrigation technologies to enhance productivity and sustainability, reducing resource wastage and promoting equitable access for smallholder farmers. These subsidies drive cost-effective production improvements, unlike output subsidies which risk market distortions by artificially inflating crop prices and often fail to incentivize efficient farming practices.

Output-Linked Incentive Schemes

Output-linked incentive schemes under agricultural policy directly reward farmers based on produced quantities or quality, fostering efficiency and market responsiveness more effectively than input subsidies, which may lead to resource misallocation. Empirical studies highlight that output subsidies enhance productivity and income stability by aligning government support with actual market performance and innovation adoption.

Nutrient-Based Subsidy (NBS)

Nutrient-Based Subsidies (NBS) provide targeted support by subsidizing specific fertilizer nutrients such as nitrogen, phosphorus, and potassium, enhancing efficiency and reducing waste compared to traditional input subsidies that broadly lower fertilizer costs. Output subsidies, which incentivize increased agricultural production, often lead to market distortions, whereas NBS fosters balanced nutrient use, promoting sustainable soil health and optimizing crop yields.

Yield-Indexed Output Subsidies

Yield-indexed output subsidies directly link government payments to crop production levels, encouraging farmers to increase agricultural output while minimizing market distortions common in input subsidies. Unlike input subsidies, which lower the cost of inputs like fertilizer or seeds, yield-indexed output subsidies provide financial incentives tied to actual harvest volumes, promoting efficiency and sustainable yield improvements.

Digital Fertilizer Vouchers

Digital fertilizer vouchers represent a targeted input subsidy mechanism that enhances farmers' purchasing power for essential agricultural inputs, improving fertilizer accessibility and promoting precision farming. Compared to output subsidies, which incentivize production results, digital input subsidies directly reduce input costs, fostering sustainable agricultural productivity and efficient resource use.

Input Use Efficiency Payments

Input subsidies target specific agricultural inputs such as seeds, fertilizers, and machinery to enhance input use efficiency by lowering production costs and encouraging optimal resource allocation. Output subsidies, by contrast, directly support crop yields or sales prices but may lead to market distortions, making input subsidies more effective in promoting sustainable and efficient input utilization.

Market Price Deficiency Payments

Market Price Deficiency Payments, a form of output subsidy, compensate farmers for the gap between market prices and predetermined support prices, stabilizing income without distorting input markets. Unlike input subsidies that lower production costs directly, these payments target revenue protection, encouraging market-oriented production and reducing inefficiencies in resource allocation.

Precision Subsidy Targeting

Precision subsidy targeting enhances the efficiency of input subsidies by directing resources such as seeds, fertilizers, and machinery to farmers based on farm size, soil quality, and production capacity, thereby reducing waste and improving crop yields. Output subsidies, while supporting market prices, often lack such specificity, leading to market distortions and inefficiencies that precision targeting in input subsidies can help mitigate.

Result-Based Agricultural Aid

Result-based agricultural aid prioritizes output subsidies by directly rewarding farmers for increased production, quality improvements, or sustainability outcomes, enhancing efficiency and market responsiveness. In contrast, input subsidies, which reduce costs for seeds, fertilizers, or equipment, risk inefficiencies and overuse, making output-based support a more targeted and outcome-driven approach in agricultural policy.

Input Subsidies vs Output Subsidies for government support Infographic

agridif.com

agridif.com