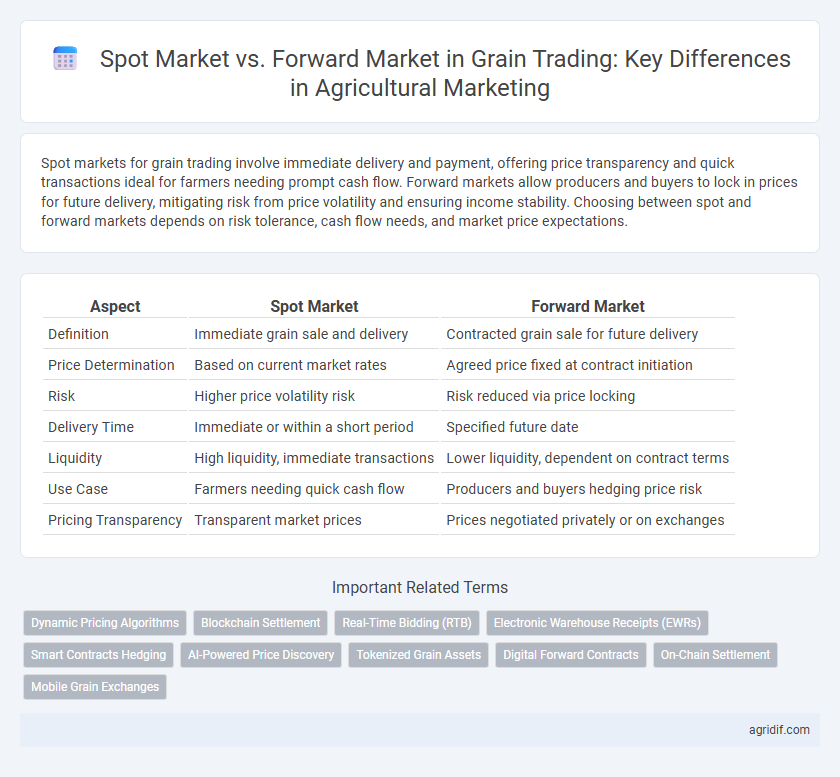

Spot markets for grain trading involve immediate delivery and payment, offering price transparency and quick transactions ideal for farmers needing prompt cash flow. Forward markets allow producers and buyers to lock in prices for future delivery, mitigating risk from price volatility and ensuring income stability. Choosing between spot and forward markets depends on risk tolerance, cash flow needs, and market price expectations.

Table of Comparison

| Aspect | Spot Market | Forward Market |

|---|---|---|

| Definition | Immediate grain sale and delivery | Contracted grain sale for future delivery |

| Price Determination | Based on current market rates | Agreed price fixed at contract initiation |

| Risk | Higher price volatility risk | Risk reduced via price locking |

| Delivery Time | Immediate or within a short period | Specified future date |

| Liquidity | High liquidity, immediate transactions | Lower liquidity, dependent on contract terms |

| Use Case | Farmers needing quick cash flow | Producers and buyers hedging price risk |

| Pricing Transparency | Transparent market prices | Prices negotiated privately or on exchanges |

Introduction to Spot and Forward Markets in Grain Trading

Spot markets in grain trading involve the immediate purchase and delivery of agricultural commodities, ensuring rapid transaction settlement based on current market prices. Forward markets facilitate the buying and selling of grain at predetermined prices, with delivery and payment occurring at a future date, allowing farmers and buyers to hedge against price volatility. These markets play crucial roles in managing risks, stabilizing income, and improving price discovery within the agricultural supply chain.

Key Differences Between Spot and Forward Markets

Spot markets enable immediate buying and selling of grain with instant delivery and payment, reflecting current market prices and supply-demand conditions. Forward markets involve contracts set in advance for future grain delivery at predetermined prices, reducing price risk and allowing producers and buyers to hedge against market volatility. Key differences lie in timing, pricing certainty, and risk management strategies tailored to agricultural marketing needs.

Advantages of Spot Markets for Grain Sellers

Spot markets offer grain sellers immediate payment and quick transaction settlement, enhancing cash flow and reducing exposure to price fluctuations. The ability to sell grain at current market prices provides transparency and market-driven pricing advantages. Spot markets also allow sellers to respond swiftly to market demand and supply changes, improving flexibility in managing inventory.

Benefits of Forward Contracts in Grain Marketing

Forward contracts in grain marketing provide price certainty by locking in prices ahead of harvest, minimizing the risk of adverse market fluctuations. They facilitate better cash flow management and enable farmers to plan production and sales strategies more effectively. These agreements also reduce exposure to spot market volatility, ensuring stable income and enhanced financial security for grain producers.

Price Risk Management in Spot vs Forward Markets

Spot markets for grain trading expose farmers and buyers to immediate price volatility, requiring swift decisions to manage risks in fluctuating market conditions. Forward markets enable producers and purchasers to lock in prices through contracts ahead of delivery, providing certainty and reducing exposure to adverse price movements. Utilizing forward contracts effectively mitigates price risk by stabilizing expected revenue and input costs, while spot market transactions offer flexibility but increased vulnerability to market swings.

Impact on Farmer Income and Profitability

Spot markets provide immediate payment to farmers by selling grain at current market prices, which can enhance short-term cash flow but expose them to price volatility risk. Forward contracts allow farmers to lock in prices before harvest, offering income stability and reduced market uncertainty, which can improve long-term profitability. Choosing the right balance between spot and forward markets is crucial for optimizing farmer income and managing risk in grain trading.

Contract Terms and Delivery Mechanisms

Spot market transactions for grain trading involve immediate contract execution with prompt delivery, typically within days, ensuring quick transfer of ownership and physical commodities. Forward market contracts specify terms for future delivery at agreed prices, allowing farmers and buyers to hedge against price volatility through predetermined schedules and locations. Delivery mechanisms in spot markets are straightforward with immediate exchange, whereas forward contracts often include stipulations on quality standards, delivery windows, and logistics to align with production cycles and storage capabilities.

Market Accessibility for Small vs Large Producers

Spot markets offer immediate transactions favorable to small producers needing quick cash flow, with minimal entry barriers and straightforward pricing. Forward markets suit large producers by enabling price locking and risk management over time, despite higher complexity and contract commitments. Accessibility disparities arise as small producers often lack the resources and market information required to effectively utilize forward contracts compared to larger counterparts.

Role of Spot and Forward Markets in Price Discovery

Spot markets for grain trading enable immediate transactions at current market prices, reflecting real-time supply and demand conditions critical for swift price discovery. Forward markets facilitate agreements on future delivery at predetermined prices, helping producers and buyers hedge against price volatility while providing valuable price signals for long-term planning. The interaction between spot and forward markets enhances overall market efficiency by balancing immediate price transparency with future price expectations.

Challenges and Risks in Spot and Forward Grain Trading

Spot market grain trading faces challenges such as price volatility and immediate payment requirements, increasing financial risk for farmers and buyers. Forward market contracts mitigate price uncertainty by locking in prices, but expose participants to risks from unforeseen market fluctuations and counterparty defaults. Both markets demand robust risk management strategies to navigate supply inconsistencies, quality disputes, and regulatory compliance issues effectively.

Related Important Terms

Dynamic Pricing Algorithms

Dynamic pricing algorithms in spot markets for grain trading enable real-time price adjustments based on supply-demand fluctuations, weather patterns, and market sentiment, optimizing transaction timing and profitability. Forward markets leverage predictive analytics within these algorithms to establish contract prices ahead of delivery, mitigating risk and stabilizing income for producers amid volatile commodity prices.

Blockchain Settlement

Spot markets enable immediate grain trading with instant payment and delivery, enhancing liquidity through blockchain settlement that records transactions securely and transparently. Forward markets facilitate contract-based trading with future delivery, where blockchain ensures immutable settlement records, reducing counterparty risk and enhancing trust in agricultural commodity exchanges.

Real-Time Bidding (RTB)

Real-Time Bidding (RTB) in grain trading enhances the efficiency of spot markets by enabling instant price discovery and immediate transaction settlement based on current supply and demand. Forward markets, while offering price stability through contracts set for future delivery, lack the dynamic responsiveness of RTB systems that optimize grain pricing through continuous auction mechanisms.

Electronic Warehouse Receipts (EWRs)

Electronic Warehouse Receipts (EWRs) enhance liquidity and transparency in grain trading by facilitating settlement in both Spot and Forward Markets, allowing farmers and traders to optimize price risk management with secure, digitally recorded ownership. EWRs improve market efficiency by enabling seamless transfer and financing of grain inventories, reducing transaction costs and promoting timely delivery in electronic spot transactions and future-oriented contracts.

Smart Contracts Hedging

Smart contracts in grain trading enhance risk management by automating transactions in the spot market, ensuring immediate settlement and price discovery, while in the forward market, they secure future delivery terms and prices, effectively hedging against price volatility. This integration minimizes counterparty risk and operational costs, optimizing the agricultural supply chain's efficiency and transparency.

AI-Powered Price Discovery

AI-powered price discovery in grain trading enhances the efficiency of spot markets by providing real-time, data-driven price signals that reflect current supply and demand dynamics. In contrast, forward markets benefit from AI by improving future price predictions through advanced machine learning models that analyze historical trends and market conditions, enabling better hedging and risk management strategies for agricultural producers and buyers.

Tokenized Grain Assets

Tokenized grain assets enhance transparency and liquidity in both spot and forward markets by enabling real-time verification of ownership and quality through blockchain technology. Spot markets benefit from immediate settlement and price discovery, while forward markets leverage tokenization to securely lock in future prices and delivery terms, reducing counterparty risk and improving contract enforcement.

Digital Forward Contracts

Digital forward contracts in grain trading enable precise price locking and risk management by securing future delivery terms on an online platform, contrasting with the spot market where grains are exchanged immediately at current prices. These contracts leverage blockchain technology for transparency and reduce counterparty risk, streamlining transactions in agricultural marketing.

On-Chain Settlement

Spot market transactions for grain trading settle immediately using on-chain settlement, ensuring transparent, secure, and instantaneous transfer of ownership and funds via blockchain technology. Forward market agreements leverage on-chain smart contracts to lock in prices and settlement terms, reducing counterparty risk and enabling automated execution upon contract maturity.

Mobile Grain Exchanges

Mobile grain exchanges enhance spot market efficiency by enabling real-time trading and immediate delivery of agricultural commodities, improving price transparency and liquidity for farmers and buyers. In contrast, forward markets facilitated by mobile platforms allow producers to lock in prices in advance, reducing risk and providing financial stability amid fluctuating grain prices.

Spot Market vs Forward Market for grain trading Infographic

agridif.com

agridif.com