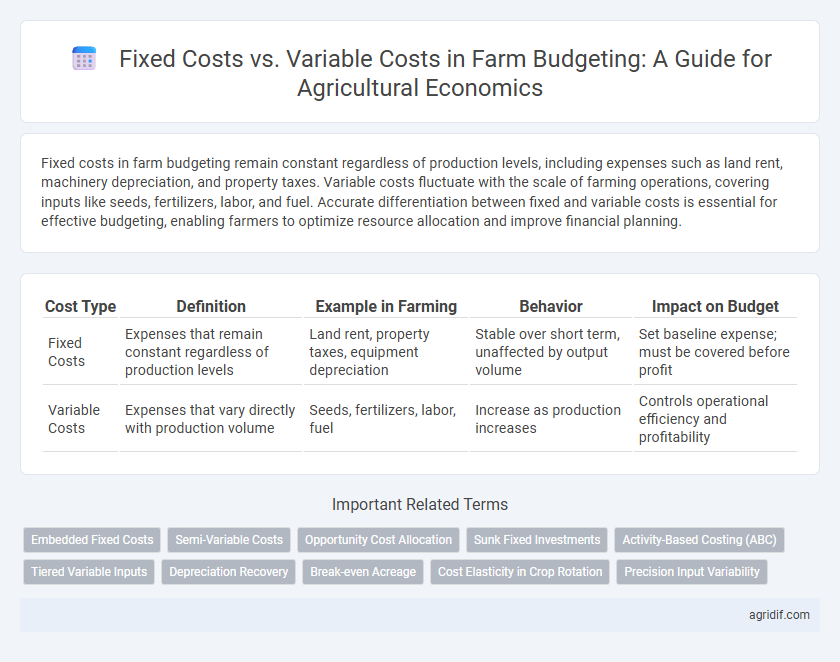

Fixed costs in farm budgeting remain constant regardless of production levels, including expenses such as land rent, machinery depreciation, and property taxes. Variable costs fluctuate with the scale of farming operations, covering inputs like seeds, fertilizers, labor, and fuel. Accurate differentiation between fixed and variable costs is essential for effective budgeting, enabling farmers to optimize resource allocation and improve financial planning.

Table of Comparison

| Cost Type | Definition | Example in Farming | Behavior | Impact on Budget |

|---|---|---|---|---|

| Fixed Costs | Expenses that remain constant regardless of production levels | Land rent, property taxes, equipment depreciation | Stable over short term, unaffected by output volume | Set baseline expense; must be covered before profit |

| Variable Costs | Expenses that vary directly with production volume | Seeds, fertilizers, labor, fuel | Increase as production increases | Controls operational efficiency and profitability |

Understanding Fixed and Variable Costs in Agriculture

Fixed costs in farm budgeting include expenses such as land rent, machinery depreciation, and property taxes that remain constant regardless of production levels. Variable costs fluctuate with output and encompass seed, fertilizer, labor, and fuel expenses directly tied to crop or livestock production. Accurate distinction between fixed and variable costs enables farmers to better manage financial risk, optimize resource allocation, and forecast profitability under different production scenarios.

Key Differences Between Fixed and Variable Costs

Fixed costs in farm budgeting remain constant regardless of crop yield or livestock numbers, including expenses like land lease payments, machinery depreciation, and property taxes. Variable costs fluctuate directly with production levels, such as seeds, fertilizers, labor hours, and fuel usage for equipment. Understanding the distinction between fixed and variable costs enables precise cost management, improves profitability analysis, and enhances decision-making for resource allocation in agricultural operations.

Examples of Fixed Costs in Farm Operations

Fixed costs in farm operations include expenses such as property taxes, insurance premiums, and depreciation on farm machinery and buildings, which remain constant regardless of production levels. These costs are essential for budgeting as they must be paid whether the farm produces crops or livestock or not. Understanding fixed costs helps farmers determine the minimum revenue needed to cover basic operational expenses and maintain financial stability.

Examples of Variable Costs in Farming

Variable costs in farming include expenses that fluctuate with production levels, such as seeds, fertilizers, pesticides, fuel, and labor specifically hired for planting or harvesting. These costs directly impact the overall budget and profitability, as they increase with the scale of farming activities. Understanding variable costs helps farmers optimize input use and make informed decisions about crop management and resource allocation.

Impact of Fixed and Variable Costs on Farm Profitability

Fixed costs, such as land rent and machinery depreciation, remain constant regardless of output levels, influencing overall farm profitability by setting a baseline expense that must be covered. Variable costs, including seeds, fertilizers, and labor, fluctuate directly with production volume, affecting short-term profit margins and decision-making on resource allocation. Effective farm budgeting requires balancing fixed and variable costs to optimize profitability, ensuring fixed costs are spread over sufficient production while variable costs align with market conditions.

Allocating Fixed and Variable Costs in Farm Budgets

Accurate allocation of fixed and variable costs is essential in farm budgeting to enhance profitability and efficiency. Fixed costs such as land leases, depreciation on machinery, and property taxes remain constant regardless of production levels, while variable costs including seeds, fertilizers, and labor fluctuate with output. Distinguishing these costs helps farmers optimize resource allocation, improve cost control, and make informed decisions on crop planning and investment.

Strategies to Minimize Variable Costs in Agriculture

Minimizing variable costs in agriculture involves precise input management such as optimizing seed, fertilizer, and pesticide usage to reduce waste and enhance efficiency. Employing advanced technologies like GPS-guided equipment and soil sensors enables targeted application, lowering labor and material expenses. Implementing crop rotation and integrated pest management also decreases dependency on costly chemical inputs, contributing to sustainable cost reduction in farm budgeting.

Evaluating Fixed Costs when Expanding Farm Operations

Evaluating fixed costs when expanding farm operations is essential for accurate budgeting and profitability analysis in agricultural economics. Fixed costs, such as land lease payments, equipment depreciation, and property taxes, remain constant regardless of production volume and significantly impact the break-even point during expansion. Careful assessment of these expenses ensures that increases in scale do not lead to financial strain, enabling strategic investment decisions in farm growth.

Role of Cost Classification in Farm Decision-Making

Fixed costs, such as land rent and machinery depreciation, remain constant regardless of production levels, while variable costs, including seeds, labor, and fertilizers, fluctuate with output. Accurate classification of these costs is essential for farm budgeting, as it aids in identifying breakeven points and optimizing resource allocation. Understanding the distinction between fixed and variable costs enhances decision-making by allowing farmers to assess cost behavior under different production scenarios and improve profitability.

Fixed vs Variable Costs: Implications for Farm Financial Planning

Fixed costs in farm budgeting include expenses such as land lease payments, property taxes, and equipment depreciation that remain constant regardless of production levels. Variable costs fluctuate with the scale of farm operations, encompassing inputs like seeds, fertilizer, labor, and fuel needed for planting and harvesting. Understanding the balance between fixed and variable costs is crucial for farm financial planning, as it affects cash flow management, break-even analysis, and profit optimization.

Related Important Terms

Embedded Fixed Costs

Embedded fixed costs in farm budgeting represent long-term, non-variable expenses such as land ownership, equipment depreciation, and property taxes that do not fluctuate with production levels. Distinguishing these from variable costs like seeds, labor, and fertilizer is essential for accurate financial planning and optimizing resource allocation in agricultural economics.

Semi-Variable Costs

Semi-variable costs in farm budgeting combine fixed and variable elements, such as fuel expenses that include a baseline monthly charge plus usage-based fees, complicating precise cost allocation and forecasting. Accurate identification and segregation of these semi-variable costs enable farmers to optimize resource allocation, improve cash flow management, and enhance budgeting accuracy in agricultural economics.

Opportunity Cost Allocation

Fixed costs in farm budgeting represent expenses like land rent and depreciation that remain constant regardless of production levels, while variable costs fluctuate with output, such as seeds and labor. Allocating opportunity costs accurately between fixed and variable categories ensures farmers assess true economic profitability by considering foregone alternatives in resource use.

Sunk Fixed Investments

Sunk fixed investments in farm budgeting represent irreversible expenditures such as land acquisition, machinery, and infrastructure that do not vary with crop production levels, distinguishing them from variable costs like seeds and fertilizers, which fluctuate with output. Recognizing the impact of these fixed sunk costs is crucial for long-term financial planning, as they affect break-even analysis and profitability thresholds regardless of short-term production changes.

Activity-Based Costing (ABC)

Activity-Based Costing (ABC) in agricultural economics allocates fixed costs such as machinery depreciation and land rent more precisely to specific farming activities, enhancing the accuracy of farm budgeting. Variable costs like seeds, fertilizers, and labor are directly traced to each activity, allowing farmers to identify cost drivers and optimize resource allocation for improved profitability.

Tiered Variable Inputs

Tiered variable inputs in farm budgeting create distinct cost increments based on input usage levels, significantly impacting variable costs by introducing nonlinear expenditure patterns as production scales. Understanding these tiered structures is crucial for accurately forecasting total costs and optimizing resource allocation between fixed costs such as machinery and land, and variable inputs like fertilizers and labor.

Depreciation Recovery

Depreciation recovery represents a fixed cost essential for farm budgeting, reflecting the gradual allocation of the purchase cost of farm machinery and equipment over its useful life. Accurately estimating this non-cash expense ensures farmers allocate sufficient funds for asset replacement without distorting short-term variable costs like labor and inputs.

Break-even Acreage

Break-even acreage in farm budgeting identifies the minimum land area required to cover fixed costs, such as machinery and land leases, by balancing revenue against variable costs like seeds, labor, and fertilizer. Calculating this metric optimizes resource allocation, enabling farmers to set production targets that prevent losses and improve profitability.

Cost Elasticity in Crop Rotation

Fixed costs in farm budgeting, such as land rent and machinery depreciation, remain constant regardless of crop rotation decisions, while variable costs like seeds, fertilizers, and labor fluctuate with changes in crop types and acreage. Understanding cost elasticity in crop rotation allows farmers to optimize input allocation, maximize productivity, and improve profitability by adjusting variable expenses in response to different crop cycles.

Precision Input Variability

Fixed costs in farm budgeting, such as land leases and equipment depreciation, remain constant regardless of production levels, while variable costs fluctuate with precision input variability, including seeds, fertilizers, and pesticides applied based on site-specific data. Understanding this distinction helps optimize resource allocation and enhance profitability by tailoring input use to precise field conditions and crop needs.

Fixed Costs vs Variable Costs for farm budgeting Infographic

agridif.com

agridif.com