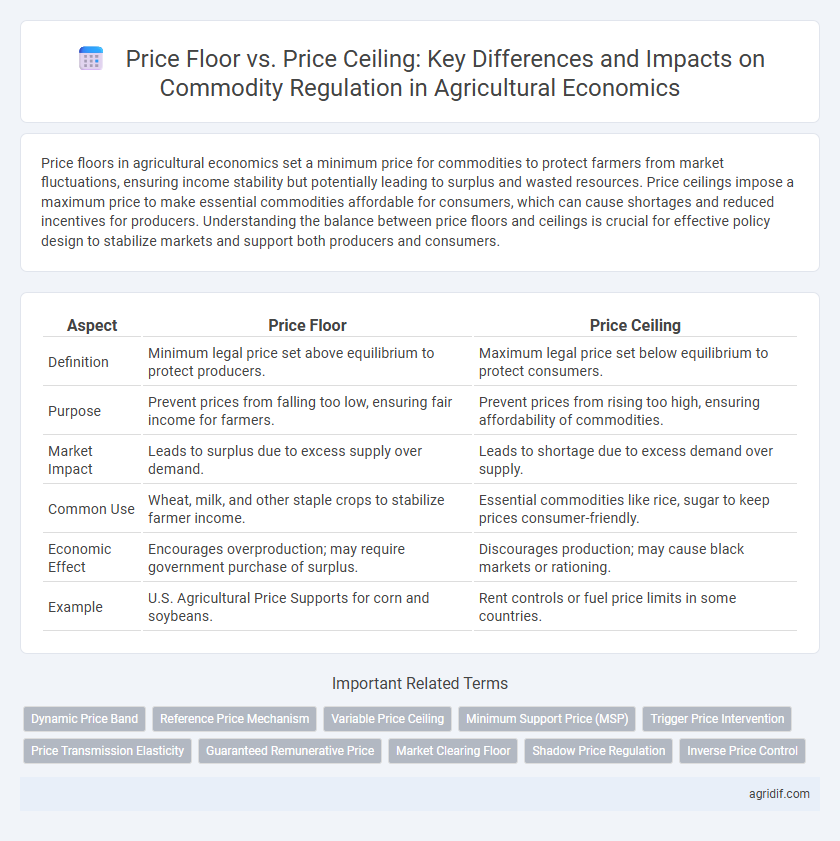

Price floors in agricultural economics set a minimum price for commodities to protect farmers from market fluctuations, ensuring income stability but potentially leading to surplus and wasted resources. Price ceilings impose a maximum price to make essential commodities affordable for consumers, which can cause shortages and reduced incentives for producers. Understanding the balance between price floors and ceilings is crucial for effective policy design to stabilize markets and support both producers and consumers.

Table of Comparison

| Aspect | Price Floor | Price Ceiling |

|---|---|---|

| Definition | Minimum legal price set above equilibrium to protect producers. | Maximum legal price set below equilibrium to protect consumers. |

| Purpose | Prevent prices from falling too low, ensuring fair income for farmers. | Prevent prices from rising too high, ensuring affordability of commodities. |

| Market Impact | Leads to surplus due to excess supply over demand. | Leads to shortage due to excess demand over supply. |

| Common Use | Wheat, milk, and other staple crops to stabilize farmer income. | Essential commodities like rice, sugar to keep prices consumer-friendly. |

| Economic Effect | Encourages overproduction; may require government purchase of surplus. | Discourages production; may cause black markets or rationing. |

| Example | U.S. Agricultural Price Supports for corn and soybeans. | Rent controls or fuel price limits in some countries. |

Introduction to Price Controls in Agricultural Markets

Price floors set a minimum price for agricultural commodities to ensure farmers receive adequate income, preventing prices from falling below production costs. Price ceilings impose a maximum price to protect consumers from excessively high food costs, but can lead to shortages and reduced farmer revenues. Both mechanisms aim to stabilize agricultural markets, balancing producer sustainability with consumer affordability.

Understanding Price Floors in Agriculture

Price floors in agriculture set a minimum legal price for commodities to ensure farmers receive adequate income despite market fluctuations. They help stabilize farmers' earnings by preventing prices from falling below production costs, which supports supply sustainability and rural economic stability. However, price floors may lead to excess supply or government purchases to maintain set prices.

The Role of Price Ceilings for Commodity Regulation

Price ceilings in commodity regulation are implemented to prevent prices from rising above a set limit, protecting consumers from exorbitant costs during shortages or inflationary periods. These controls can stabilize market fluctuations and maintain affordability, particularly for essential agricultural products like staple grains and dairy. However, persistent price ceilings may lead to supply shortages as producers reduce output due to lower profitability, disrupting market equilibrium.

Objectives of Price Regulation Policies

Price floor policies aim to prevent commodity prices from falling below a set level, ensuring farmers receive minimum income and stabilizing agricultural markets. Price ceilings restrict prices from exceeding a certain threshold, protecting consumers from excessively high costs and promoting affordability. Both mechanisms regulate market balance by addressing price volatility and ensuring fair income distribution within the agricultural sector.

Market Impacts: Surpluses and Shortages

Price floors in agriculture, set above equilibrium prices, create surpluses as supply exceeds demand, often leading to wasted crops or government stockpiling. Price ceilings, set below equilibrium, cause shortages where demand surpasses supply, resulting in rationing and reduced producer income. Both mechanisms disrupt market equilibrium, distorting supply and demand signals vital for efficient commodity regulation.

Effects on Farmers’ Income and Livelihoods

Price floors in commodity markets ensure minimum prices, protecting farmers from income volatility and enabling stable livelihoods by preventing prices from falling below production costs. Price ceilings, while aiming to keep consumer prices low, can reduce farmers' revenue, potentially leading to decreased investment in agricultural inputs and negatively impacting farm productivity. Balancing these regulatory tools is crucial to maintaining both market stability and sustainable farmer incomes.

Consumer Welfare and Price Regulation

Price floors in commodity markets set minimum prices above equilibrium, often leading to surpluses and reduced consumer welfare due to higher consumer prices and limited access. Price ceilings establish maximum prices below equilibrium, improving consumer welfare by making commodities more affordable but causing shortages and reduced supply incentives. Effective price regulation balances these impacts, aiming to stabilize markets without significantly harming consumer access or producer viability.

Government Intervention and Policy Implementation

Price floors set a minimum legal price to protect farmers from market prices falling below production costs, stabilizing income but potentially causing surpluses. Price ceilings impose a maximum price to keep essential commodities affordable, which can lead to shortages if set below equilibrium. Effective government intervention requires careful calibration of these policies to balance market stability and consumer welfare in agricultural markets.

Case Studies: Price Floors and Ceilings in Agriculture

Price floors, such as the U.S. dairy price support program, guarantee minimum prices to protect farmers from market volatility, often leading to surplus production and government stockpiling. Conversely, price ceilings like those implemented for staple foods in India aim to make commodities affordable but can result in shortages and reduced farmer incomes. Case studies reveal the critical need to balance market intervention to stabilize agricultural incomes without distorting supply-demand dynamics.

Future Perspectives for Price Regulation in Agricultural Economics

Price floors in agricultural economics ensure minimum income for farmers by preventing commodity prices from falling below a set level, promoting supply stability but risking surpluses. Price ceilings aim to protect consumers from excessively high prices during shortages, enhancing affordability but potentially causing underproduction. Future perspectives emphasize dynamic, data-driven price regulation systems integrating market signals, technology, and policy flexibility to balance producer sustainability and consumer protection effectively.

Related Important Terms

Dynamic Price Band

Dynamic Price Bands regulate commodity markets by adjusting price floors and ceilings based on supply-demand fluctuations and volatility indices, ensuring market stability without rigid intervention. This mechanism balances producer protection against price crashes while preventing consumer prices from exceeding affordability thresholds, optimizing agricultural economic outcomes.

Reference Price Mechanism

The Reference Price Mechanism in agricultural economics stabilizes commodity markets by setting a price floor, ensuring farmers receive minimum income despite market fluctuations. Unlike price ceilings that limit consumer prices but can cause shortages, price floors support producers, maintaining supply levels and protecting against income volatility.

Variable Price Ceiling

Variable price ceilings in commodity regulation cap maximum prices based on market conditions, preventing excessive price surges while allowing flexibility in supply-demand fluctuations. Unlike fixed price floors that guarantee minimum prices to protect producers, variable price ceilings aim to balance consumer affordability with market stability in agricultural economies.

Minimum Support Price (MSP)

Minimum Support Price (MSP) acts as a price floor set by the government to ensure farmers receive a guaranteed minimum income for their commodities, preventing prices from falling below production costs. Price ceilings, in contrast, limit the maximum price to protect consumers but can lead to reduced incentives for producers, making MSPs crucial for maintaining agricultural supply stability and farmer welfare.

Trigger Price Intervention

Trigger Price Intervention sets a minimum or maximum price level to stabilize commodity markets by activating government purchases or sales when prices cross predefined limits. Price floors protect producers by preventing prices from falling below a threshold, while price ceilings safeguard consumers by capping prices, both mechanisms addressing market volatility and ensuring fair trade conditions in agricultural economics.

Price Transmission Elasticity

Price floor policies in agricultural markets often lead to higher producer prices but can reduce price transmission elasticity by causing disconnects between farmgate and retail prices, limiting market responsiveness. In contrast, price ceilings tend to compress consumer prices and increase price transmission elasticity, promoting more efficient price signals across the supply chain but potentially causing supply shortages.

Guaranteed Remunerative Price

Guaranteed Remunerative Price (GRP) acts as a price floor in agricultural commodity markets, ensuring farmers receive a minimum income regardless of market fluctuations, thereby preventing prices from falling below production costs. Unlike price ceilings that limit prices to protect consumers from high costs, GRP stabilizes farmer earnings and incentivizes production, fostering economic viability in the agricultural sector.

Market Clearing Floor

A market clearing price floor in agricultural economics sets a minimum price above equilibrium to guarantee farmers receive sufficient income while preventing market surpluses by adjusting supply levels. Unlike price ceilings that restrict prices below equilibrium causing shortages, a market clearing floor balances supply and demand by aligning production with guaranteed minimum prices.

Shadow Price Regulation

Shadow price regulation in agricultural commodities strategically manipulates price floors and ceilings to balance market stability and producer incentives by reflecting the true economic value of resources under constraints. Implementing shadow prices enables policymakers to address supply-demand imbalances, optimize resource allocation, and mitigate market distortions caused by rigid price controls.

Inverse Price Control

Inverse price control in agricultural economics refers to regulatory mechanisms where price floors are established to prevent prices from falling below a certain level, ensuring farmer incomes remain stable despite market fluctuations. Unlike price ceilings that limit maximum prices to protect consumers, price floors create a minimum price threshold, which can lead to surplus production if set above equilibrium prices.

Price floor vs price ceiling for commodity regulation Infographic

agridif.com

agridif.com