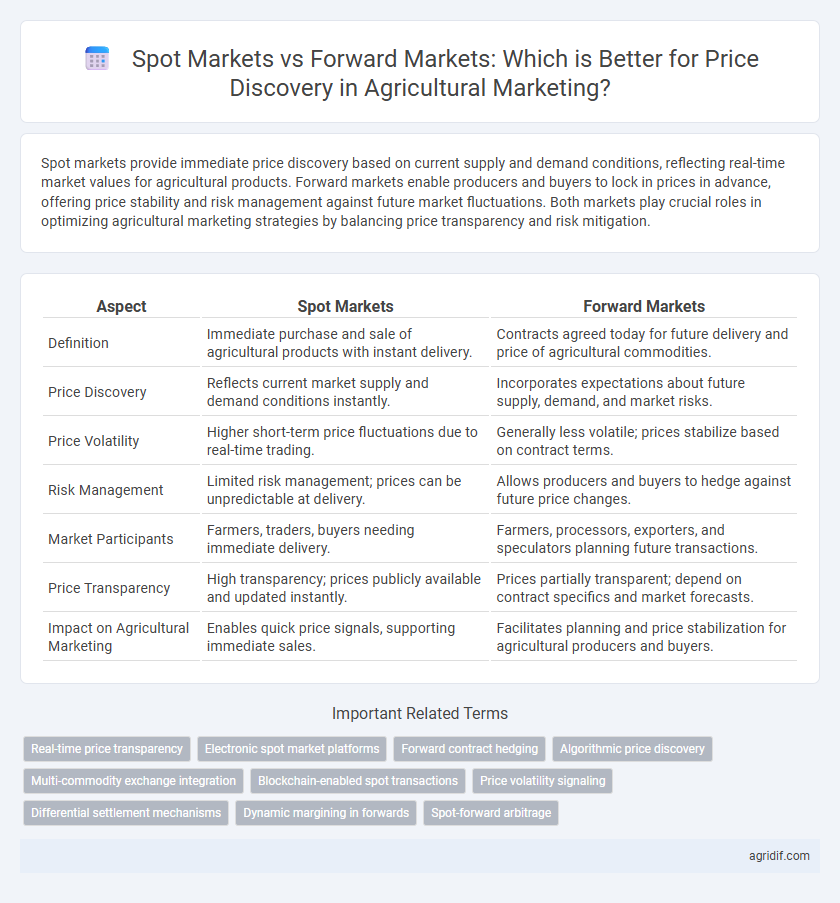

Spot markets provide immediate price discovery based on current supply and demand conditions, reflecting real-time market values for agricultural products. Forward markets enable producers and buyers to lock in prices in advance, offering price stability and risk management against future market fluctuations. Both markets play crucial roles in optimizing agricultural marketing strategies by balancing price transparency and risk mitigation.

Table of Comparison

| Aspect | Spot Markets | Forward Markets |

|---|---|---|

| Definition | Immediate purchase and sale of agricultural products with instant delivery. | Contracts agreed today for future delivery and price of agricultural commodities. |

| Price Discovery | Reflects current market supply and demand conditions instantly. | Incorporates expectations about future supply, demand, and market risks. |

| Price Volatility | Higher short-term price fluctuations due to real-time trading. | Generally less volatile; prices stabilize based on contract terms. |

| Risk Management | Limited risk management; prices can be unpredictable at delivery. | Allows producers and buyers to hedge against future price changes. |

| Market Participants | Farmers, traders, buyers needing immediate delivery. | Farmers, processors, exporters, and speculators planning future transactions. |

| Price Transparency | High transparency; prices publicly available and updated instantly. | Prices partially transparent; depend on contract specifics and market forecasts. |

| Impact on Agricultural Marketing | Enables quick price signals, supporting immediate sales. | Facilitates planning and price stabilization for agricultural producers and buyers. |

Introduction to Spot and Forward Markets in Agriculture

Spot markets in agriculture involve immediate buying and selling of commodities at current market prices, offering transparent and real-time price discovery essential for farmers and traders. Forward markets enable contracts for future delivery at predetermined prices, helping stakeholders hedge against price volatility and plan production and sales strategies effectively. Both markets play crucial roles in agricultural marketing by balancing risk management and price signals across different time frames.

Key Differences Between Spot and Forward Markets

Spot markets facilitate immediate buying and selling of agricultural commodities at current market prices, enabling quick price discovery based on real-time supply and demand conditions. Forward markets involve contracts to buy or sell commodities at predetermined prices for future delivery, providing price certainty and risk management but with less immediate price transparency. The key difference lies in timing and flexibility: spot markets offer instant transaction execution and price revelation, whereas forward markets allow producers and buyers to lock in prices, hedging against future price volatility.

Role of Spot Markets in Agricultural Price Discovery

Spot markets play a crucial role in agricultural price discovery by providing immediate transaction data reflecting current supply and demand conditions. These markets offer real-time price signals that guide farmers, traders, and policymakers in making informed decisions about production and inventory management. Price transparency and liquidity in spot markets contribute to efficient allocation of agricultural resources and help stabilize overall market dynamics.

Forward Markets: Mechanisms and Functions

Forward markets in agricultural marketing facilitate price discovery by allowing buyers and sellers to agree on commodity prices for future delivery, reducing uncertainty and price volatility. These mechanisms include futures contracts and forward contracts, which enable producers to hedge against price risks and secure predictable revenue streams. By locking in prices ahead of harvest, forward markets provide essential information on expected market conditions and support better production planning.

Price Volatility Management in Spot vs Forward Markets

Spot markets offer immediate transactions with prices reflecting current supply-demand conditions, leading to higher price volatility due to rapid market fluctuations. Forward markets enable producers and buyers to lock in prices for future delivery, reducing uncertainty and managing price volatility effectively over time. Using forward contracts helps agricultural stakeholders stabilize revenue and plan production by mitigating the risks associated with unpredictable price swings in spot markets.

Impact of Market Transparency on Price Discovery

Spot markets provide immediate price signals based on current supply and demand conditions, enhancing transparency and real-time price discovery for agricultural commodities. Forward markets, relying on contracts negotiated for future delivery, can reduce price volatility but often face challenges in transparency, potentially obscuring true market sentiment. Higher market transparency in spot markets facilitates more accurate price discovery by reflecting authentic transaction data, thereby influencing decision-making for producers and traders.

How Seasonality Affects Spot and Forward Pricing

Seasonality significantly influences price discovery in spot and forward markets by causing fluctuations in supply and demand throughout the year. Spot markets reflect immediate prices driven by current harvest yields and storage levels, often leading to higher volatility during peak harvest seasons. Forward markets incorporate expectations of future supply and demand conditions, allowing producers and buyers to hedge against seasonal price risks by locking in prices before harvest periods.

Participation of Farmers in Spot and Forward Markets

Farmers predominantly participate in spot markets to sell their produce immediately, taking advantage of current prices but facing higher price volatility and limited price assurance. In contrast, forward markets enable farmers to lock in prices ahead of harvest, reducing income uncertainty and facilitating better financial planning despite lower immediate liquidity. The degree of farmer participation in forward markets often depends on market access, knowledge of contract use, and availability of reliable market infrastructure.

Regulatory Frameworks Governing Price Discovery

Regulatory frameworks governing price discovery in agricultural marketing differ significantly between spot markets and forward markets, with spot markets typically subject to real-time trading regulations that ensure transparency and prevent price manipulation. Forward markets operate under regulatory oversight focused on contract enforcement and disclosure requirements to mitigate counterparty risk and promote price stability. These frameworks aim to create efficient pricing mechanisms by balancing market transparency with protections against fraud and volatility.

Future Trends in Agricultural Price Discovery Methods

Spot markets provide immediate price signals based on current supply and demand, crucial for real-time agricultural product valuation. Forward markets enable producers and buyers to hedge against price volatility by locking in prices for future delivery, enhancing risk management. Emerging trends integrate digital platforms and blockchain technology to increase transparency and accuracy in agricultural price discovery, improving market efficiency and farmer income stability.

Related Important Terms

Real-time price transparency

Spot markets provide real-time price transparency by enabling immediate transactions based on current supply and demand, facilitating accurate price discovery for agricultural commodities. Forward markets lock in prices for future delivery, reducing uncertainty but offering less real-time price information, which can limit immediate market responsiveness.

Electronic spot market platforms

Electronic spot market platforms enhance price discovery in agricultural marketing by facilitating real-time transactions, improving transparency, and reflecting current supply and demand conditions instantly. In contrast, forward markets rely on negotiated contracts set for future delivery, which can introduce price uncertainty and less immediate market responsiveness.

Forward contract hedging

Forward markets enable agricultural producers to lock in prices through forward contract hedging, reducing exposure to price volatility and ensuring revenue stability. Unlike spot markets, which reflect immediate supply and demand conditions, forward contracts provide a mechanism for managing risk by setting future prices in advance.

Algorithmic price discovery

Algorithmic price discovery enhances spot markets by utilizing real-time data and machine learning to rapidly adjust prices based on supply and demand fluctuations, increasing market transparency and efficiency for agricultural commodities. In forward markets, algorithms analyze historical trends and contract specifics to predict future prices, enabling farmers and traders to hedge risks and optimize decision-making in agricultural marketing.

Multi-commodity exchange integration

Spot markets offer real-time price discovery based on immediate supply and demand dynamics, while forward markets enable price locking through contracts for future delivery, crucial for risk management in agriculture. Integration of multi-commodity exchanges enhances price transparency and efficiency by aggregating diverse commodity data, facilitating better-informed decisions for farmers and traders across spot and forward platforms.

Blockchain-enabled spot transactions

Blockchain-enabled spot markets enhance price discovery in agricultural marketing by providing transparent, real-time transaction records that reduce information asymmetry and improve trust among participants. Forward markets rely on contract-based pricing but lack the immediate data verification and decentralization features of blockchain, making spot transactions more efficient for dynamic price adjustment.

Price volatility signaling

Spot markets provide immediate price signals reflecting current supply and demand, which often leads to higher price volatility due to short-term fluctuations. Forward markets enable producers and buyers to hedge against future price risks by locking in prices, thereby reducing price volatility and improving market stability.

Differential settlement mechanisms

Spot markets enable immediate transaction settlement based on current commodity prices, facilitating real-time price discovery essential for perishable agricultural goods. Forward markets involve contracts settled at a future date with prices agreed upon in advance, using differential settlement mechanisms that hedge against price volatility and provide price certainty for producers and buyers.

Dynamic margining in forwards

Spot markets provide immediate price discovery based on current supply and demand conditions, while forward markets enable price determination for future delivery, incorporating expectations and risk management. Dynamic margining in forward contracts adjusts collateral requirements in real-time based on market volatility and credit risk, enhancing the stability and reliability of price discovery mechanisms in agricultural marketing.

Spot-forward arbitrage

Spot markets provide immediate price discovery based on current supply and demand, while forward markets reflect anticipated future prices, enabling producers and buyers to hedge against volatility. Spot-forward arbitrage exploits price differentials between these markets to secure riskless profits, improving overall market efficiency and stabilizing agricultural commodity prices.

Spot markets vs Forward markets for price discovery Infographic

agridif.com

agridif.com