Spot markets allow farmers to sell grain immediately at current prices, providing quick cash flow and reducing storage costs. Forward markets involve contracts to sell grain at a predetermined price and future date, helping farmers hedge against price volatility and secure income stability. Choosing between spot and forward markets depends on risk tolerance, market forecasts, and cash flow needs.

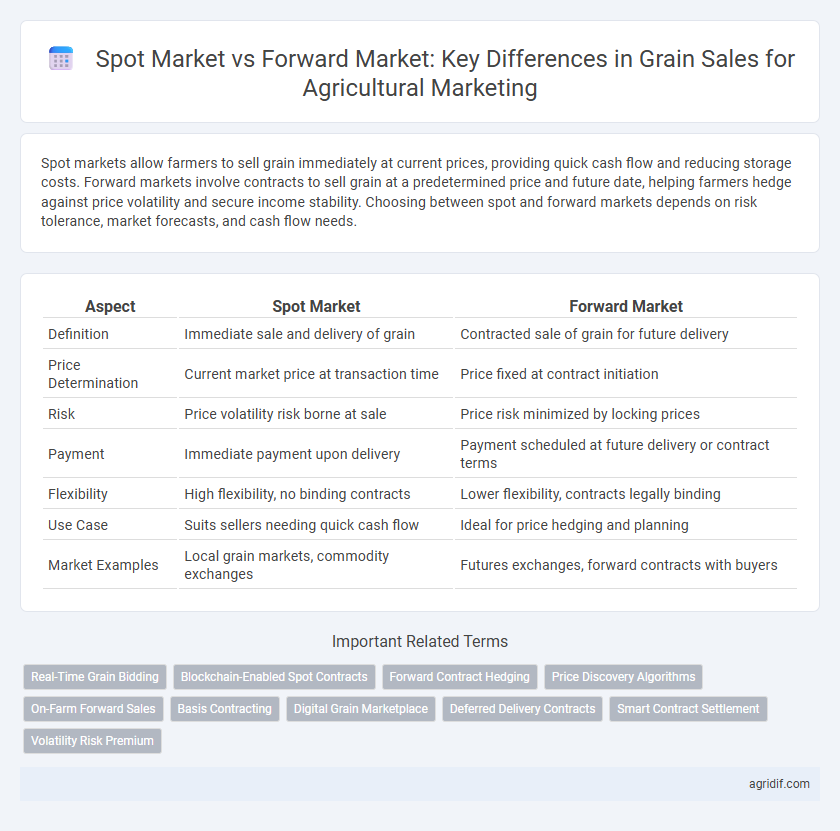

Table of Comparison

| Aspect | Spot Market | Forward Market |

|---|---|---|

| Definition | Immediate sale and delivery of grain | Contracted sale of grain for future delivery |

| Price Determination | Current market price at transaction time | Price fixed at contract initiation |

| Risk | Price volatility risk borne at sale | Price risk minimized by locking prices |

| Payment | Immediate payment upon delivery | Payment scheduled at future delivery or contract terms |

| Flexibility | High flexibility, no binding contracts | Lower flexibility, contracts legally binding |

| Use Case | Suits sellers needing quick cash flow | Ideal for price hedging and planning |

| Market Examples | Local grain markets, commodity exchanges | Futures exchanges, forward contracts with buyers |

Introduction to Grain Markets: Spot vs Forward

Spot markets for grain involve immediate transactions where prices reflect current supply and demand, offering farmers quick payment and transfer of ownership upon delivery. Forward markets allow producers and buyers to agree on a future price and delivery date, mitigating price volatility risk and providing income certainty before harvest. Understanding the differences between spot and forward grain markets is essential for effective risk management and strategic sales planning in agricultural marketing.

Definition and Key Features of Spot Markets

Spot markets for grain sales involve the immediate exchange of commodities at current market prices, with delivery and payment occurring promptly. Key features include real-time price determination based on supply and demand, straightforward transactions, and minimal contractual obligations. These markets enable farmers and buyers to capitalize on prevailing prices without long-term commitments, providing flexibility but exposing them to price volatility.

Understanding Forward Markets in Grain Sales

Forward markets in grain sales allow producers and buyers to lock in prices for future delivery, reducing exposure to price volatility prevalent in spot markets. Contracts specify grain quantity, quality, delivery time, and price, providing stability and predictability for farm revenue and supply chain planning. These markets are crucial for managing risk in agricultural marketing, enabling better financial forecasting and mitigating the impact of fluctuating commodity prices.

Pricing Mechanisms: Spot vs Forward Contracts

Spot market pricing for grain sales reflects real-time supply and demand conditions, offering immediate settlement at current market prices. Forward contracts lock in prices in advance, providing price certainty and risk management for both farmers and buyers by mitigating exposure to price volatility. The choice between spot and forward pricing mechanisms depends on market predictability, cash flow needs, and risk tolerance in agricultural marketing.

Risk Management in Spot and Forward Grain Transactions

Spot market grain sales offer immediate delivery and payment, reducing price risk but exposing sellers to market volatility at the time of sale. Forward market contracts allow farmers to lock in prices ahead of harvest, providing price certainty and mitigating revenue fluctuations but risking opportunity loss if market prices rise. Effective risk management in grain transactions involves balancing the immediacy and flexibility of spot sales against the price stability and planning benefits of forward contracts.

Advantages of Spot Markets for Grain Farmers

Spot markets offer grain farmers immediate payment upon delivery, enhancing cash flow and reducing credit risk. Price transparency and real-time market fluctuations allow farmers to capitalize on favorable market conditions without long-term commitments. This flexibility supports efficient inventory management and quick response to supply and demand changes in the grain sector.

Benefits of Forward Contracts in Agriculture

Forward contracts in agriculture offer price certainty and risk management for grain producers by locking in prices before harvest, reducing exposure to volatile market fluctuations. These contracts enhance cash flow planning and improve financial stability by ensuring guaranteed sales, which supports better resource allocation and investment decisions. Farmers benefit from stronger bargaining positions and reduced marketing costs compared to spot market transactions.

Challenges Faced in Spot and Forward Grain Markets

Spot market grain sales face challenges such as price volatility due to immediate delivery requirements and limited time for price negotiation, which can reduce profitability for farmers. Forward market transactions involve risks like contract non-fulfillment and price fluctuations between agreement and delivery, complicating risk management. Both markets require careful planning and market knowledge to mitigate financial losses and optimize sale timing.

Decision Factors: Choosing Between Spot and Forward Sales

Farmers deciding between spot market and forward market grain sales consider price volatility, cash flow needs, and risk tolerance to balance immediate revenue against price assurance. Spot market sales offer flexibility and the potential to capitalize on favorable current prices, while forward contracts provide price certainty and help manage market risks by locking in prices before harvest. Market conditions, storage costs, and forecasted supply-demand dynamics further influence the choice, aligning sales strategy with financial goals and risk management preferences.

Future Trends in Grain Market Trading

Spot markets for grain sales enable immediate transactions with current prices reflecting real-time supply and demand dynamics, while forward markets involve contracts for future delivery, providing price certainty and risk management for producers and buyers. Emerging trends indicate increased integration of digital platforms and blockchain technology to enhance transparency and efficiency in grain trading across both spot and forward markets. Climate change impacts and evolving global trade policies are expected to drive greater volatility, prompting more frequent use of forward contracts and advanced pricing tools to mitigate risks in grain market trading.

Related Important Terms

Real-Time Grain Bidding

Real-time grain bidding in the spot market offers immediate price discovery based on current supply and demand, enabling farmers to sell grain with minimal delay and capture market fluctuations effectively. Forward markets lock in prices ahead of delivery, providing price certainty but limiting responsiveness to sudden market changes, making spot market bidding critical for maximizing revenue during volatile price periods.

Blockchain-Enabled Spot Contracts

Blockchain-enabled spot contracts for grain sales enhance transparency and reduce counterparty risks by providing immutable, real-time transaction records directly on the ledger. Unlike forward markets, spot markets with blockchain integration enable immediate settlement and verification, promoting efficiency and trust among farmers, traders, and buyers.

Forward Contract Hedging

Forward contract hedging in grain sales enables producers to lock in prices ahead of harvest, reducing exposure to volatile market fluctuations on the spot market. This strategy provides price certainty and financial stability by securing sales terms in advance, minimizing risk from unpredictable supply and demand changes.

Price Discovery Algorithms

Price discovery algorithms in the spot market for grain sales leverage real-time data to adjust prices based on immediate supply and demand, ensuring transparent and efficient transaction pricing. In contrast, forward market price discovery algorithms incorporate predictive analytics and historical data, enabling farmers and buyers to hedge risks by agreeing on prices for future delivery dates.

On-Farm Forward Sales

On-farm forward sales allow farmers to lock in prices for grain before harvest, providing price certainty and reducing exposure to market volatility compared to spot market transactions. These contracts enable producers to manage risk effectively by securing future delivery terms directly on the farm, enhancing cash flow planning and marketing strategies.

Basis Contracting

Basis contracting in agricultural marketing leverages the spot market's current cash prices while securing future delivery through forward contracts, minimizing price risk for grain sellers. This strategy optimizes basis risk management by locking in the differential between local cash prices and prevailing futures prices, enhancing revenue predictability in grain sales.

Digital Grain Marketplace

Spot markets enable immediate grain sales at prevailing prices, offering farmers instant liquidity and flexible transactions through digital grain marketplaces. Forward markets allow producers to lock in prices for future delivery, minimizing price risk and providing financial planning certainty within digital trading platforms.

Deferred Delivery Contracts

Deferred delivery contracts in grain sales allow farmers and buyers to agree on prices today for future delivery, reducing exposure to spot market price volatility and enabling better cash flow management. These forward market agreements contrast with spot market transactions by securing a predetermined price and delivery timeline, facilitating risk management and planning in agricultural marketing.

Smart Contract Settlement

Spot markets facilitate immediate grain sales with instant payment and delivery, while forward markets agree on future transactions at predetermined prices, enabling farmers to hedge price volatility. Smart contract settlement automates these agreements through blockchain technology, ensuring transparent, immutable, and timely execution of grain sales without intermediaries.

Volatility Risk Premium

Spot market transactions for grain sales reflect immediate delivery prices subject to high volatility influenced by current supply and demand dynamics, while forward markets allow producers to lock in prices in advance, effectively mitigating volatility risk premium. The volatility risk premium in forward contracts compensates sellers for uncertainty in future prices, providing price stability that can enhance income predictability and reduce financial exposure to grain price fluctuations.

Spot Market vs Forward Market for grain sales Infographic

agridif.com

agridif.com