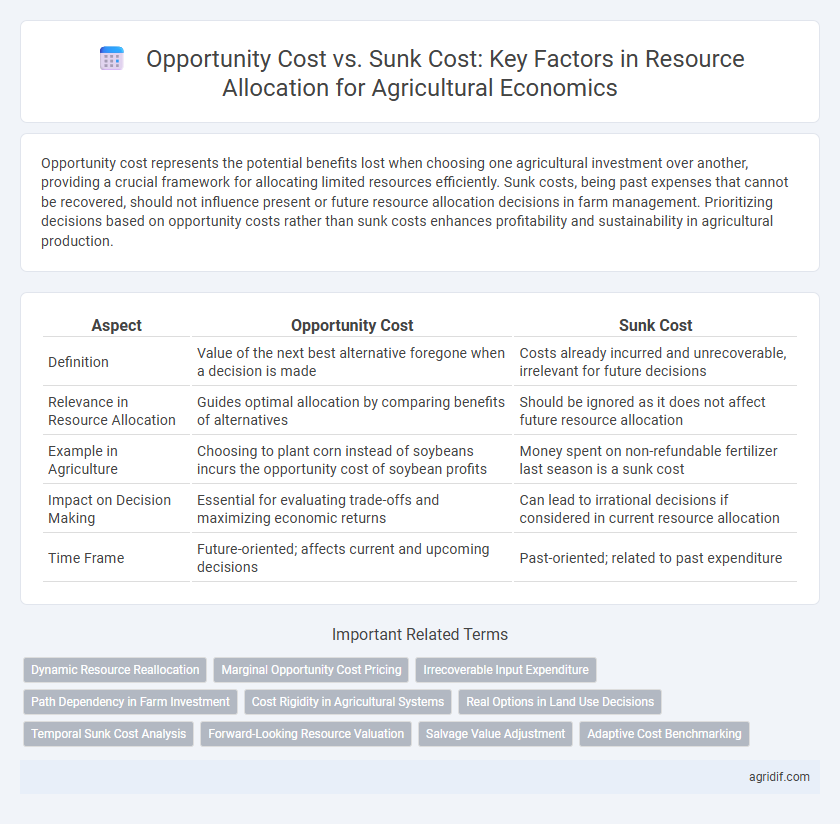

Opportunity cost represents the potential benefits lost when choosing one agricultural investment over another, providing a crucial framework for allocating limited resources efficiently. Sunk costs, being past expenses that cannot be recovered, should not influence present or future resource allocation decisions in farm management. Prioritizing decisions based on opportunity costs rather than sunk costs enhances profitability and sustainability in agricultural production.

Table of Comparison

| Aspect | Opportunity Cost | Sunk Cost |

|---|---|---|

| Definition | Value of the next best alternative foregone when a decision is made | Costs already incurred and unrecoverable, irrelevant for future decisions |

| Relevance in Resource Allocation | Guides optimal allocation by comparing benefits of alternatives | Should be ignored as it does not affect future resource allocation |

| Example in Agriculture | Choosing to plant corn instead of soybeans incurs the opportunity cost of soybean profits | Money spent on non-refundable fertilizer last season is a sunk cost |

| Impact on Decision Making | Essential for evaluating trade-offs and maximizing economic returns | Can lead to irrational decisions if considered in current resource allocation |

| Time Frame | Future-oriented; affects current and upcoming decisions | Past-oriented; related to past expenditure |

Understanding Opportunity Cost in Agricultural Economics

Opportunity cost in agricultural economics represents the value of the best alternative use of resources such as land, labor, and capital, guiding farmers in optimal resource allocation to maximize returns. Unlike sunk costs, which are past expenditures that cannot be recovered, opportunity cost emphasizes future potential benefits foregone when choosing one crop or investment over another. Understanding opportunity cost enables farmers to make informed decisions that enhance productivity and sustainability in agricultural operations.

Defining Sunk Cost and Its Role in Farming Decisions

Sunk costs in agricultural economics refer to expenses already incurred, such as investments in irrigation systems or specialized machinery, which cannot be recovered regardless of future decisions. These costs should be excluded from resource allocation decisions, as continuing a farming activity solely to justify past expenditures can lead to inefficiency. Optimal farm management requires focusing on marginal costs and benefits to maximize profitability rather than attempting to recoup sunk costs.

Key Differences Between Opportunity Cost and Sunk Cost

Opportunity cost in agricultural economics represents the value of the next best alternative foregone when allocating scarce resources, essential for optimal decision-making in crop selection or land use. Sunk cost refers to past expenditures, such as investments in specialized equipment or input costs, which should not influence current resource allocation decisions because they are irrecoverable. Recognizing that opportunity costs guide future-oriented choices while sunk costs are irrelevant to marginal analysis helps farmers and policymakers optimize resource efficiency and profitability.

Impact of Opportunity Cost on Resource Allocation

Opportunity cost plays a critical role in resource allocation within agricultural economics by highlighting the value of the foregone alternatives when selecting resource uses. Efficient allocation decisions require farmers to compare the potential returns from different crops or investments, ensuring resources are directed toward options with the highest expected opportunity cost. Ignoring opportunity costs can lead to suboptimal resource deployment, reducing overall farm profitability and sustainability.

Avoiding the Sunk Cost Fallacy in Agriculture

In agricultural economics, understanding opportunity cost is crucial for effective resource allocation, as it reflects the true value of forgone alternatives when making decisions. Avoiding the sunk cost fallacy ensures that farmers do not continue investing in unprofitable crops or technologies simply because of past expenditures, which are irrecoverable. Prioritizing future benefits over past costs helps optimize farm productivity and profitability by reallocating resources to more productive uses.

Case Studies: Opportunity Cost vs Sunk Cost in Farm Investments

Opportunity cost in farm investments represents the potential returns foregone when choosing one agricultural project over another, guiding farmers to allocate resources efficiently for maximum profitability. Sunk costs, such as past expenditures on machinery or land improvements, should not influence current investment decisions as they are irrecoverable and irrelevant to future choices. Case studies reveal that farmers who prioritize opportunity costs over sunk costs achieve better resource allocation, enhancing overall farm productivity and economic sustainability.

Practical Strategies for Allocating Agricultural Resources

Opportunity cost in agricultural resource allocation emphasizes selecting inputs that maximize returns by evaluating the benefits foregone from alternative uses, guiding farmers to invest in crops or livestock with higher profitability. Sunk costs, such as past equipment purchases or land improvements, should be disregarded in decision-making to avoid inefficient resource use and focus on future gains. Practical strategies include conducting cost-benefit analyses, reallocating resources to the most productive activities, and adopting flexible farm management practices that respond to market signals and environmental conditions.

The Role of Economic Theory in Farm Management Decisions

Opportunity cost plays a crucial role in farm management decisions by quantifying the value of the next best alternative use of resources, guiding farmers to allocate land, labor, and capital efficiently. Sunk costs, representing past expenditures that cannot be recovered, should be disregarded in current decision-making to avoid misallocation of agricultural inputs. Economic theory emphasizes comparing marginal benefits and costs, ensuring optimal resource utilization and maximizing farm profitability through informed opportunity cost analysis.

Opportunity Cost Analysis for Crop Selection

Opportunity cost analysis in crop selection involves evaluating the potential returns from alternative crops that could be cultivated using the same resources. By comparing the expected profits and resource requirements of different crops, farmers can allocate land, labor, and capital more efficiently to maximize economic gains. Sunk costs, such as past investments in machinery or land preparation, should not influence current crop choices, as they do not affect future returns.

Best Practices for Minimizing Sunk Costs in Agriculture

Minimizing sunk costs in agriculture requires careful evaluation of initial investments and avoiding expenditures on non-recoverable assets before confirming resource usability. Employing rigorous cost-benefit analysis and adopting flexible farming practices, such as crop rotation and diversified production systems, can reduce irreversible commitments and improve resource allocation efficiency. Monitoring market trends and technological advancements helps farmers pivot strategies promptly, ensuring capital is allocated to opportunities with the highest potential returns rather than being tied up in sunk costs.

Related Important Terms

Dynamic Resource Reallocation

Opportunity cost in agricultural economics quantifies the benefits foregone by reallocating resources to alternative uses, driving efficient decision-making in dynamic resource reallocation. Sunk costs, being past and irrecoverable expenses, should be excluded from current resource allocation decisions to optimize future returns and enhance farm productivity.

Marginal Opportunity Cost Pricing

Marginal Opportunity Cost Pricing in agricultural economics ensures resources are allocated efficiently by valuing the next best alternative foregone, rather than sunk costs which are irrecoverable and irrelevant to current decisions. Emphasizing opportunity cost enables farmers and policymakers to optimize production choices and maximize economic returns under resource constraints.

Irrecoverable Input Expenditure

In agricultural economics, opportunity cost represents the value of the next best alternative forgone when allocating scarce resources, whereas sunk costs are irrecoverable input expenditures that should not influence future production decisions. Efficient resource allocation requires ignoring sunk costs and focusing on marginal benefits and opportunity costs to maximize farm profitability and sustainability.

Path Dependency in Farm Investment

Opportunity cost in farm investment highlights the value of foregone alternatives, guiding optimal resource allocation by comparing potential returns, while sunk costs represent past expenditures that should not influence future decisions. Path dependency arises as past investments create lock-in effects, limiting flexibility and impacting the evaluation of opportunity costs in long-term agricultural economic strategies.

Cost Rigidity in Agricultural Systems

Opportunity cost in agricultural economics represents the potential benefits lost when resources are allocated to one activity over another, crucial for optimizing farm input usage. Sunk costs, characterized by cost rigidity in agricultural systems, hinder adaptive decision-making as irreversible investments in machinery or land limit flexibility in reallocating resources.

Real Options in Land Use Decisions

Opportunity cost in agricultural land use decisions reflects the potential gains from the next best alternative, guiding resource allocation toward the most economically beneficial crop or investment, while sunk costs represent past expenditures that should not influence future land use choices. Real options analysis enhances decision-making by incorporating flexibility and uncertainty, allowing farmers to evaluate the value of waiting or switching land use strategies amid fluctuating market conditions and environmental factors.

Temporal Sunk Cost Analysis

Temporal sunk cost analysis in agricultural economics emphasizes that opportunity cost reflects future benefits foregone when allocating resources, whereas sunk costs, being past expenditures irrecoverable regardless of future actions, should not influence current decision-making. Efficient resource allocation demands ignoring temporal sunk costs to maximize profit and productivity in farming investments.

Forward-Looking Resource Valuation

Opportunity cost in agricultural economics reflects the value of the next best alternative foregone, guiding forward-looking resource allocation decisions to maximize productivity and profitability. Sunk costs, being past expenditures that cannot be recovered, do not influence current investment choices and should be excluded from consideration in the valuation of future resource use.

Salvage Value Adjustment

Opportunity cost in agricultural economics represents the potential returns lost when allocating resources to one activity over another, whereas sunk costs refer to past expenditures that cannot be recovered and should not influence current decisions. Incorporating salvage value adjustment ensures that remaining asset value is accounted for in resource allocation, optimizing economic efficiency by reflecting true opportunity costs rather than irrelevant sunk costs.

Adaptive Cost Benchmarking

Opportunity cost in agricultural economics measures the potential benefits foregone when resources are allocated to one activity over another, guiding efficient resource use, while sunk cost refers to past expenditures that should not influence current decisions. Adaptive Cost Benchmarking utilizes opportunity cost analysis to dynamically assess and reallocate resources for optimal productivity, minimizing the impact of irrelevant sunk costs on strategic farm management.

Opportunity cost vs sunk cost for resource allocation Infographic

agridif.com

agridif.com